Westjet 2015 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2015 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WestJet Annual Report 2015 | 36

Share Capital

Outstanding share data

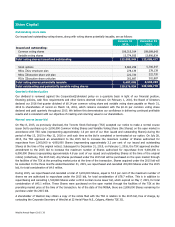

Our issued and outstanding voting shares, along with voting shares potentially issuable, are as follows:

January 31

2016

December 31

2015

Issued and outstanding:

Common voting shares 109,315,014 109,089,643

Variable voting shares

13,774,935

13,996,834

Total voting shares issued and outstanding 123,089,949 123,086,477

Stock options 5,683,259

5,706,547

RSUs – Key employee plan

278,139

278,139

RSUs – Executive share unit plan 222,720

222,720

PSUs – Executive share unit plan 302,887

302,887

Total voting shares potentially issuable

6,487,005

6,510,293

Total outstanding and potentially issuable voting shares 129,576,954

129,596,770

Quarterly dividend policy

Our dividend is reviewed against the Corporation’s dividend policy on a quarterly basis in light of our financial position,

financing policies, cash flow requirements and other factors deemed relevant. On February 1, 2016, the Board of Directors

declared our 2016 first quarter dividend of $0.14 per common voting share and variable voting share payable on March 31,

2016 to shareholders of record on March 16, 2016, which remains consistent with the $0.14 per common voting share

declared and paid quarterly throughout 2015. We believe this demonstrates our confidence in delivering continued profitable

results and is consistent with our objective of creating and returning value to our shareholders.

Normal course issuer bid

On May 8, 2015, as previously disclosed, the Toronto Stock Exchange (TSX) accepted our notice to make a normal course

issuer bid to purchase up to 2,000,000 Common Voting Shares and Variable Voting Share (the Shares) on the open market in

accordance with TSX rules (representing approximately 1.6 per cent of our then issued and outstanding Shares) during the

period of May 13, 2015 to May 12, 2016 or until such time as the bid is completed or terminated at our option. On July 28,

2015, the TSX approved an amendment to the 2015 bid to increase the maximum number of Shares authorized for

repurchase from 2,000,000 to 4,000,000 Shares (representing approximately 3.2 per cent of our issued and outstanding

Shares at the time of the original notice). Subsequent to December 31, 2015, on February 1, 2016, the TSX approved another

amendment to the 2015 bid to increase the maximum number of Shares authorized for repurchase from 4,000,000 to

6,000,000 Shares (representing approximately 4.8 per cent of our issued and outstanding Shares at the time of the original

notice) (collectively, the 2015 bid). Any Shares purchased under the 2015 bid will be purchased on the open market through

the facilities of the TSX at the prevailing market price at the time of the transaction. Shares acquired under the 2015 bid will

be cancelled. In the three months ended December 31, 2015, we repurchased and cancelled 200,000 Shares under the 2015

bid, for total consideration of $4.0 million.

During 2015, we repurchased and cancelled a total of 3,200,000 Shares, equal to 53.3 per cent of the maximum number of

shares we are authorized to repurchase under the 2015 bid, for total consideration of $78.7 million. This is in addition to

repurchasing and cancelling 1,519,690 Shares under a 2014 normal course issuer bid, which expired on May 7, 2015, for total

consideration of $45.1 million. These Shares were purchased on the open market through the facilities of the TSX at the

prevailing market price at the time of the transaction. As of the date of this MD&A, there are 2,800,000 Shares remaining for

purchase under the 2015 bid.

A shareholder of WestJet may obtain a copy of the notice filed with the TSX in relation to the 2015 bid, free of charge, by

contacting the Corporate Secretary of WestJet at 22 Aerial Place N.E., Calgary, Alberta T2E 3J1.