3M 2011 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2011 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

55

value is defined as the exit price, or the amount that would be received to sell an asset or paid to transfer a liability in

an orderly transaction between market participants as of the measurement date. The standard also establishes a

hierarchy for inputs used in measuring fair value that maximizes the use of observable inputs and minimizes the use

of unobservable inputs by requiring that the most observable inputs be used when available. Observable inputs are

inputs market participants would use in valuing the asset or liability developed based on market data obtained from

sources independent of the Company. Unobservable inputs are inputs that reflect the Company’s assumptions about

the factors market participants would use in valuing the asset or liability developed based upon the best information

available in the circumstances. The hierarchy is broken down into three levels. Level 1 inputs are quoted prices

(unadjusted) in active markets for identical assets or liabilities. Level 2 inputs include quoted prices for similar assets

or liabilities in active markets, quoted prices for identical or similar assets or liabilities in markets that are not active,

and inputs (other than quoted prices) that are observable for the asset or liability, either directly or indirectly. Level 3

inputs are unobservable inputs for the asset or liability. Categorization within the valuation hierarchy is based upon

the lowest level of input that is significant to the fair value measurement.

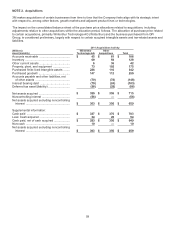

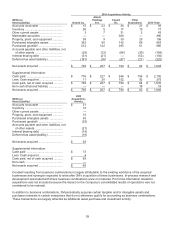

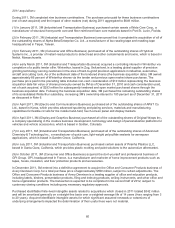

Acquisitions: The Company accounts for business acquisitions in accordance with ASC 805, Business Combinations.

This standard requires the acquiring entity in a business combination to recognize all (and only) the assets acquired

and liabilities assumed in the transaction and establishes the acquisition-date fair value as the measurement

objective for all assets acquired and liabilities assumed in a business combination. Certain provisions of this standard

prescribe, among other things, the determination of acquisition-date fair value of consideration paid in a business

combination (including contingent consideration) and the exclusion of transaction and acquisition-related

restructuring costs from acquisition accounting. 3M applies this standard to business combinations and adjustments

to an acquired entity’s deferred tax asset and liability balances occurring after December 31, 2008. Pre-2009

business combinations were accounted for under a former standard which, among other aspects, required

transaction and acquisition-related restructuring costs to be included in the acquisition purchase accounting and did

not require the recognition of certain contingent consideration as of the acquisition date.

New Accounting Pronouncements

In April 2009, the FASB issued three accounting standards which (1) provide guidance on estimating the fair value of

an asset or liability when the volume and level of activity for the asset or liability have significantly declined and

identifying transactions that are not orderly, (2) modify the requirements for recognizing other-than-temporarily

impaired debt securities and change the impairment model for such securities, and (3) add additional disclosure

requirements with respect to fair value measurements including disclosures in interim periods. For 3M, these

standards were effective beginning April 1, 2009. The Company discloses the additional required information. The

other aspects of these standards did not have a material impact on 3M’s consolidated results of operations or

financial condition.

In June 2009, the FASB issued a new standard regarding the accounting for transfers of financial assets amending

the existing guidance on transfers of financial assets to, among other things, eliminate the qualifying special-purpose

entity concept, include a new unit of account definition that must be met for transfers of portions of financial assets to

be eligible for sale accounting, clarify and change the derecognition criteria for a transfer to be accounted for as a

sale, and require significant additional disclosure. For 3M, this standard was effective for new transfers of financial

assets beginning January 1, 2010. Because 3M does not have significant transfers of financial assets, the adoption

of this standard did not have a material impact on 3M’s consolidated results of operations or financial condition.

In June 2009, the FASB issued a new standard that revises the consolidation guidance for variable-interest entities.

The modifications include the elimination of the exemption for qualifying special purpose entities, a new approach for

determining who should consolidate a variable-interest entity, and changes to when it is necessary to reassess who

should consolidate a variable-interest entity. For 3M, this standard was effective January 1, 2010. The adoption of

this standard did not have a material impact on 3M’s consolidated results of operations or financial condition.

In August 2009, the FASB issued Accounting Standards Update (ASU) No. 2009-05, Measuring Liabilities at Fair

Value, which provides additional guidance on how companies should measure liabilities at fair value under ASC 820.

The ASU clarifies that the quoted price for an identical liability should be used. However, if such information is not

available, a entity may use the quoted price of an identical liability when traded as an asset, quoted prices for similar

liabilities or similar liabilities traded as assets, or another valuation technique (such as the market or income

approach). The ASU also indicates that the fair value of a liability is not adjusted to reflect the impact of contractual

restrictions that prevent its transfer and indicates circumstances in which quoted prices for an identical liability or

quoted price for an identical liability traded as an asset may be considered level 1 fair value measurements (see Note

13 for a description of level 1 measurements). For 3M, this ASU was effective October 1, 2009. The adoption of this

ASU did not have a material impact on 3M’s consolidated results of operations or financial condition.