Food Lion 2004 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2004 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DELHAIZE GROUP ANNUAL REPORT 2004

44

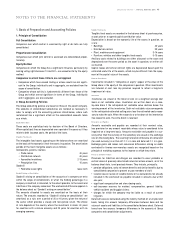

Deferred tax assets are included in the consolidated accounts only to the

extent that their realisation is probable in the foreseeable future.

Within each fiscal entity in the Group, deferred tax assets and liabilities

are offset. Net asset balances are recorded under a separate account in

long-term receivables.

Translation of Foreign Currencies

The balance sheets of foreign subsidiaries are converted to euro at the

year-end rate (closing rate).

The profit and loss accounts are translated at the average daily rate, i.e.

the yearly ave rage of the rates each w orking day of the currencies involved.

The differences arising from the use of the average daily rate for the profit

and loss account and the closing rate for the balance sheet are recorded in

the “ Cumulative translation adjustment” component of equity.

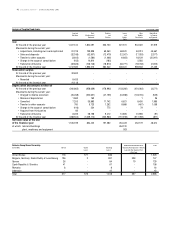

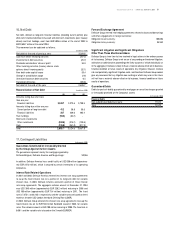

(in EUR) Closing Rate Average Daily Rate

2004 2003 2004 2003

1 USD 0.734160 0.791766 0.803922 0.884048

100 CZK 3.282563 3.085467 3.135671 3.140125

100 SKK 2.580978 2.428953 2.498637 2.410284

100 ROL 0.002539 0.002430 0.002469 0.002663

100 THB 1.876595 2.005463 1.995110* 2.125583

100 IDR 0.007864 0.009408 0.008987 0.010289

1 SGD - 0.466200 - 0.507532*

(*) Average for the period until the date of deconsolidation

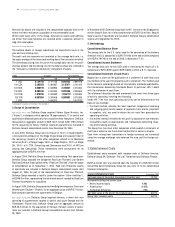

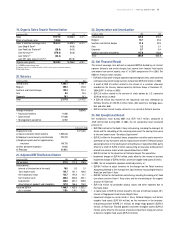

3. Scope of Consolidation

Main changes during 2004. Delhaize Group acquired Victory Super M arkets, Inc.

(“ Victory” ), a company which operates 19 supermarkets, 17 in central and

southeastern M assachusetts and two in southern New Hampshire. Delhaize

Group paid an aggregate amount of EUR 143.7 million (USD 178.6 million)

for the acquisition of Victory. Victory’s results of operations are included in

Delhaize Group’s consolidated results from November 26, 2004.

In June 2004, Delhaize Group sold its interest of 70.0% in Super Dolphin,

a non-operating company of the M ega Image Group and acquired most of

the remaining interests of the other companies related to its Romanian

activities (30.0% of M ega Image, 18.6% of M ega Dolphin, 13.2% of M ega

Doi, 30.0% of A.T.T.M . Consulting and Commercial and 30.0% of NP Lion

Leasing and Consulting). These transactions were consumated for an

aggregate price of EUR 0.3 million.

In August 2004, Delhaize Group divested its loss-making Thai operations.

Delhaize Group excluded the companies Food Lion Thailand, Lion Garden

Food and Delhaize Siam (collectiveley “ Food Lion Thailand” ) from the scope

of consolidation as of September 1, 2004. Food Lion Thailand’s results

of operations are included in Delhaize Group’s consolidated results until

August 31, 2004. As part of the deconsolidation of Food Lion Thailand,

Delhaize Group recorded a liability (under the caption “ Other liabilities” ),

of EUR 8.5 million, representing the estimated amount needed by Food Lion

Thailand to complete its liquidation.

In August 2004, Delhaize Group acquired two Belgian companies, Distra and

Warenhuizen Trouken – Peeters, for an aggregate price of EUR 5.7 million.

