3M 2011 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2011 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

68

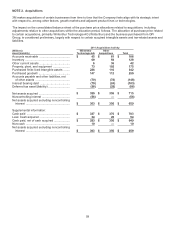

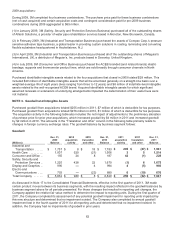

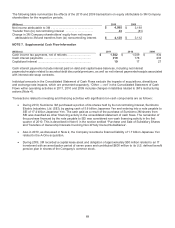

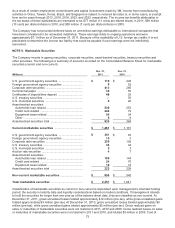

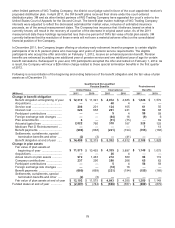

The following table summarizes the effects of the 2010 and 2009 transactions on equity attributable to 3M Company

shareholders for the respective periods.

(Millions) 2010 2009

Net income attributable to 3M ............................. $ 4,085

$3,193

Transfer from (to) noncontrolling interest ................... 43

(81 )

Change in 3M Company shareholders’ equity from net income

attributable to 3M and transfers from (to) noncontrolling interest

$

4,128

$3,112

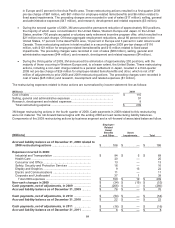

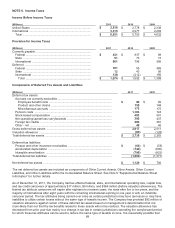

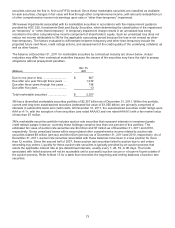

NOTE 7. Supplemental Cash Flow Information

(Millions) 2011 2010 2009

Cash income tax payments, net of refunds ............................. $ 1,542

$ 1,509 $ 834

Cash interest payments .......................................................... 219

178 233

Capitalized interest .................................................................. 19

17 27

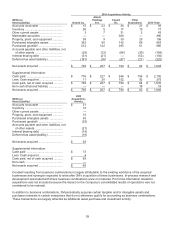

Cash interest payments include interest paid on debt and capital lease balances, including net interest

payments/receipts related to accreted debt discounts/premiums, as well as net interest payments/receipts associated

with interest rate swap contracts.

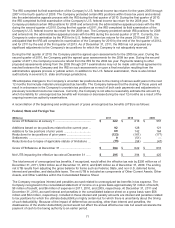

Individual amounts in the Consolidated Statement of Cash Flows exclude the impacts of acquisitions, divestitures

and exchange rate impacts, which are presented separately. “Other — net” in the Consolidated Statement of Cash

Flows within operating activities in 2011, 2010 and 2009 includes changes in liabilities related to 3M’s restructuring

actions (Note 4).

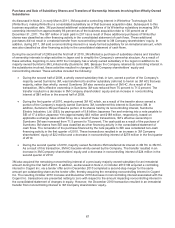

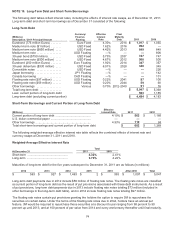

Transactions related to investing and financing activities with significant non-cash components are as follows:

x During 2010, Sumitomo 3M purchased a portion of its shares held by its noncontrolling interest, Sumitomo

Electric Industries, Ltd. (SEI), by paying cash of 5.8 billion Japanese Yen and entering into a note payable to

SEI of 17.4 billion Japanese Yen. The cash paid as a result of the purchase of Sumitomo 3M shares from

SEI was classified as other financing activity in the consolidated statement of cash flows. The remainder of

the purchase financed by the note payable to SEI was considered non-cash financing activity in the first

quarter of 2010. This is described in Note 6 in the section entitled “Purchase and Sale of Subsidiary Shares

and Transfers of Ownership Interests Involving Non-Wholly Owned Subsidiaries”.

x Also in 2010, as discussed in Note 2, the Company recorded a financed liability of 1.7 billion Japanese Yen

related to the A-One acquisition.

x During 2009, 3M recorded a capital lease asset and obligation of approximately $50 million related to an IT

investment with an amortization period of seven years and contributed $600 million to its U.S. defined benefit

pension plan in shares of the Company’s common stock.