Food Lion 2004 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2004 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DELHAIZE GROUP ANNUAL REPORT 2004

68

Authorized Capital

The Extraordinary General M eeting of M ay 23, 2002, authorized the Board

of Directors of Delhaize Group SA, for a period of five years expiring in June

2007, w ithin certain legal limits, to increase the capital of Delhaize Group

SA or issue convertible bonds or subscription rights which might result in a

further increase of capital by a maximum of approximately EUR 46.2 million

corresponding to approximately 92.4 million shares.

On April 7, 2004, the Board of Directors of Delhaize Group SA issued a con-

vertible bond offering to institutional investors for an amount of EUR 300

million. They have a maturity of five years. The bonds have been issued at

100% of their nominal value and w ill be redeemable at maturity at 100% of

their nominal value. The initial conversion price has been set at EUR 57.0.

The bonds are, subject to the terms and conditions of the offering circular,

convertible into 5,263,158 new Delhaize Group ordinary shares at the initial

conversion price.

At the end of 2004, the Board of Directors had, after several applications

of the authorization granted in 2002, a remaining authorization to increase

the capital by a maximum of approximately EUR 39.8 million corresponding

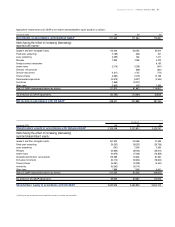

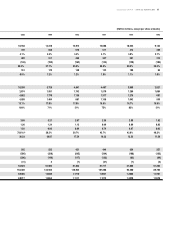

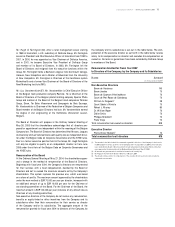

Authorized Capital - Status

M aximum Number of Shares M aximum Amount (excl. Share Premium) in EUR

to approximately 79.6 million shares. The authorized increase in capital

may be realized by contributions in cash or, to the extent permitted by

law, by contributions in-kind or by incorporation of available or unavaila-

ble reserves or of the share premium account. The Board of Directors of

Delhaize Group SA may, for this increase in capital, limit or suppress the

preferential subscription rights of Delhaize Group’s shareholders, within

certain legal limits.

To the extent permitted by law, the Board of Directors is authorized to

increase the share capital after it has received notice of a public take-

over bid related to the Company. In such a case, the Board of Directors is

especially authorized to limit or suppress the preferential right of the sha-

reholders, even in favor of specific persons. Such authorization is granted

to the Board of Directors for a period of three years from the date of the

Extraordinary General M eeting of M ay 23, 2002. It may be renew ed under

the terms and conditions provided by law.

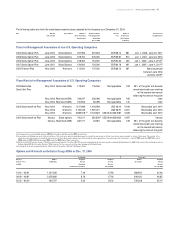

Acquisition and Transfer of Ow n Shares

The Extraordinary General M eeting held on M ay 23, 2002, authorized the

Board of Directors of Delhaize Group SA to purchase Delhaize Group shares,

for a period of three years expiring in June 2005, when such a purchase

is necessary in order to avoid serious and imminent damage to Delhaize

Group SA.

In the absence of any threat of serious and imminent damage, the Board of

Directors was also authorized on M ay 27, 2004 for a period of 18 months

expiring in November 2005 to purchase a maximum of 10% of the outstan-

ding Delhaize Group shares at a minimum price of EUR 1.00 and a maximum

price not higher than 20% above the highest closing price of the Delhaize

Group share on Euronext Brussels during the 20 trading days preceding the

acquisition.

In M ay 2004, the Board of Directors approved the repurchase of up to

EUR 200 million of the Company’s shares or ADRs from time to time in

the open market, in compliance with applicable law and subject to and

within the limits of an outstanding authorization granted to the Board by

the shareholders, to satisfy exercises under the stock option plans that

Delhaize Group offers to its associates. No time limit has been set for these

repurchases and they may be discontinued at any time.

In 2004, Delimmo SA, a w holly-ow ned subsidiary of Delhaize Group SA,

sold its 60,000 Delhaize Group shares (having an aggregate par value of

EUR 30,000) in the market to Delhaize Group SA for an aggregate conside-

ration of EUR 2,223,000. The shares purchased, representing approximately

0.13% of the share capital as at December 31, 2004, enable Delhaize Group

SA to satisfy the exercise of w arrants granted pursuant to the 2002 Stock

Incentive Plan. Delhaize Group SA did not acquire other Delhaize Group

shares or ADRs in 2004. As a consequence, at the end of 2004, the mana-

gement of Delhaize Group SA had a remaining authorization for the pur-

chase of its own shares or ADRs for an amount up to EUR 197,777,000.

Authorized Capital as approved at the M ay 23, 2002 General M eeting 92,392,704 46,196,352.00

M ay 22, 2002 Issuance of w arrants under the Delhaize Group 2002

Stock Incentive Plan (3,853,578) (1,926,789.00)

M ay 22, 2003 Issuance of w arrants under the Delhaize Group 2002

Stock Incentive Plan (2,132,043) (1,066,021.50)

April 7, 2004 Issuance of convertible bonds (5,263,158) (2,631,579.00)

M ay 27, 2004 Issuance of w arrants under the Delhaize Group 2002

Stock Incentive Plan (1,517,988) (758,994.00)

Balance of remaining authorized capital as of December 31, 2004 79,625,937 39,812,968.50