Food Lion 2004 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2004 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DELHAIZE GROUP ANNUAL REPORT 2004 47

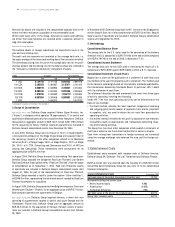

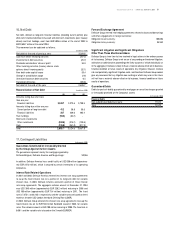

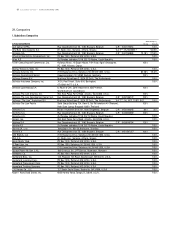

Leases

Delhaize Group’s stores operate principally in leased premises. Lease terms

generally range from 3 to 27 years w ith renewal options ranging from 3 to

27 years. The average remaining lease term for closed stores is 6.4 years.

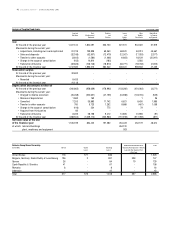

The follow ing table details, at December 31, 2004, the future minimum

lease payments under capital and operating leases:

(in thousands of EUR) Capital Leases Operating Leases

Open Stores Closed Stores

2005 97,339 181,118 28,534

2006 96,196 178,844 27,229

2007 95,229 170,989 26,187

2008 94,463 160,225 25,100

2009 92,141 148,596 22,568

Thereafter 676,172 1,259,235 114,423

Total minimum payments 1,151,540 2,099,007 244,041

Less estimated executory costs 20,724

Net minimum lease payments 1,130,816

Less amount representing interest 570,465

Present value of net minimum

lease payments 560,351

M inimum payments have not been reduced by minimum sublease income

of approximately EUR 45.4 million due over the term of non-cancelable

subleases.

Rent expenses, including scheduled rent increases, are recognized on a

straight-line basis over the minimum lease term.

Total Rent Expense under

Operating Leases for Open and Closed Stores

(in millions of EUR)

2004 245

2003 260

2002 291

2001 298

2000 257

In addition, Delhaize Group has signed lease agreements for additional

store facilities, the construction of which was not complete at December

31, 2004. The leases expire on various dates extending to 2031 with

renewal options generally ranging from 3 to 27 years. Total future minimum

rents under these agreements are approximately EUR 187 million.

Provisions of approximately EUR 101 million and EUR 100 million at December

31, 2004 and 2003, respectively, for remaining lease liabilities on closed stores

are included in provisions for liabilities and charges. Delhaize Group uses a

discount rate based on the current treasury note rates to calculate the present

value of the remaining rent payments on closed stores.

