3M 2011 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2011 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

73

securities sold use the first in, first out (FIFO) method. Since these marketable securities are classified as available-

for-sale securities, changes in fair value will flow through other comprehensive income, with amounts reclassified out

of other comprehensive income into earnings upon sale or “other-than-temporary” impairment.

3M reviews impairments associated with its marketable securities in accordance with the measurement guidance

provided by ASC 320, Investments-Debt and Equity Securities, when determining the classification of the impairment

as “temporary” or “other-than-temporary”. A temporary impairment charge results in an unrealized loss being

recorded in the other comprehensive income component of shareholders’ equity. Such an unrealized loss does not

reduce net income attributable to 3M for the applicable accounting period because the loss is not viewed as other-

than-temporary. The factors evaluated to differentiate between temporary and other-than-temporary include the

projected future cash flows, credit ratings actions, and assessment of the credit quality of the underlying collateral, as

well as other factors.

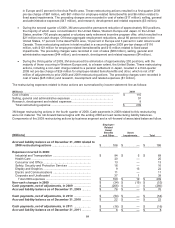

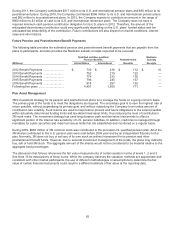

The balance at December 31, 2011 for marketable securities by contractual maturity are shown below. Actual

maturities may differ from contractual maturities because the issuers of the securities may have the right to prepay

obligations without prepayment penalties.

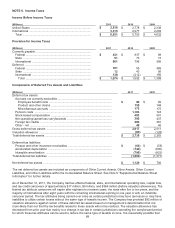

Dec. 31,

(Millions) 2011

Due in one year or less ............................. $ 867

Due after one year through three years .... 1,339

Due after three years through five years ... 138

Due after five years ................................... 13

Total marketable securities ....................... $ 2,357

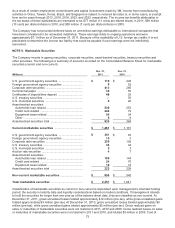

3M has a diversified marketable securities portfolio of $2.357 billion as of December 31, 2011. Within this portfolio,

current and long-term asset-backed securities (estimated fair value of $1.055 billion) are primarily comprised of

interests in automobile loans and credit cards. At December 31, 2011, the asset-backed securities credit ratings were

AAA or A-1+, with the exception of two securities (one rated AAA/A3 and one rated AAA/A1) with a fair market value

of less than $7 million.

3M’s marketable securities portfolio includes auction rate securities that represent interests in investment grade

credit default swaps; however, currently these holdings comprise less than one percent of this portfolio. The

estimated fair value of auction rate securities are $4 million and $7 million as of December 31, 2011 and 2010,

respectively. Gross unrealized losses within accumulated other comprehensive income related to auction rate

securities totaled $9 million (pre-tax) and $6 million (pre-tax) as of December 31, 2011 and 2010, respectively. As of

December 31, 2011, auction rate securities associated with these balances have been in a loss position for more

than 12 months. Since the second half of 2007, these auction rate securities failed to auction due to sell orders

exceeding buy orders. Liquidity for these auction-rate securities is typically provided by an auction process that

resets the applicable interest rate at pre-determined intervals, usually every 7, 28, 35, or 90 days. The funds

associated with failed auctions will not be accessible until a successful auction occurs or a buyer is found outside of

the auction process. Refer to Note 13 for a table that reconciles the beginning and ending balances of auction rate

securities.