3M 2011 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2011 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

112

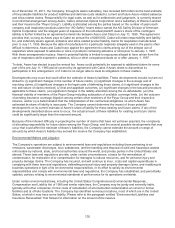

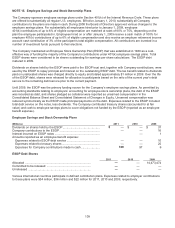

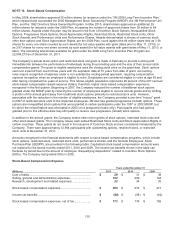

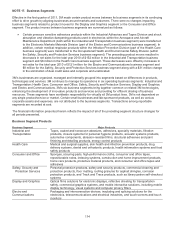

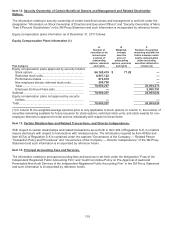

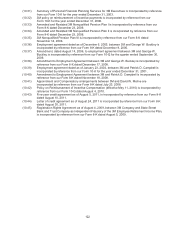

The following table summarizes restricted stock and restricted stock unit activity during the twelve months ended

December 31:

Restricted Stock and Restricted Stock Units

2011 2010 2009

Number of Grant Date Number of Grant Date Number of Grant Date

Awards Fair Value* Awards Fair Value* Awards Fair Value*

Nonvested balance —

As of January 1 ................. 4,812,657 $ 68.75 4,379,480 $ 68.85 2,957,538 $ 77.41

Granted:

Annual ....................... 889,448 89.46

902,549 78.81 1,150,819 53.89

Other .......................... 351,624 87.07

527,823 70.09 522,581 54.82

Vested ........................... (1,077,816) 72.21

(948,233 ) 79.12 (157,104) 73.26

Forfeited ........................ (116,941) 72.01

(48,962 ) 76.22 (94,354) 69.57

As of December 31 ........... 4,858,972 $ 73.02 4,812,657 $ 68.75 4,379,480 $ 68.85

* Weighted average

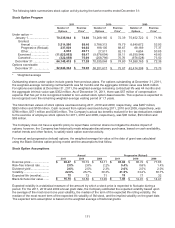

As of December 31, 2011, there was $85 million of compensation expense that has yet to be recognized related to

non-vested restricted stock and restricted stock units. This expense is expected to be recognized over the remaining

weighted-average vesting period of 2.1 years. The total fair value of restricted stock and restricted stock units that

vested during the twelve-month periods ended December 31, 2011, 2010 and 2009, respectively, was $102 million,

$75 million and $10 million. The Company’s actual tax benefits realized for the tax deductions related to the vesting

of restricted stock and restricted stock units was $36 million for 2011, $20 million for 2010, and was not material for

2009.

Restricted stock units granted under the “3M 2008 Long-Term Incentive Plan” generally vest three years following the

grant date assuming continued employment. The one-time “buyout” restricted stock unit grant in 2007 vests at the

end of five years. Restricted stock unit grants issued in 2008 and prior did not accrue dividends during the vesting

period. Beginning in 2009, dividend equivalents equal to the dividends payable on the same number of shares of 3M

common stock accrue on these restricted stock units during the vesting period, although no dividend equivalents are

paid on any of these restricted stock units that are forfeited prior to the vesting date. Dividend equivalents are paid

out in cash at the vest date on all vested restricted stock units. Since the rights to dividend equivalents are forfeitable,

there is no impact on basic earnings per share calculations. Weighted average restricted stock unit shares

outstanding are included in the computation of diluted earnings per share.

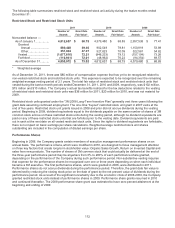

Performance Shares

Beginning in 2008, the Company grants certain members of executive management performance shares on an

annual basis. The performance criteria, which were modified in 2010, are designed to focus management attention

on three key factors that create long-term stockholder value: Organic Sales Growth, Return on Invested Capital and

sales from new products. The number of shares of 3M common stock that could actually be delivered at the end of

the three-year performance period may be anywhere from 0% to 200% of each performance share granted,

depending on the performance of the Company during such performance period. Non-substantive vesting requires

that expense for the performance shares be recognized over one or three years depending on when each individual

became a 3M executive. The first performance shares, which were granted in 2008, were distributed in 2011.

Performance shares do not accrue dividends during the performance period. Therefore, the grant date fair value is

determined by reducing the closing stock price on the date of grant by the net present value of dividends during the

performance period. As a result of the significant uncertainty due to the economic crisis of 2008-2009, the Company

granted restricted stock units instead of performance shares in 2009. Performance share grants resumed in 2010

and continued thereafter. The 2008 performance share grant was estimated to have zero percent attainment at the

beginning and ending of 2009.