3M 2011 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2011 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

89

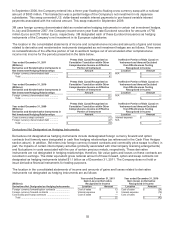

NOTE 12. Derivatives

The Company uses interest rate swaps, currency swaps, commodity price swaps, and forward and option contracts

to manage risks generally associated with foreign exchange rate, interest rate and commodity price fluctuations. The

information that follows explains the various types of derivatives and financial instruments used by 3M, how and why

3M uses such instruments, how such instruments are accounted for, and how such instruments impact 3M’s financial

position and performance.

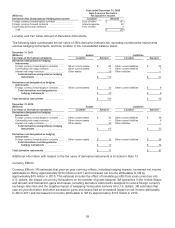

Additional information with respect to the impacts on other comprehensive income of nonderivative hedging and

derivative instruments is included in Note 6. Additional information with respect to the fair value of derivative

instruments is included in Note 13. References to information regarding derivatives and/or hedging instruments

associated with the Company’s long-term debt are also made in Note 10.

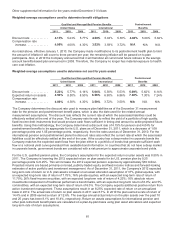

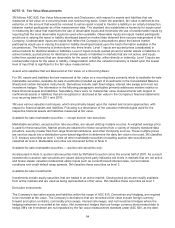

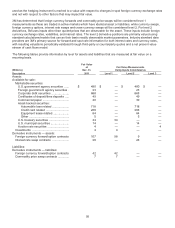

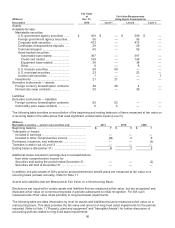

Types of Derivatives/Hedging Instruments and Inclusion in Income/Other Comprehensive Income

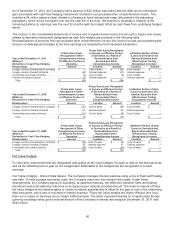

Cash Flow Hedges:

For derivative instruments that are designated and qualify as cash flow hedges, the effective portion of the gain or

loss on the derivative is reported as a component of other comprehensive income and reclassified into earnings in

the same period during which the hedged transaction affects earnings. Gains and losses on the derivative

representing either hedge ineffectiveness or hedge components excluded from the assessment of effectiveness are

recognized in current earnings.

Cash Flow Hedging - Foreign Currency Forward and Option Contracts: The Company enters into foreign exchange

forward and option contracts to hedge against the effect of exchange rate fluctuations on cash flows denominated in

foreign currencies and certain intercompany financing transactions. These transactions are designated as cash flow

hedges. The settlement or extension of these derivatives will result in reclassifications (from accumulated other

comprehensive income) to earnings in the period during which the hedged transactions affect earnings. Generally,

3M dedesignates these cash flow hedge relationships in advance of the occurrence of the forecasted transaction.

The portion of gains or losses on the derivative instrument previously accumulated in other comprehensive income

for dedesignated hedges remains in accumulated other comprehensive income until the forecasted transaction

occurs. Changes in the value of derivative instruments after dedesignation are recorded in earnings and are included

in the Derivatives Not Designated as Hedging Instruments section below. Hedge ineffectiveness and the amount

excluded from effectiveness testing recognized in income on cash flow hedges were not material for 2011, 2010 and

2009. The maximum length of time over which 3M hedges its exposure to the variability in future cash flows for a

majority of the forecasted transactions is 12 months and, accordingly, at December 31, 2011, the majority of the

Company’s open foreign exchange forward and option contracts had maturities of one year or less. The dollar

equivalent gross notional amount of the Company’s foreign exchange forward and option contracts designated as

cash flow hedges at December 31, 2011 was approximately $4.5 billion.

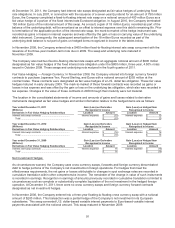

Cash Flow Hedging - Commodity Price Management: The Company manages commodity price risks through

negotiated supply contracts, price protection agreements and forward physical contracts. The Company uses

commodity price swaps relative to natural gas as cash flow hedges of forecasted transactions to manage price

volatility. The related mark-to-market gain or loss on qualifying hedges is included in other comprehensive income to

the extent effective, and reclassified into cost of sales in the period during which the hedged transaction affects

earnings. Generally, the length of time over which 3M hedges its exposure to the variability in future cash flows for its

forecasted natural gas transactions is 12 months. No significant commodity cash flow hedges were discontinued and

hedge ineffectiveness was not material for 2011, 2010 and 2009. The dollar equivalent gross notional amount of the

Company’s natural gas commodity price swaps designated as cash flow hedges at December 31, 2011 was $29

million.

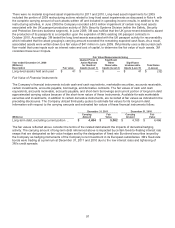

Cash Flow Hedging ² Forecasted Debt Issuance: In August 2011, in anticipation of the September 2011 issuance of

$1 billion in five-year fixed rate notes, 3M executed a pre-issuance cash flow hedge on a notional amount of $400

million by entering into a forward-starting five-year floating-to-fixed interest rate swap. Upon debt issuance in

September 2011, 3M terminated the floating-to-fixed interest rate swap. The termination of the swap resulted in a $7

million pre-tax loss ($4 million after-tax) that will be amortized over the five-year life of the note and, when material, is

included in the tables below as part of the loss recognized in income on the effective portion of derivatives as a result

of reclassification from accumulated other comprehensive income.