3M 2011 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2011 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

17

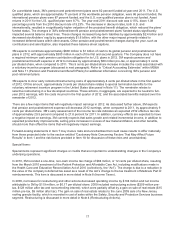

On a worldwide basis, 3M’s pension and postretirement plans were 82 percent funded at year-end 2011. The U.S.

qualified plans, which are approximately 71 percent of the worldwide pension obligation, were 86 percent funded, the

international pension plans were 87 percent funded, and the U.S. non-qualified pension plan is not funded. Asset

returns in 2011 for the U.S. qualified plan were 8.7%. The year-end 2011 discount rate was 4.15%, down 1.08

percentage points from the 2010 discount rate of 5.23%. The decrease in discount rates, both U.S. and

internationally, resulted in a significantly higher valuation of the projected benefit obligation, which reduced the plans’

funded status. The changes in 3M’s defined-benefit pension and postretirement plans’ funded status significantly

impacted several balance sheet lines. These changes increased long-term liabilities by approximately $2.4 billion and

decreased stockholders’ equity by approximately $1.6 billion, with the other major impact primarily related to

increased deferred taxes within other assets. Other pension and postretirement changes during the year, such as

contributions and amortization, also impacted these balance sheet captions.

3M expects to contribute approximately $800 million to $1 billion of cash to its global pension and postretirement

plans in 2012, with approximately $300 million in each of the first and second quarters. The Company does not have

a required minimum cash pension contribution obligation for its U.S. plans in 2012. 3M expects pension and

postretirement benefit expense in 2012 to increase by approximately $89 million pre-tax, or approximately 9 cents

per diluted share, when compared to 2011. This 9 cents per diluted share increase includes the costs associated with

a voluntary incentive program (discussed in next paragraph). Refer to “Critical Accounting Estimates” within MD&A

and Note 11 (Pension and Postretirement Benefit Plans) for additional information concerning 3M’s pension and

post-retirement plans.

3M expects to incur early retirement/restructuring costs of approximately 4 cents per diluted share in the first quarter

of 2012. Of this amount, approximately 3 cents per diluted share relates to special termination benefits for the

voluntary retirement incentive program in the United States (discussed in Note 11). The remainder relates to

selective restructuring in a few developed countries. These actions, in aggregate, are expected to be neutral to full-

year 2012 earnings, with the costs incurred in the first quarter of 2012, and the associated benefits realized over the

remainder of 2012.

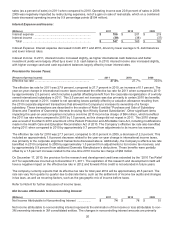

There are a few major items that will negatively impact earnings in 2012. As discussed further above, 3M expects

that pension and postretirement expense will decrease 2012 earnings, when compared to 2011, by approximately 9

cents per diluted share. 3M’s early assessment of the income tax rate indicates an expected 2012 effective tax rate

of approximately 29.5 percent compared to 27.8 percent for 2011. In addition, currency effects are expected to have

a negative impact on earnings. 3M currently expects that sales growth and related incremental income, in addition to

expected productivity improvements, selling price increases in excess of raw material inflation, and other benefits,

should more than offset the items that will negatively impact earnings.

Forward-looking statements in Item 7 may involve risks and uncertainties that could cause results to differ materially

from those projected (refer to the section entitled “Cautionary Note Concerning Factors That May Affect Future

Results” in Item 1 and the risk factors provided in Item 1A for discussion of these risks and uncertainties).

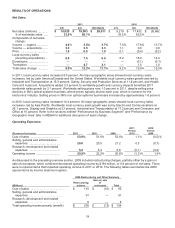

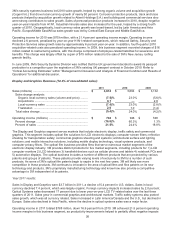

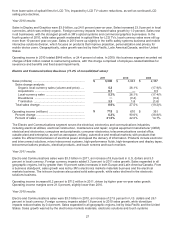

Special Items:

Special items represent significant charges or credits that are important to understanding changes in the Company’s

underlying operations.

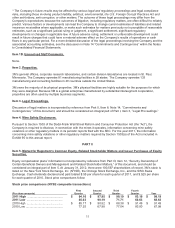

In 2010, 3M recorded a one-time, non-cash income tax charge of $84 million, or 12 cents per diluted share, resulting

from the March 2010 enactment of the Patient Protection and Affordable Care Act, including modifications made in

the Health Care and Education Reconciliation Act of 2010 (collectively, the “Act”). The charge is due to a reduction in

the value of the company’s deferred tax asset as a result of the Act’s change to the tax treatment of Medicare Part D

reimbursements. This item is discussed in more detail in Note 8 (Income Taxes).

In 2009, net losses for restructuring and other actions decreased operating income by $194 million and net income

attributable to 3M by $119 million, or $0.17 per diluted share. 2009 included restructuring actions ($209 million pre-

tax, $128 million after tax and noncontrolling interest), which were partially offset by a gain on sale of real estate ($15

million pre-tax, $9 million after tax). The gain on sale of real estate relates to the June 2009 sale of a New Jersey

roofing granule facility, which is recorded in cost of sales within the Safety, Security and Protection Services business

segment. Restructuring is discussed in more detail in Note 4 (Restructuring Actions).