Each company operates one supermarket in Belgium.

Main changes during 2003. Delhaize Group acquired Harveys, a chain that was

operating 43 supermarkets located in central and south Georgia and the

Tallahassee, Florida area. Delhaize Group paid an aggregate amount of

EUR 28.2 million for the acquisition of Harveys. Harveys’ results of opera-

tions are included in Delhaize Group’s consolidated results from October

26, 2003.

In November 2003, Delhaize Group sold its 49% interest in the Singaporean

retailer Shop N Save for a total consideration of EUR 21.8 million. Shop N

Save's results of operations are included in Delhaize Group’s consolidated

results until September 30, 2003.

4. M ethodology

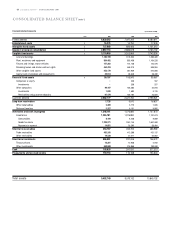

Consolidated Balance Sheet

The closing rate for the U.S. dollar used for the conversion of the balance

sheets of the U.S. companies is EUR 0.734160 at the end of 2004 compared

with EUR 0.791766 at the end of 2003, a decrease of 7.3%.

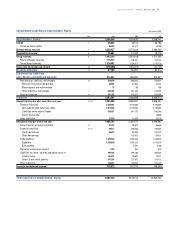

Consolidated Income Statement

The average daily rate for one USD used in translating the results of U.S.

companies is EUR 0.8039 against EUR 0.8840 in 2003, a 9.1% decrease.

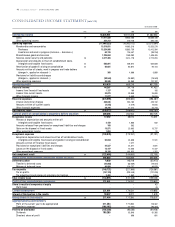

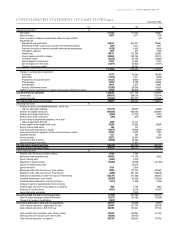

Consolidated Statement of Cash Flow s

Belgian law is silent on the publication of a statement of cash flow s and

the methods to be used for preparing such a statement. The method used

by the Group is accordingly based on international standards published by

the International Accounting Standards Board. In particular, IAS 7 deals

with the statement of cash flows.

This statement describes the cash movements that result from three types

of activity: operating, investing and financing.

Under IAS 7 the flow from operating activities can be determined on the

basis of two methods:

• the direct method, whereby the most important categories of incoming

and outgoing gross funds (receipt of payments from clients, payments

to suppliers, etc.) are used to obtain the net cash flow generated by

operating activities.

• the indirect method, whereby the net profit is adjusted for non-monetary

transactions (such as depreciation) and transactions concerning inves-

ting and financing activities.

The Group has, like most other companies w hich publish a statement of

cash flows, opted to use the indirect method that is easier to employ.

Cash flows arising from transactions in foreign currencies are translated

using the average exchange rate between the euro and the foreign cur-

rencies.

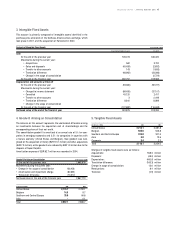

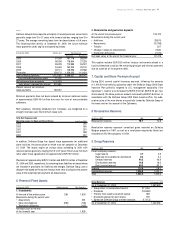

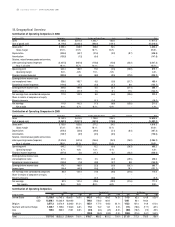

2. Establishment Costs

Establishment costs represent debt issuance costs at Delhaize America,

Delhaize Group SA, Delhaize “ The Lion” Nederland and Delhaize Finance.

EUR 5.0 million cost w as incurred upon the issuance of a EUR 300 million

convertible bond by Delhaize Group SA (see note 14 to the consolidated

financial statements).

Analysis of Establishment Costs

(in thousands of EUR)

Net book value at the end of the previous financial year 14,750

M ovements during the current year:

• New ly incurred costs 4,962

• Amortization (2,655)

• Translation difference (782)

Net book value at the end of the financial year 16,275

Being: debt issuance costs 16,275