Barclays 2013 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2013 Barclays annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312 -

313

313 -

314

314 -

315

315 -

316

316 -

317

317 -

318

318 -

319

319 -

320

320 -

321

321 -

322

322 -

323

323 -

324

324 -

325

325 -

326

326 -

327

327 -

328

328 -

329

329 -

330

330 -

331

331 -

332

332 -

333

333 -

334

334 -

335

335 -

336

336 -

337

337 -

338

338 -

339

339 -

340

340 -

341

341 -

342

342 -

343

343 -

344

344 -

345

345 -

346

346 -

347

347 -

348

348 -

349

349 -

350

350 -

351

351 -

352

352 -

353

353 -

354

354 -

355

355 -

356

356 -

357

357 -

358

358 -

359

359 -

360

360 -

361

361 -

362

362 -

363

363 -

364

364 -

365

365 -

366

366 -

367

367 -

368

368 -

369

369 -

370

370 -

371

371 -

372

372 -

373

373 -

374

374 -

375

375 -

376

376 -

377

377 -

378

378 -

379

379 -

380

380 -

381

381 -

382

382 -

383

383 -

384

384 -

385

385 -

386

386 -

387

387 -

388

388 -

389

389 -

390

390 -

391

391 -

392

392 -

393

393 -

394

394 -

395

395 -

396

396 -

397

397 -

398

398 -

399

399 -

400

400 -

401

401 -

402

402 -

403

403 -

404

404 -

405

405 -

406

406 -

407

407 -

408

408 -

409

409 -

410

410 -

411

411 -

412

412 -

413

413 -

414

414 -

415

415 -

416

416 -

417

417 -

418

418 -

419

419 -

420

420 -

421

421 -

422

422 -

423

423 -

424

424 -

425

425 -

426

426 -

427

427 -

428

428 -

429

429 -

430

430 -

431

431 -

432

432 -

433

433 -

434

434 -

435

435 -

436

436

|

|

Chief Executive’s strategic review

2013 has been a year of significant change for Barclays.

A year ago we set out the outcome of our strategic review

and our Transform plan to make Barclays the ‘Go-To’ bank

for all our stakeholders. We continue to take steps to

de-risk the business, strengthen the balance sheet,

increase the efficiency of our operations and are making

good progress against our plan.

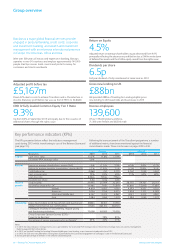

Our 2013 results clearly demonstrate the benefits of the diversity

we enjoy in the Group, as well as the strength of our core franchises.

While impacted by the restructuring and de-risking activity, underlying

business performance has been resilient, with adjusted income of

£28.2bn and adjusted profit before tax of £5.2bn. Our core franchises

remain strong, with UK Retail and Business Banking, Barclaycard, UK

Corporate Banking, and within the Investment Bank our Equities and

Investment Banking businesses all delivering good performances in

2013. Important progress has also been made in repositioning our

African, European and Wealth businesses, although further work is

required to get returns to acceptable levels. Our Fixed Income,

Currency and Commodities business in the Investment Bank saw

revenues fall, in line with our European peers, as market conditions

remained subdued.

We are making good headway across the financial commitments we

set out as part of our Transform plan as well as on de-leveraging to

meet the PRA’s revised target. I am pleased by our progress on RWAs

and leverage. We have been able to move more quickly than anticipated

in managing down CRD IV RWAs, bringing us a little below our

Transform target well ahead of the 2015 timeline. Through rigorous

analysis and focus, we have also virtually achieved the PRA leverage

target six months in advance of the June 2014 deadline.

We have invested considerably in transforming our businesses. In the

months ahead we expect to see the benefits of this coming through.

We narrowly missed our cost guidance for 2013, largely due to a

£331m increase at year-end in certain litigation provisions, but the true

operating performance of Barclays was on track. Costs are a key area of

focus for us and we remain committed to our 2015 Transform cost

target of £16.8bn. Compensation for key talent is one area that we

were prepared to invest in strategically. Our aim is to deliver a greater

share of the income we generate to shareholders while remaining

competitive on pay. Although profits for 2013 were down, the 38%

reduction in incentives in the previous two years had begun to cause

demonstrable damage to our business through increased attrition, with

a near doubling of resignations of senior staff in the US for example.

We concluded that a 2013 incentive pool of £2,378m was appropriate.

Whilst this is up 10% on the final 2012 incentive pool, before

adjustment for risk and conduct events it is down 18% on 2012

and remains 32% below the pool level in 2010 when we started

to reposition Barclays’ remuneration. This was a difficult decision,

but the right one for the long term interest of our shareholders.

We have also made progress against the two non-financial

commitments we made last February. The first of these, culture

change, and in particular the process of embedding our Purpose and

Values throughout the organisation, is going well. Every colleague has

completed a mandatory training programme, and we have integrated

our Purpose and Values into the day to day management processes of

the Bank. We have developed and published our new Code of Conduct

which every colleague must abide by and attest to annually.

‘We have made good

progress in 2013 and we

start 2014 in a better position

than for several years. While

recognising there is much

more to do, we have every

reason to feel positive about

our prospects and confident

that we will become the

‘Go-To’ bank for all our

stakeholders.’

barclays.com/annualreport

04 Barclays PLC Annual Report 2013