Food Lion 2004 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2004 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DELHAIZE GROUP ANNUAL REPORT 2004 69

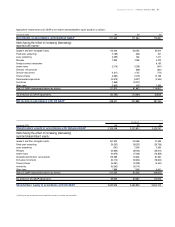

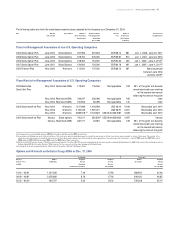

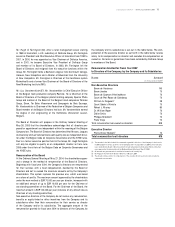

Recent Capital Increases Capital Share Premium Account Number of Shares

Additionally, in 2004 Delhaize America repurchased 191,403 Delhaize

Group ADRs for an aggregate amount of USD 11.9 million, representing

approximately 0.2% of the Delhaize Group share capital as at December 31,

2004 and transferred 215,558 ADRs to satisfy the exercise of stock options

granted to U.S. management associates pursuant to the Delhaize America

2000 Stock Incentive Plan and the Delhaize America 2002 Restricted Stock

Unit Plan. In 2004, Delhaize America also borrowed 30,000 Delhaize Group

ADRs in connection w ith stock option exercises. During the remainder of

2004, Delhaize America purchased 30,000 Delhaize Group ADRs and used

them to reimburse the borrow ing. At the end of 2004, Delhaize America

had no borrow ed ADRs.

At the end of 2004, Delhaize Group SA owned 294,735 treasury shares

(incl. ADRs), of which 292,200 acquired prior to 2004, representing approxi-

mately 0.3% of the Delhaize Group share capital.

Consultation of the Issuer’s Documents

The public documents concerning the issuer can be consulted at the registe-

red office (rue Osseghemstraat 53, 1080 Brussels - Belgium).

In the United States, Delhaize Group is subject to the informational requi-

rements of the U.S. Securities Exchange Act of 1934, as amended (the

“ Exchange Act” ), and in accordance with the Exchange Act Delhaize Group

files reports and other information with the U.S. Securities and Exchange

Commission (the “ SEC” ). The reports and other information Delhaize Group

files w ith the SEC can be inspected at the SEC’s public reference room at

Room 1024, Judiciary Plaza, 450 Fifth Street, N.W., Washington, D.C., U.S.A.

20549. Copies of this information can be obtained from the public reference

room of the SEC at prescribed rates. You may call the SEC at 1 (800) SEC-0330

for further information regarding the operation of the public reference room.

Also, the SEC maintains a w ebsite at www.sec.gov that contains reports and

other information that registrants have filed electronically w ith the SEC.

Delhaize Group makes available free of charge, on or through the sharehol-

der information section of Delhaize Group’s website (ww w.delhaizegroup.

com), the Company’s reports filed electronically with the SEC pursuant to the

Exchange Act as soon as reasonably practicable after the Company electro-

nically files such material w ith the SEC.

ADRs of Delhaize Group are listed on the New York Stock Exchange under the

symbol “ DEG,” and its reports and other information can be inspected and

copied at the offices of the New York Stock Exchange, Inc., 20 Broad Street,

New York, New York, U.S.A. 10005.

Legal Version of the Annual Report

Only the French version of the annual report has legal force. The Dutch and

English versions represent translations of the French original. The consis-

tency between the different language versions has been verified by Delhaize

Group under its own responsibility.

Capital on December 31, 2001 46,196,352.00 2,264,224,571.50 92,392,704

Capital on December 31, 2002 46,196,352.00 2,264,224,571.50 92,392,704

Increase in capital on October 3, 2003* 24,224.00 1,325,209.06 48,448

Increase in capital on November 20, 2003* 91,702.50 7,617,941.78 183,405

Capital on December 31, 2003 46,312,278.50 2,273,167,722.34 92,624,557

Increase in capital on February 17, 2004* 56,515.00 4,702,206.82 113,030

Increase in capital on M ay 19, 2004* 53,965.00 4,566,100.46 107,930

Increase in capital on August 4, 2004* 72,140.00 5,576,963.58 144,280

Increase in capital on September 14, 2004* 85,903.00 7,429,811.56 171,806

Increase in capital on October 8, 2004* 91,777.50 8,680,843.80 183,555

Increase in capital on November 16, 2004* 81,581.00 8,152,862.61 163,162

Increase in capital on November 26, 2004* 80,120.50 8,650,106.33 160,241

Capital on December 31, 2004 46,834,280.50 2,320,926,617.50 93,668,561

* Increase in capital as a consequence of the exercise of w arrants under the 2002 Stock Incentive Plan.