Food Lion 2004 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2004 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DELHAIZE GROUP ANNUAL REPORT 2004 79

Shareholder Structure and Ownership Reporting

In accordance with Belgian law, any individual or entity w ho, as a result of

acquiring voting securities or securities giving the right to subscribe to or

acquire voting securities, becomes the owner of 5% or more of the total

voting rights of a company, taking into account the securities held by the

owner as well as by persons acting for its account or affiliated or acting

jointly with it, must, within two business days after such acquisition, dis-

close to the Company and to the Belgian Banking, Finance and Insurance

Commission the information set forth in the Law of M arch 2, 1989 and the

Royal Decree of M ay 10, 1989 implementing this Law. Such disclosure

obligation must be complied with upon every acquisition or disposal which

causes such ow ner’s voting rights (taking into account the voting rights

attached to securities held by persons acting for its account or affiliated or

acting jointly w ith it) to increase above or fall below 5% or any multiple of

5% of the total number of voting rights.

Under Delhaize Group’s Articles of Association, any person or legal

entity, which ow ns or acquires securities of the Company granting voting

right, whether representing the share capital or not, must disclose to

the Company and to the Banking, Finance and Insurance Commission, in

compliance with legal provisions in force, the number of securities that

such person or legal entity owns, alone or jointly with one or several other

persons or legal entities, when the voting rights attached to such securities

amount to three percent (3%) or more of the total of the voting rights exis-

ting when the situation triggering the disclosure obligation occurs.

Such person or legal entity must also do so in the event of a transfer or an

additional acquisition of securities referred to in the preceding paragraph

when, after such transaction, the voting rights attached to securities that

it owns amount to 5%, 10%, and so on by blocks of 5% of the total of the

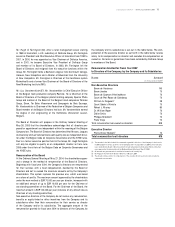

Date of

Notification

Name of Shareholder Number

of

Shares

Held

Shareholding in Percentage

of the Number of

Outstanding Shares and Warrants

According to the Notification

Shareholding in Percentage

of the Number of

Outstanding Shares and Warrants as

at February 28, 2005

August 31,

2004

Axa (consolidated)

Avenue M atignon 25

75008 Paris

France

The number of shares held

include the number of shares

notified by its subsidiary:

Alliance Capital Management L.P.

1345 Avenue of the Americas

New York, NY, 10105

United States of America

6,194,527 5.93% 5.93%

August 19,

2004 5,557,618 5.31% 5.31%

June 11,

2003

Sofina SA

Rue des Colonies 11

1000 Brussels

Belgium

3,168,444 3.22% 3.03%

voting rights existing when the situation triggering the disclosure obliga-

tion occurs, or w hen the voting rights attached to securities that it ow ns

fall below one of those thresholds or below the threshold referred to in the

preceding paragraph.

Any person or legal entity w hich acquires or transfers, alone or jointly, the

direct or indirect control of a corporation w hich ow ns 3% at least of the

voting rights of the Company must disclose such acquisition or transfer to

the Company and to the Banking, Finance and Insurance Commission in

compliance with legal provisions in force.

Disclosure statements relating to the acquisition or transfer of securities,

which are made in compliance w ith this requirement, must be addressed

to the Banking, Finance and Insurance Commission and to the Board of

Directors of the Company at the latest the second business day after the

occurrence of the triggering event. The documents of the transaction that

gave rise to the disclosure obligation must be addressed to the Banking,

Finance and Insurance Commission within the same period of time. The

number of securities acquired by succession must only be disclosed thirty

days after such succession has been accepted, under the benefit of inven-

tory as the case may be.

In order for a beneficial ow ner to be eligible to exercise voting rights w ith

respect to all Delhaize Group ordinary shares held by a beneficial owner

exceeding such thresholds, such beneficial owner must have (a) complied

in a timely manner w ith these disclosure requirements and (b) provided the

required disclosure materials at least 20 days prior to the date of the sha-

reholders’ meeting with respect to such Delhaize Group ordinary shares. A

beneficial ow ner may not exercise voting rights in respect of a number of

Delhaize Group ordinary shares greater than the number disclosed at least

20 days prior to the date of the applicable shareholders’ meeting.