Enom 2010 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2010 Enom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Growth Strategy

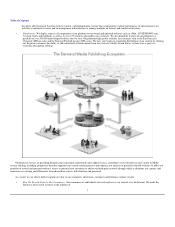

We believe we are in the early stages of a large and long-term business opportunity. Our plan is to achieve long-term and sustainable growth by fostering

the following virtuous cycle:

Create and distribute in-demand content using proprietary algorithms and processes to our owned and operated websites and to our network of

customer websites;

Monetize the traffic driven to our owned and operated websites and to our network of customer websites through targeted advertisements

matched with our content in a manner that maximizes advertising revenue and end-user experience; and

Reinvest back into our platform to generate additional content, improve our proprietary algorithms and processes and expand our network of

owned and operated websites and customer websites.

Content & Media Products and Services

Content Creation

Our Content & Media offering is focused on creating long-lived media content, primarily consisting of text articles and videos, and delivering it along

with our social media and monetization tools to our owned and operated websites and to our network of customer websites. We leverage proprietary

technology and algorithms and our automated online workflow processes to create content with a predicted economic return above a minimum threshold. We

believe that our process matches or exceeds the editorial processes of traditional media companies and of our online competitors, and ensures that the content

we create is of high quality and factually accurate.

Title Generation. Utilizing a series of proprietary technologies, algorithms and processes, we analyze search query and user behavior data to

identify commercially valuable topics that are in-demand. Once commercially valuable titles have been identified, they undergo a multi-step

process whereby a subset of our community of qualified freelance content creators quality check, edit and approve specific article and video titles

to ensure that they are appropriate, accurate and clearly understandable.

Content Generation. Our creators can claim titles, both for text and video, by searching within categories we make available to them online.

After the content creator submits a text article or video to us, it undergoes a series of human editorial reviews, including copy editing, fact

checking and reference checking, as well as an automated plagiarism check. The creation of the vast majority of our text articles involves a multi-

step process which includes direct interaction with at least 14 human touch points. At the end of the process, we own full rights to the content as

works made for hire. The text article or video is then distributed to our owned and operated websites or to our network of customer websites.

Content Investment Strategy

We strive to create long-lived content with positive growth characteristics that is expected to yield an attractive financial return over its useful life. We

base our capital allocation decisions primarily on our analysis of a predicted internal rate of return and have generally observed favorable historical returns on

content.

Internal rates of return for content produced now or in the future may be significantly less than those achieved in previous periods. See Item 1A. "Risk

Factors—We base our capital allocation decisions primarily on our analysis of the predicted internal rate of return on content. If the estimates and

assumptions we use in calculating internal rate of return on content are inaccurate, our capital may be inefficiently allocated. If we fail to appropriately

allocate our capital, our growth rate and financial results

9

•

•

•

•

•