3M 2011 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2011 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

13

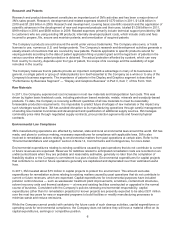

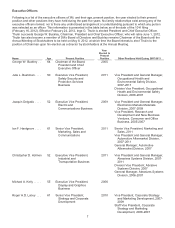

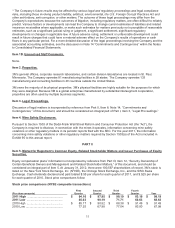

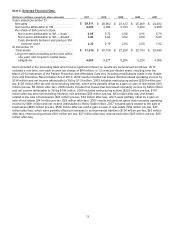

Item 6. Selected Financial Data.

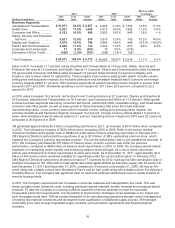

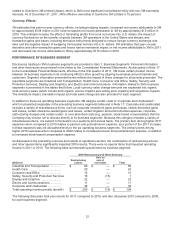

(Dollars in millions, except per share amounts) 2011 2010 2009 2008 2007

Years ended December 31:

Net sales .............................. $ 29,611 $ 26,662 $ 23,123 $ 25,269 $ 24,462

Net income attributable to 3M ............. 4,283

4,085 3,193 3,460 4,096

Per share of 3M common stock:

Net income attributable to 3M — basic ... 6.05

5.72 4.56 4.95 5.70

Net income attributable to 3M — diluted .. 5.96

5.63 4.52 4.89 5.60

Cash dividends declared and paid per 3M

common share ...................... 2.20

2.10 2.04 2.00 1.92

A

t December 31:

Total assets ............................ $ 31,616 $ 30,156 $ 27,250 $ 25,793 $ 24,699

Long-term debt (excluding portion due within

one year) and long-term capital lease

obligations ........................... 4,563

4,277 5,204 5,224 4,088

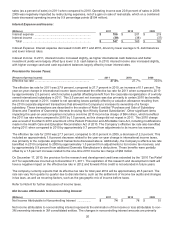

Items included in the preceding table which had a significant impact on results are summarized as follows. 2010

included a one-time, non-cash income tax charge of $84 million, or 12 cents per diluted share, resulting from the

March 2010 enactment of the Patient Protection and Affordable Care Act, including modifications made in the Health

Care and Education Reconciliation Act of 2010. 2009 results included net losses that decreased operating income by

$194 million and net income attributable to 3M by $119 million. 2009 included restructuring actions ($209 million pre-

tax, $128 million after tax and noncontrolling interest), which were partially offset by a gain on sale of real estate ($15

million pre-tax, $9 million after tax). 2008 results included net losses that decreased operating income by $269 million

and net income attributable to 3M by $194 million. 2008 included restructuring actions ($229 million pre-tax, $147

million after-tax and noncontrolling interest), exit activities ($58 million pre-tax, $43 million after-tax) and losses

related to the sale of businesses ($23 million pre-tax, $32 million after-tax), which were partially offset by a gain on

sale of real estate ($41 million pre-tax, $28 million after-tax). 2007 results included net gains that increased operating

income by $681 million and net income attributable to 3M by $448 million. 2007 included gains related to the sale of

businesses ($849 million pre-tax, $550 million after-tax) and a gain on sale of real estate ($52 million pre-tax, $37

million after-tax), which were partially offset by increases in environmental liabilities ($134 million pre-tax, $83 million

after-tax), restructuring actions ($41 million pre-tax, $27 million after-tax), and exit activities ($45 million pre-tax, $29

million after-tax).