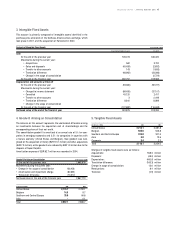

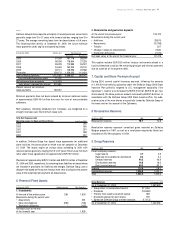

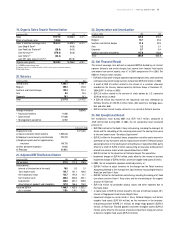

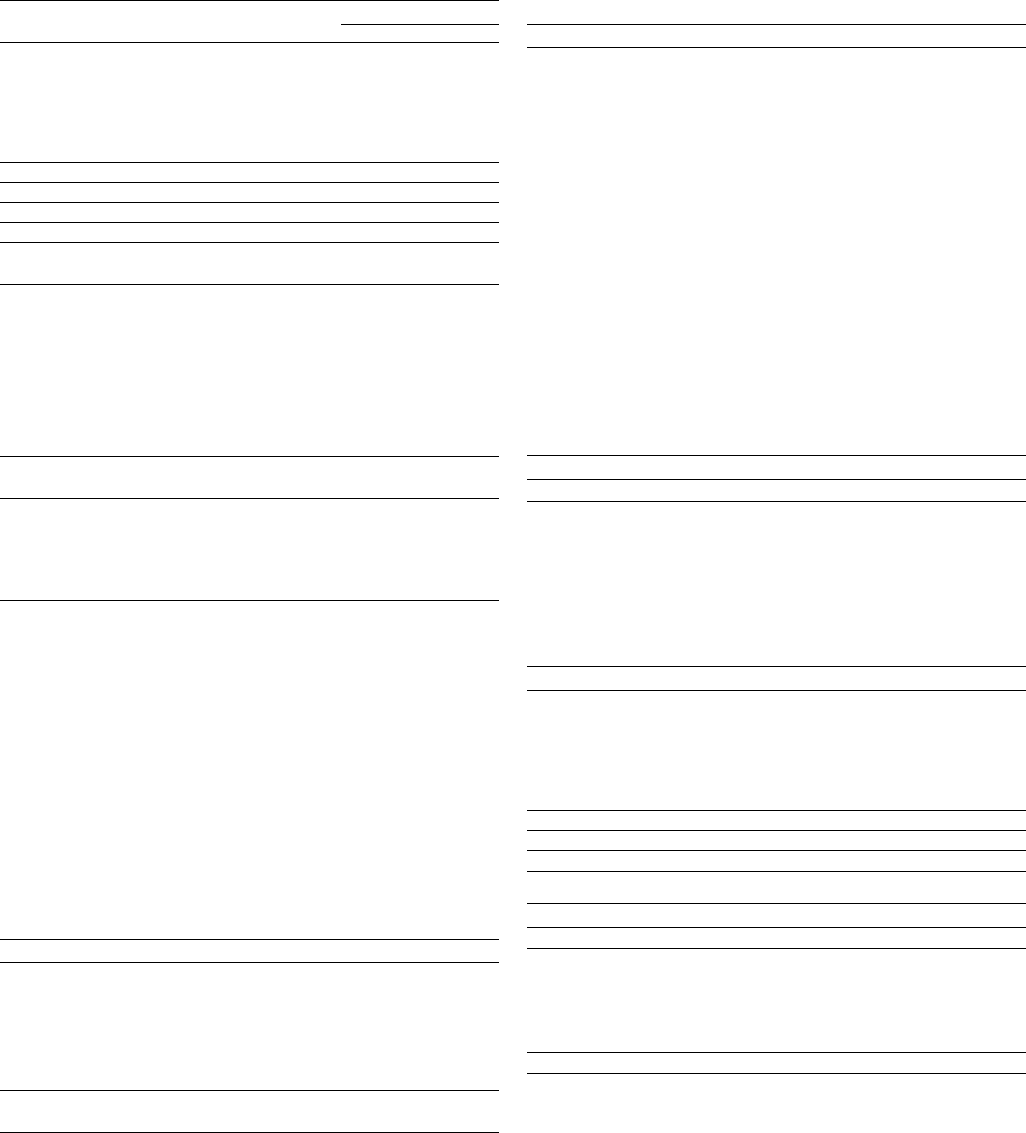

6. Financial Fixed Assets

(in thousands of EUR) Equity Investments Other Companies

1. Investments

At the end of the previous year 238 1,603

M ovements during the current year:

• Acquisitions - 261

• Sales and disposals (238) (128)

• Translation difference - (107)

Net book value at the end

of the financial year - 1,629

2. Receivables and guarantee deposits

At the end of the previous year 103,702

M ovements during the current year:

• Additions 29,875

• Repayments (31,786)

• Transfer 527

• Change in scope of consolidation 2,630

• Translation difference (7,470)

Net book value at the end of the financial year 97,478

This caption includes EUR 53.5 million treasury instruments placed in a

trust by Hannaford to satisfy the remaining principal and interest payments

due on a portion of its long-term debt.

7. Capital and Share Premium Account

During 2004, several capital increases occurred, following the exercise

of 1,044,004 warrants by optionees under the Delhaize Group 2002 Stock

Incentive Plan primarily targeted to U.S. management associates (“the

Optionees” ). Capital was increased by EUR 0.5 million (EUR 0.50 per new

share issued); the share premium account increased by EUR 47.8 million. In

accordance w ith the Delhaize Group 2002 Stock Incentive Plan, the subs-

cription price of the new shares was partially funded by Delhaize Group in

the name and for the account of the Optionees.

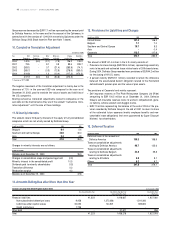

8. Revaluation Reserves

(in millions of EUR) 2004 2003

Revaluation reserves 18.7 14.8

Revaluation reserves represent unrealized gains recorded on Delhaize

Belgium property in 1981, as w ell as a revaluation required by Greek law

recorded on Alfa-Beta property in 2004.

9. Group Reserves

(in millions of EUR) 2004 2003

Parent company reserves :

Legal reserve 4.7 4.6

Reserves not available for distribution 0.4 0.4

Untaxed reserves 44.2 43.9

Distributable reserves 16.8 16.5

Profit carried forward 49.3 63.1

Subtotal 115.4 128.5

Consolidated reserves 1,326.8 1,224.1

Total 1,442.2 1,352.6

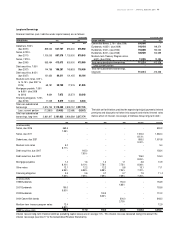

Group Reserves

(in thousands of EUR)

As of December 31, 2003 1,352,618

• Group share in consolidated results 211,454

• Dividends (105,289)

• Transfer from taxed revaluation surplus 369

• Dividends received on own shares 195

• Spread on Delhaize Group warrant exercises (17,113)

As of December 31, 2004 1,442,234