3M 2011 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2011 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

91

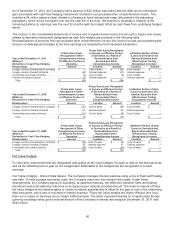

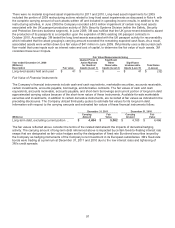

At December 31, 2011, the Company had interest rate swaps designated as fair value hedges of underlying fixed

rate obligations. In July 2007, in connection with the issuance of a seven-year Eurobond for an amount of 750 million

Euros, the Company completed a fixed-to-floating interest rate swap on a notional amount of 400 million Euros as a

fair value hedge of a portion of the fixed interest rate Eurobond obligation. In August 2010, the Company terminated

150 million Euros of the notional amount of this swap. As a result, a gain of 18 million Euros, recorded as part of the

balance of the underlying debt, will be amortized as an offset to interest expense over this debt’s remaining life. Prior

to termination of the applicable portion of the interest rate swap, the mark-to-market of the hedge instrument was

recorded as gains or losses in interest expense and was offset by the gain or loss on carrying value of the underlying

debt instrument. Consequently, the subsequent amortization of the 18 million Euros recorded as part of the

underlying debt balance is not part of gains on hedged items recognized in income in the tables below.

In November 2006, the Company entered into a $400 million fixed-to-floating interest rate swap concurrent with the

issuance of the three-year medium-term note due in 2009. The swap and underlying note matured in

November 2009.

The Company also had two fixed-to-floating interest rate swaps with an aggregate notional amount of $800 million

designated as fair value hedges of the fixed interest rate obligation under the $800 million, three-year, 4.50% notes

issued in October 2008. These swaps and underlying note matured in the fourth quarter of 2011.

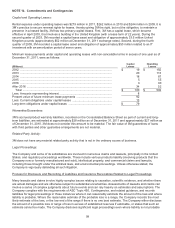

Fair Value Hedging ² Foreign Currency: In November 2008, the Company entered into foreign currency forward

contracts to purchase Japanese Yen, Pound Sterling, and Euros with a notional amount of $255 million at the

contract rates. These contracts were designated as fair value hedges of a U.S. dollar tax obligation. These fair value

hedges matured in early January 2009. The mark-to-market of these forward contracts was recorded as gains or

losses in tax expense and was offset by the gain or loss on the underlying tax obligation, which also was recorded in

tax expense. Changes in the value of these contracts in 2009 through their maturity were not material.

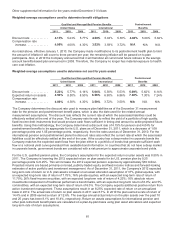

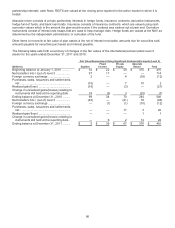

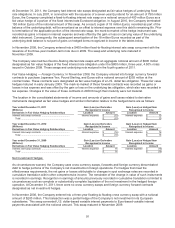

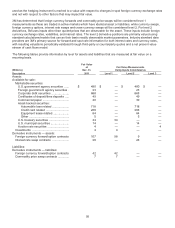

The location in the consolidated statements of income and amounts of gains and losses related to derivative

instruments designated as fair value hedges and similar information relative to the hedged items are as follows:

Y

ear ended December 31, 2011 Gain (Loss) on Derivative Gain (Loss) on Hedged Item

(Millions) Recognized in Income Recognized in Income

Derivatives in Fair Value Hedging Relationships Location Amount Location Amount

Interest rate swap contracts .......................................... Interest expense $ (10 ) Interest expense $ 10

Total ......................................................................... $ (10 ) $ 10

Y

ear ended December 31, 2010 Gain (Loss) on Derivative Gain (Loss) on Hedged Item

(Millions) Recognized in Income Recognized in Income

Derivatives in Fair Value Hedging Relationships Location Amount Location Amount

Interest rate swap contracts .......................................... Interest expense $ (16 ) Interest expense $ 16

Total ......................................................................... $ (16 ) $ 16

Y

ear ended December 31, 2009 Gain (Loss) on Derivative Gain (Loss) on Hedged Item

(Millions) Recognized in Income Recognized in Income

Derivatives in Fair Value Hedging Relationships Location Amount Location Amount

Interest rate swap contracts .......................................... Interest expense $ 16 Interest expense $ (16 )

Total ......................................................................... $ 16 $ (16 )

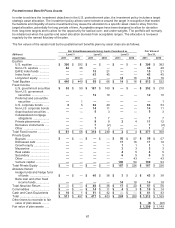

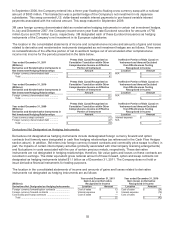

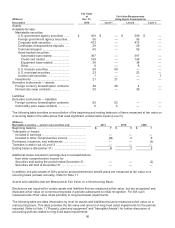

Net Investment Hedges:

As circumstances warrant, the Company uses cross currency swaps, forwards and foreign currency denominated

debt to hedge portions of the Company’s net investments in foreign operations. For hedges that meet the

effectiveness requirements, the net gains or losses attributable to changes in spot exchange rates are recorded in

cumulative translation within other comprehensive income. The remainder of the change in value of such instruments

is recorded in earnings. Recognition in earnings of amounts previously recorded in cumulative translation is limited to

circumstances such as complete or substantially complete liquidation of the net investment in the hedged foreign

operation. At December 31, 2011, there were no cross currency swaps and foreign currency forward contracts

designated as net investment hedges.

In November 2006, the Company entered into a three-year floating-to-floating cross currency swap with a notional

amount of $200 million. This transaction was a partial hedge of the Company’s net investment in its European

subsidiaries. This swap converted U.S. dollar-based variable interest payments to Euro-based variable interest

payments associated with the notional amount. This swap matured in November 2009.