Westjet 2015 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2015 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

As at and for the years ended December 31, 2015 and 2014

(Stated in thousands of Canadian dollars, except percentage, ratio, share and per share amounts)

WestJet Annual Report 2015 | 90

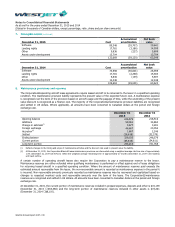

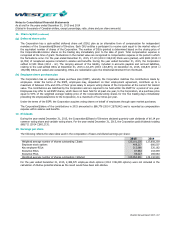

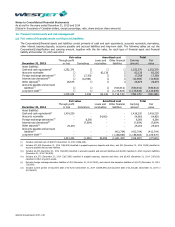

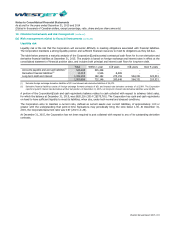

14. Financial instruments and risk management (continued)

(b) Risk management related to financial instruments

The Corporation is exposed to market, credit and liquidity risks associated with its financial assets and liabilities. From time to

time, the Corporation may use various financial derivatives to reduce exposures from changes in foreign exchange rates, interest

rates and jet fuel prices. The Corporation does not hold or use any derivative instruments for trading or speculative purposes.

The Corporation’s Board of Directors has responsibility for the establishment and approval of the Corporation’s overall risk

management policies, including those related to financial instruments. Management performs continuous assessments so that all

significant risks related to financial instruments are reviewed and addressed in light of changes to market conditions and the

Corporation’s operating activities.

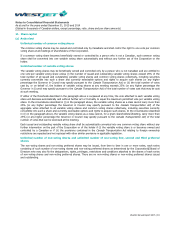

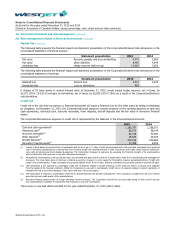

Market risk

Market risk is the risk that the fair value or future cash flows of a financial instrument will fluctuate due to changes in market

prices. The Corporation’s significant market risks relate to fuel price risk, foreign exchange risk and interest rate risk.

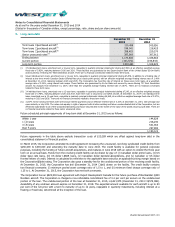

(i) Fuel price risk

The airline industry is inherently dependent upon jet fuel to operate and, therefore, the Corporation is exposed to the risk of

volatile fuel prices. Fuel prices are impacted by a host of factors outside the Corporation’s control, such as significant weather

events, geopolitical tensions, refinery capacity, and global demand and supply. For the year ended December 31, 2015, aircraft

fuel expense represented approximately 24% (2014 – 31%) of the Corporation’s total operating expenses.

(ii) Foreign exchange risk

The Corporation is exposed to foreign exchange risks arising from fluctuations in exchange rates on its US-dollar-denominated

monetary assets and liabilities and its US-dollar operating expenditures, mainly aircraft fuel, aircraft leasing expense, the land

component of vacations packages and certain maintenance and airport operation costs.

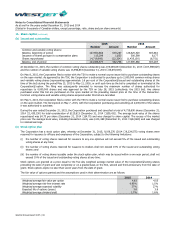

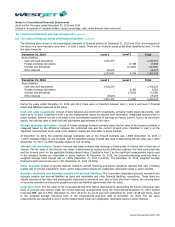

US dollar monetary assets and liabilities

The gain or loss on foreign exchange included in the Corporation’s consolidated statement of earnings is mainly attributable to

the changes and settlements in the value of the Corporation’s US-dollar-denominated monetary assets and liabilities. At

December 31, 2015, US-dollar-denominated net monetary liabilities totaled approximately US $24,039 (2014 – US $6,073 net

assets).

The Corporation estimates that a one-cent change in the value of the US dollar versus the Canadian dollar at December 31,

2015, would have increased or decreased net earnings for the year ended December 31, 2015, by $170 (2014 – $44), as a

result of the Corporation’s US-dollar-denominated net monetary asset balance.

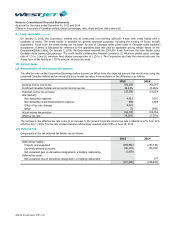

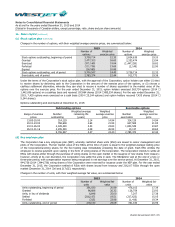

US-dollar aircraft leasing and vacation package hotel costs

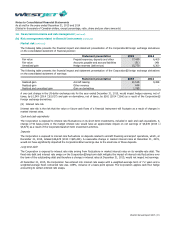

In September 2015, the Corporation entered into additional foreign exchange forward contracts to fix the foreign exchange rate

on a portion of US-dollar hotel costs that form part of the Corporation’s vacation packages. These contracts were in addition to

the existing foreign exchange forward contracts used by the Corporation to fix the US-dollar cost of aircraft leasing. All foreign

exchange forward contracts are governed by the Corporation’s Foreign Currency Risk Management Policy.

At December 31, 2015, the Corporation has entered into foreign exchange forward contracts for an average of US $19,011

(2014 – US $11,689) per month for the period of January to December 2016 for a total of US $228,127 (2014 – US $140,273)

at a weighted average contract price of 1.3069 (2014 – 1.1187) Canadian dollars to one US dollar. The Corporation applies cash

flow hedge accounting for certain foreign exchange hedges.