Westjet 2015 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2015 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

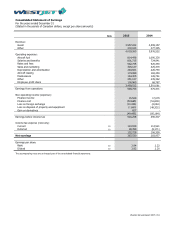

WestJet Annual Report 2015 | 59

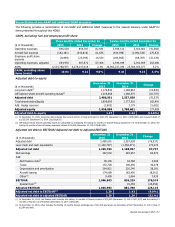

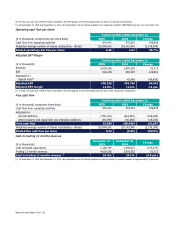

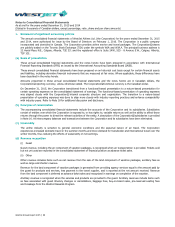

Return on invested capital

($ in thousands)

December 31

2015

December 31

2014

Change

Earnings before income taxes (trailing twelve months) 520,258 390,307 129,951

Special item(i)

―

45,459

(45,459)

Adjusted earnings before income taxes (trailing twelve

months)

520,258 435,766 84,492

Add:

Finance costs

53,665

51,838

1,827

Implicit interest in operating leases

(ii)

91,397 95,786 (4,389)

Return

665,320

583,390

81,930

Invested capital:

Average long-term debt

(iii)

1,181,748 1,033,529 148,219

Average shareholders' equity

1,868,748

1,683,671

185,077

Off-balance-sheet aircraft leases

(iv)

1,305,668 1,368,375 (62,707)

Invested capital

4,356,164

4,085,575

270,589

Return on invested capital

15.3%

14.3%

1.0 pts.

(i) Pre-tax non-cash loss of $45.5 million recorded in the third quarter of 2014 associated with the sale of 10 aircraft to Southwest.

(ii) Interest implicit in operating leases is equal to 7.0 per cent of 7.5 times the trailing 12 months of aircraft lease expense. 7.0 per cent is a proxy and does not

necessarily represent actual for any given period.

(iii) Average long-term debt includes the current portion and long-term portion.

(iv) Off-balance-sheet aircraft operating leases are calculated by multiplying the trailing 12 months of aircraft leasing expense by 7.5. At December 31, 2015, the

trailing 12 months of aircraft leasing expenses totaled $174,089 (December 31, 2014 – $182,450).

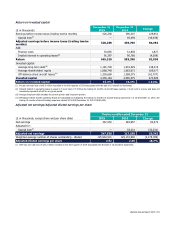

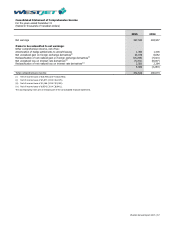

Adjusted net earnings/Adjusted diluted earnings per share

Twelve months ended December 31

($ in thousands, except share and per share data) 2015 2014 Change

Net earnings

367,530

283,957

83,573

Adjusted for:

Special item(i)

―

33,231

(33,231)

Adjusted net earnings 367,530 317,188 50,342

Weighted average number of shares outstanding - diluted 125,964,541 129,142,940 (3,178,399)

Adjusted diluted earnings per share 2.92 2.46 18.7%

(i) After-tax non-cash loss of $33.2 million recorded in the third quarter of 2014 associated with the sale of 10 aircraft to Southwest.