3M 2011 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2011 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

19

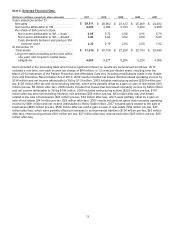

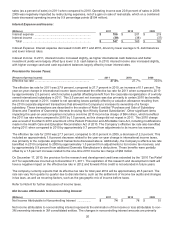

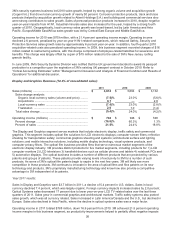

Pension and postretirement expense increased in both 2011 and 2010. The year-on-year increase for 2011

compared to 2010, and 2010 compared to 2009, was $233 million and $99 million, respectively. These increases

negatively impacted cost of sales; selling, general and administrative expenses (SG&A); and research, development

and related expenses (R&D).

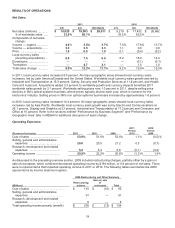

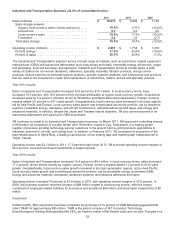

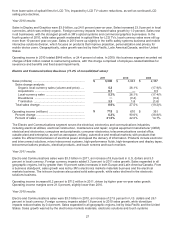

Cost of Sales:

Cost of sales includes manufacturing, engineering and freight costs. Cost of sales, measured as a percent of net

sales, was 53.0 percent in 2011, an increase of 1.1 percentage points from 2010 levels. On a dollar basis, selling

price increases largely offset raw material inflation for total year 2011, as selling prices increased 1 percent year-on-

year and gross raw material prices increased approximately 4 percent year-on-year. However, measured as a

percent of sales, selling price/gross raw material impacts accounted for approximately 0.5 percentage points of the

cost of sales increase. As discussed in the preceding paragraph, cost of sales as a percent of net sales was also

negatively impacted by higher pension and postretirement costs. These impacts were partially offset by organic sales

volume growth of 3.7 percent.

Cost of sales, measured as a percent of net sales, was 51.9 percent in 2010, a decrease of 0.5 percentage points

from 2009. A number of positive factors impacted year-on-year results. These factors included 13.7 percent growth in

organic sales volume, improved factory utilization levels, along with cost savings related to prior years’ restructuring

actions. In addition, 2009 included a penalty of 0.5 percentage points (as a percent of net sales) related to special

items. As discussed in Note 4 (Restructuring Actions), in 2009, 3M recorded $209 million in restructuring charges, of

which $110 million was recorded in cost of sales. This was partially offset by a $15 million gain on sale of a New

Jersey roofing granule facility, which was also recorded in cost of sales. In addition, 3M decided to swap Venezuelan

bolivars into U.S. dollars in 2009, given the economic conditions in Venezuela at that time, which also negatively

impacted cost of sales in 2009. These year-on-year net benefits were partially offset by pricing impacts, as selling

prices declined 0.2 percent year-on-year, and gross raw material prices increased approximately 2 percent year-on-

year.

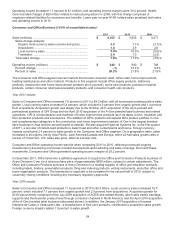

Selling, General and Administrative Expenses:

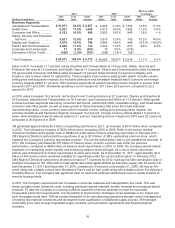

Selling, general and administrative (SG&A) expenses increased 13 percent in 2011 when compared to 2010, due to

several factors. Approximately 5 percentage points of this growth in SG&A was due to increases from businesses

acquired in the last twelve months, primarily related to SG&A spending for the Winterthur Technologie AG, Arizant

Inc., Cogent Inc. and Attenti Holdings S.A. acquisitions. Another 3 percentage points of growth in 2011 SG&A was

due to foreign exchange effects, which resulted in higher translated costs from 3M’s non-U.S. subsidiaries. Finally,

2011 SG&A increased in part due to higher year-on-year pension and postretirement expense and continued

investments to support future growth, such as sales representatives, advertising and promotional investments. SG&A

expenses, measured as a percent of net sales, increased 0.3 percentage points in 2011 compared to 2010.

Selling, general and administrative (SG&A) expenses increased 12 percent in 2010 when compared to 2009. In

2010, sales and marketing expenses increased 14 percent, which included advertising and promotion investment

increases of over 20 percent in 2010, which helped drive sales volumes. In addition, 3M increased both sales

coverage and its marketing strength, particularly in faster-growing emerging economies. In 2010, general and

administrative costs remained under control, as these costs increased at approximately half the rate of 2010 sales

growth. SG&A expenses, measured as a percent of net sales, decreased 0.7 percentage points in 2010 compared to

2009. As indicated in Note 4, restructuring expenses of $91 million were recorded in SG&A expenses in 2009.

Measured as a percent of sales, these restructuring expenses increased 2009 SG&A expenses by 0.4 percentage

points.

Research, Development and Related Expenses:

Research, development and related expenses (R&D) expense increased 9.5 percent in 2011 compared to 2010, and

increased 11 percent in 2010 compared to 2009, as 3M continued to support its key growth initiatives. In 2011, R&D

expense increased versus 2010 due to R&D related to businesses acquired in the last 12 months, foreign exchange

effects, and higher pension and postretirement expense, in addition to 3M’s continued investment in new products.

R&D, measured as a percent of sales, was 5.3 percent in 2011, compared to 5.4 percent in 2010 and 5.6 percent in

2009.

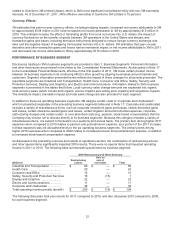

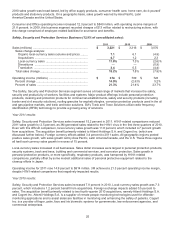

Operating Income:

3M uses operating income as one of its primary business segment performance measurement tools. Operating

income was 20.9 percent of sales in 2011, compared to 22.2 percent of sales in 2010, primarily due to higher cost of