Food Lion 2004 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2004 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.DELHAIZE GROUP ANNUAL REPORT 2004 77

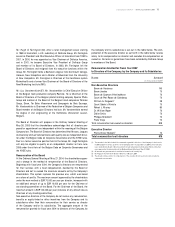

Comparison of NYSE Corporate Governance Rules Required to be

follow ed by U.S. Domestic Issuers and the Corporate Governance

Practices of Delhaize Group

Delhaize Group, as a non-U.S. company listed on the New York Stock

Exchange (“ NYSE” ), is permitted to follow home country practice in lieu of

certain corporate governance provisions of the NYSE. In accordance w ith

NYSE requirements, Delhaize Group must disclose any significant w ays

in which its corporate governance practices differ from those followed by

U.S. domestic companies under NYSE listing standards. Delhaize Group

believes that its corporate governance practices are consistent w ith those

follow ed by U.S. domestic companies under NYSE listing standards with

the following exceptions:

• The Governance Committee has one member w ho does not meet the

independence requirements of the NYSE. A governance committee of

a U.S. domestic company is required to consist solely of directors w ho

meet the independence requirements of the NYSE. The one member of

the Governance Committee who does not meet the independence requi-

rements of the NYSE will resign from the Governance Committee as of

the Ordinary General M eeting of M ay 26, 2005.

• Delhaize Group has not yet adopted corporate governance guidelines

as required for U.S. domestic companies listed on the NYSE. Under the

new Belgian Code on Corporate Governance, Delhaize Group is preparing

a corporate governance charter, which w ill be disclosed no later than

January 1, 2006. This new corporate governance charter will also meet

the NYSE corporate governance guidelines requirements applicable to

U.S. domestic companies.

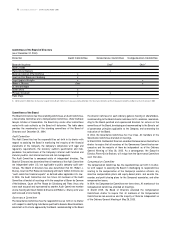

Executive M anagement

Executive Committee

The Chief Executive Officer is in charge of the day-to-day management

of the Company with the assistance of the Executive Committee. The

Executive Committee, chaired by the Chief Executive Officer, prepares the

strategy proposals for the Board of Directors, oversees the operational

activities and analyzes the business performance of the Group.

A Belgian law enacted in 2002 gives the Board of Directors the pow er to

delegate under certain conditions its management authority to a manage-

ment committee (”comité de direction / directiecomité“ ). Delhaize Group’s

Board elected not to create such a committee.

The members of the Executive Committee are appointed by the Board of

Directors. The Chief Executive Officer is the sole member of the Executive

Committee w ho is also a member of the Board of Directors. The Board of

Directors decides on the compensation of the members of the Executive

Committee and other senior officers of the Company upon recommendation

of the Compensation Committee. No executive Board member attends the

meeting when the Board discusses and decides on his compensation. The

composition of the Executive Committee can be found in the M anagement

Structure section on page 70.

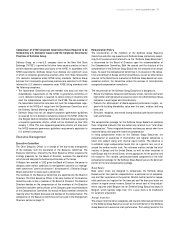

Remuneration Policy

The remuneration of the members of the Delhaize Group Executive

Committee and other top executives of Delhaize Group (collectively compri-

sing 15-20 executives and referred to as the “ Delhaize Group Executives” )

is determined by the Board of Directors upon the recommendation of

the Compensation Committee. Both the amount and the structure of the

compensation of the Delhaize Group Executives are analyzed on an annual

basis. To assist the Compensation Committee in its analysis of the compe-

titive environment in Europe and the United States, as well as other factors

relevant to the Committee’s evaluation of Delhaize Group Executive’s com-

pensation matters, the Committee retains the services of internationally

recognized compensation consultants.

The remuneration of the Delhaize Group Executives is designed to:

• Ensure that Delhaize Group can continuously attract, motivate and retain

high caliber and high potential executive talent for w hich Delhaize Group

competes in each region and internationally;

• Promote the achievement of Board-approved performance targets, ali-

gned with building shareholder value over the short, medium and long

term; and

• Stimulate, recognize, and reward strong individual contribution and solid

team performance.

The compensation package for the Delhaize Group Executives combines

three integrated elements that are collectively referred to as “ total direct

compensation.” Those integrated elements are base pay, annual short-term

incentive bonus and long-term incentive compensation.

In fixing compensation levels for the Delhaize Group Executives, the

compensation of executives in international and regional companies is

taken into account along with internal equity factors. The objective is

to establish target compensation levels that, as a general rule, are at or

around the median market level. The reference markets include the retail

industry in Europe and the United States, as well as other industries in

both Europe and the United States, w here appropriate for the position and

the executive. The variable, performance-based components of the total

compensation package for the Delhaize Group Executives are the dominant

portion of the total compensation package.

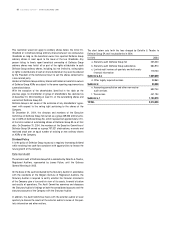

Base Salary

Base salary levels are designed to compensate the Delhaize Group

Executives for their position responsibilities, a particular set of competen-

cies and their experience in the position. M arket median levels for compa-

rable positions are targeted for the base pay and the base pay levels are

subject to regular annual review s. Except for annual cost of living adjust-

ments required under Belgium law for Delhaize Group Executives based in

Belgium, which typically range from 1-3% a year, there is no mechanism

for automatic adjustment.

Annual Incentive

The annual incentive bonus recognizes and rewards individual performance

of the Delhaize Group Executive as w ell as the contribution of the Delhaize

Group Executive to executive team performance. The funding levels for the