3M 2011 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2011 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

69

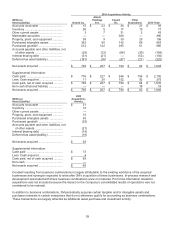

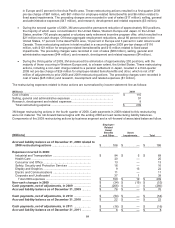

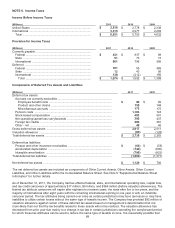

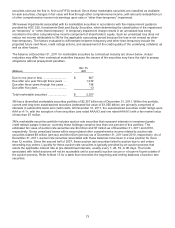

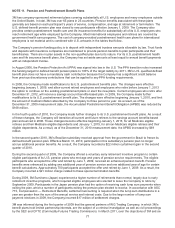

NOTE 8. Income Taxes

Income Before Income Taxes

(Millions) 2011 2010 2009

United States ........................................................................... $ 2,516

$ 2,778 $ 2,338

International ................................................................ ............. 3,515

2,977 2,294

Total ..................................................................................... $ 6,031

$ 5,755 $ 4,632

Provision for Income Taxes

(Millions) 2011 2010 2009

Currently payable .....................................................................

Federal ................................................................................. $ 431

$ 837 $ 88

State .................................................................................... 51

73 13

International ......................................................................... 861

796 586

Deferred ..................................................................................

Federal ................................................................................. 181

55 489

State .................................................................................... 12

43 56

International ......................................................................... 138

(212) 156

Total ................................................................................. $ 1,674

$ 1,592 $ 1,388

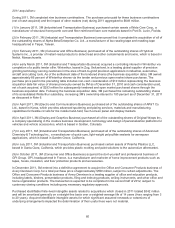

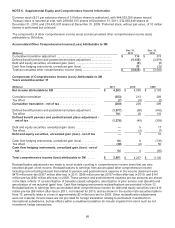

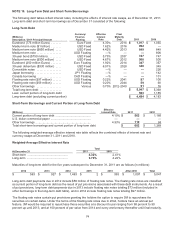

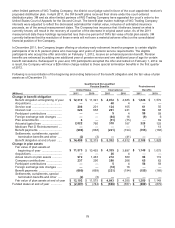

Components of Deferred Tax Assets and Liabilities

(Millions) 2011 2010

Deferred tax assets:

Accruals not currently deductible ....................................................................

Employee benefit costs .............................................................................. $ 96 $ 99

Product and other claims ........................................................................... 155 148

Miscellaneous accruals .............................................................................. 173 175

Pension costs ................................................................................................ 1,183 724

Stock-based compensation ........................................................................... 483 501

Net operating/capital loss carryforwards ....................................................... 392 437

Foreign tax credits ......................................................................................... 286 281

Other - net ...................................................................................................... 49 46

Gross deferred tax assets ................................................................................. 2,817 2,411

Valuation allowance .......................................................................................... (82) (128 )

Total deferred tax assets ................................................................................... $ 2,735 $ 2,283

Deferred tax liabilities:

Product and other insurance receivables ...................................................... $ (63) $ (59 )

Accelerated depreciation ............................................................................... (745) (695 )

Intangible amortization .................................................................................. (798) (823 )

Total deferred tax liabilities ............................................................................... (1,606) (1,577 )

Net deferred tax assets ..................................................................................... $ 1,129 $ 706

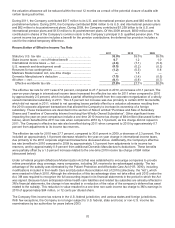

The net deferred tax assets are included as components of Other Current Assets, Other Assets, Other Current

Liabilities, and Other Liabilities within the Consolidated Balance Sheet. See Note 5 “Supplemental Balance Sheet

Information” for further details.

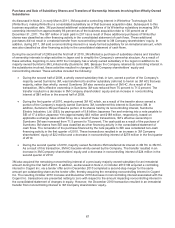

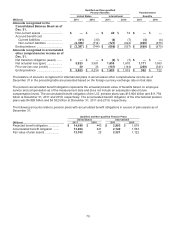

As of December 31, 2011, the Company had tax effected federal, state, and international operating loss, capital loss,

and tax credit carryovers of approximately $17 million, $9 million, and $366 million (before valuation allowances). The

federal tax attribute carryovers will expire after eighteen to nineteen years, the state after five to ten years, and the

majority of international after eight years with the remaining international expiring in one year or with an indefinite

carryover period. The tax attributes being carried over arise as certain jurisdictions may have tax losses or may have

inabilities to utilize certain losses without the same type of taxable income. The Company has provided $82 million of

valuation allowance against certain of these deferred tax assets based on management’s determination that it is

more-likely-than-not that the tax benefits related to these assets will not be realized. The valuation allowance has

decreased from prior year due mainly to a change in tax law in certain jurisdictions extending the carryforward period

for which these tax attributes can be used to reduce the same type of taxable income. It is reasonably possible that