Barclays 2013 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2013 Barclays annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Barclays’ sustainable success will be assured by

becoming the ‘Go-To’ bank for all of our stakeholders. If

we understand their needs and priorities and ensure that

these are at the heart of our decision-making, we will be

able to build a bank which is lower-risk, more predictable

and higher-performing.

The strategic response

In 2013, we launched the Transform programme to deliver the

recommendations of the Strategic Review. Transform is the plan that

will help Barclays become the ‘Go-To’ bank. It has three overall goals:

Turnaround, Return Acceptable Numbers, Sustain FORward

Momentum.

Turnaround the business

Turnaround was the immediate task of stabilising the business and

maintaining momentum. In the second half of 2012, we delivered our

new goal, purpose, and values to unite Barclays with a shared sense of

direction – how we will do business.

We have put in place a new Executive team which is focused on

delivery. The vast majority of our 139,600 colleagues have participated

in workshops and training in Barclays’ values. To cement our cultural

change, a guide for behaviour – The Barclays Way – has been published

internally and externally.

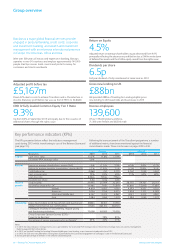

Return Acceptable Numbers

In 2013, we turned our attention towards the longer-term

transformation of Barclays. For our Return Acceptable Numbers phase,

we are de-risking and de-leveraging the business to make it more

sustainable for the long term.

We committed to consolidate to core lines of business, to generate

£1.7bn of cost savings by 2015, to lower our RWAs, funding and

liquidity, and to reach a Core Tier 1 capital ratio of 10.5%. See page 238

for further details on the Transform financial commitments.

In 2013, we:

Completed a £5.8bn rights issue in October

Issued £2.1bn of CRDIV and PRA-qualifying Additional Tier 1 (AT1)

capital

Reduced CRDIV leverage exposure by £196bn in H2 2013 to

£1,363bn, of which an estimated £55bn related to foreign exchange

Drove improvements in our loan-to-deposit ratio (to 101% at

December 2013)

Additionally, we reduced legacy assets in our Exit Quadrant portfolios

by £40bn through Investment Bank legacy asset reductions of £17bn

and derivative efficiencies of £23bn.

Sustain Forward Momentum

Our journey to ‘Go-To’ depends on continuing to adapt Barclays for the

future and ensuring that we do not return to a short-term bias as we

execute our plans. In order to Sustain FORward Momentum, we have

also set in place longer-term markers in four critical areas: Culture,

Rewards, Control and Cost.

The Board-commissioned Salz Review also prompted us to review our

conduct. We are committed to being open and transparent and to

regaining the trust of all of Barclays’ stakeholders. We have integrated

our necessary behavioural transformation into our Transform

programme. Full details on our response to the Salz Review can be

found on pages 126 to 129.

A strong culture is the first line of defence against repeating the

mistakes of the past. To unite around Barclays’ Values and Behaviours,

we published ‘The Barclays Way’ to govern our way of working across

our business globally. Colleagues are essential to embedding our

Purpose and Values and, in 2013, all colleagues attended Values and

Behaviours engagement sessions.

Reward and incentivisation is a critical enabler of behavioural change.

As of 2014, colleague performance will be measured and rewarded not

only on ‘what’ an employee delivers but also ‘how’ they achieve their

objectives. As such, remuneration will align with Barclays’ Purpose,

Values and Behaviours as well as the Group Balanced Scorecard.

As of February 2013 control functions now have solid reporting lines

into the Group CEO rather than business heads to avoid conflict of

interest.

The Remuneration Committee will embed aggregate and individual

incentive risk adjustments with additional Compliance and Risk input.

Furthermore, our principal risk framework has been enhanced with the

inclusion of conduct risk and reputation risk and a revised Enterprise-

Wide Risk Committee will ensure adequate Board oversight.

To address the cost challenge, we have focused on creating the right

level of financial analytics and on improving operational efficiencies.

The key elements of our cost programme are right-sizing our

businesses, industrialising handling of customer transactions and

queries, and adopting innovative technology and automated

processing.

Focus of efforts in 2014

In 2014, we will continue to build on the progress made in 2013. We will

focus on delivering on our financial commitments and expect to see

the benefits of our 2013 work on cost begin to crystallise.

We aim to respond positively to the evolving regulatory landscape. We

have sought to constructively engage our regulators and improve our

regulatory and public disclosures in order to improve transparency and

consistency with society’s expectations.

The new regulatory and emerging business environment will inevitably

call for continued rigorous review and adaption of the mix and

structure of the businesses of the Bank to ensure we generate

sustainable returns.

However, care needs to be taken to ensure that regulation does not go

too far. A healthy banking sector ensuring returns above the cost of

equity is essential to economic growth. Vibrant economies need vibrant

banks. It is therefore important to ensure that the rightly-increased

focus by the regulator on conduct supervision does not inadvertently

result in the withdrawal of services and the restriction of choice.

Another key focus over 2013 and the coming years is rebuilding the

trust that customers, clients, and stakeholders have in our organisation.

We have pledged to increase transparency and conduct our business in

the right way, as set out in our values.

We need to better respond to the current needs and anticipate the

future demands of our customers and clients. As they become

increasingly technology savvy we have worked to embed technology

across our product offering. This ranges from payment innovations

such as PingIt to expanding our Investment Bank’s electronic trading

platform BARX.

Group overview 02

Chief Executive’s strategic review 04

Strategy and operating environment 06

Business model/Value creation 08

Balanced Scorecard 10

Group Finance Director’s review 12

Strategic Risk overview 14

Performance review by division 18

Chairman’s governance overview 46

Summary remuneration report 48

It is important that we understand the

conditions in which we operate in order

to run the company effectively.

In this section we aim to highlight some

of the major external factors affecting

Barclays and how we aim to address

these factors through our strategy.

barclays.com/annualreport Barclays PLC Annual Report 2013 07

The Strategic Report Governance Risk review Financial review Financial statements Shareholder informationRisk management