Food Lion 2004 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2004 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DELHAIZE GROUP ANNUAL REPORT 2004

80

This restriction would not apply to ordinary shares below the initial 3%

threshold or to Delhaize Group ordinary shares between tw o consecutive

thresholds as long as the beneficial owner has reported Delhaize Group

ordinary shares at least equal to the lower of the two thresholds. Any

person failing to timely report beneficial ow nership of Delhaize Group

ordinary shares may forfeit all or part of the rights attributable to such

Delhaize Group ordinary shares, including, but not limited to, voting rights

or rights to distributions of cash or share dividends or may even be ordered

by the President of the Commercial Court to sell the shares concerned to

a non-related party.

Holders of Delhaize Group ordinary shares and holders or beneficial ow ners

of Delhaize Group ADRs are subject to the same reporting requirements as

summarized above.

With the exception of the shareholders identified in the table on the

previous page, no shareholder or group of shareholders has declared as

of December 31, 2004 holding at least 3% of the outstanding shares and

warrants of Delhaize Group SA.

Delhaize Group is not aw are of the existence of any shareholders’ agree-

ment with respect to the voting right pertaining to the shares of the

Company.

On December 31, 2004, the directors and members of the Executive

Committee of Delhaize Group SA owned as a group 469,536 ordinary sha-

res or ADRs of Delhaize Group SA, which represented approximately 0.5%

of the total number of outstanding shares of Delhaize Group SA as of that

date. On December 31, 2004, the members of the Executive Committee of

Delhaize Group SA owned as a group 797,521 stock options, warrants and

restricted stock over an equal number of existing or new ordinary shares

or ADRs of the Company.

Dividend Policy

It is the policy of Delhaize Group to pay out a regularly increasing dividend

while retaining free cash flow consistent with opportunities to finance the

future grow th of the Company.

External Audit

The external audit of Delhaize Group SA is conducted by Deloitte & Touche,

Registered Auditors, represented by James Fulton, until the Ordinary

General M eeting in 2005.

On the basis of the audit conducted by the Statutory Auditor in accordance

with the standards of the Belgian Institute of Registered Auditors, the

Statutory Auditor is required to certify w hether the financial statements

of the Company give a true and fair view of its assets, financial situation

and results of operations. The Audit Committee examines and discusses

the Statutory Auditor’s findings on both the consolidated accounts and the

statutory accounts of the Company w ith the Statutory Auditor.

In addition, the Audit Committee meets w ith the external auditor at least

quarterly to discuss the results of the external auditor’s review of the quar-

terly information and other matters.

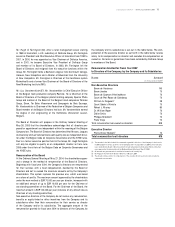

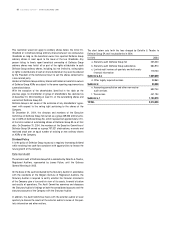

The chart below sets forth the fees charged by Deloitte & Touche to

Delhaize Group SA and its subsidiaries in 2004.

(in EUR)

2004

a. Statutory audit Delhaize Group SA 235,220

b. Statutory audit Delhaize Group subsidiaries 684,970

c. Limited audit reviews of quarterly and half-yearly

financial information 119,700

Subtotal a,b,c 1,039,890

d. Other legally required services 39,860

Subtotal d 39,860

e. Accounting consultation and other non-routine

audit services 692,744

f. Tax services 441,134

Subtotal e,f 1,133,879

TOTAL 2,213,629