Westjet 2015 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2015 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WestJet Annual Report 2015 | 29

Guest Experience

At WestJet, we are focused on meeting the needs of our guests while maintaining the highest safety standards. We are

committed to delivering a positive guest experience at every stage of our service, from the time the flight is booked to its

completion.

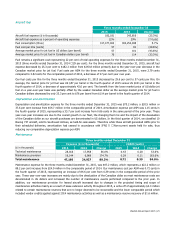

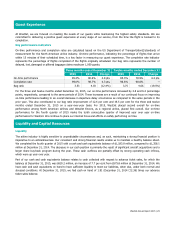

Key performance indicators

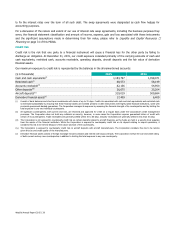

On-time performance and completion rates are calculated based on the US Department of Transportation’s standards of

measurement for the North American airline industry. On-time performance, indicating the percentage of flights that arrive

within 15 minutes of their scheduled time, is a key factor in measuring our guest experience. The completion rate indicator

represents the percentage of flights completed of the flights originally scheduled. Our bag ratio represents the number of

delayed, lost, damaged or pilfered baggage claims made per 1,000 guests.

Three months ended December 31

Twelve months ended December 31

2015 2014 Change 2015 2014 Change

On-time performance

85.4%

80.6%

4.8 pts.

85.3%

78.9%

6.4 pts.

Completion rate 99.0% 98.7% 0.3 pts. 98.6% 98.6% ―

Bag ratio

3.53

4.03

(12.4%)

3.75

4.66

(19.5%)

For the three and twelve months ended December 31, 2015, our on-time performance increased by 4.8 and 6.4 percentage

points, respectively, compared to the same periods of 2014. These increases are a result of our continued focus on improving

on-time performance leading to an overall decrease in departure delay occurrences as compared to the same periods in the

prior year. This also contributed to our bag ratio improvement of 12.4 per cent and 19.5 per cent for the three and twelve

months ended December 31, 2015 on a year-over-year basis. For 2015, WestJet placed second overall for on-time

performance among North American airlines and WestJet Encore, as a regional airline, placed first overall. Our on-time

performance for the fourth quarter of 2015 marks the tenth consecutive quarter of improved year over year on-time

performance for WestJet. We continue to place our internal focus and efforts on safely performing on time.

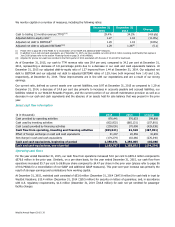

Liquidity and Capital Resources

Liquidity

The airline industry is highly sensitive to unpredictable circumstances and, as such, maintaining a strong financial position is

imperative to an airline’s success. Our consistent and strong financial results enable us to maintain a healthy balance sheet.

We completed the fourth quarter of 2015 with a cash and cash equivalents balance of $1,183.8 million, compared to $1,358.1

million at December 31, 2014. The decrease in our cash position is primarily the result of significant aircraft acquisitions and a

larger share buy-back program during the year. These cash outflows are partially offset by strong operating cash inflows,

which were up year over year.

Part of our cash and cash equivalents balance relates to cash collected with respect to advance ticket sales, for which the

balance at December 31, 2015, was $620.2 million, an increase of 7.7 per cent from $575.8 million at December 31, 2014. We

have cash and cash equivalents on hand to have sufficient liquidity to meet our liabilities, when due, under both normal and

stressed conditions. At December 31, 2015, we had cash on hand of 1.91 (December 31, 2014 – 2.36) times our advance

ticket sales balance.