Westjet 2015 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2015 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.WestJet Annual Report 2015 | 49

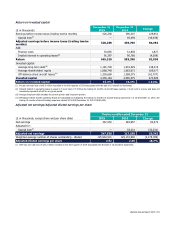

Estimates

(i) Depreciation and amortization

Depreciation and amortization are calculated to write off the cost, less estimated residual value, of assets on a systematic and

rational basis over their expected useful lives. Estimates of residual value and useful lives are based on data and information

from various sources including vendors, industry practice, and company-specific history. Expected useful lives and residual

values are reviewed annually for any change to estimates and assumptions.

Our aircraft are depreciated over a term of 15 to 20 years, with residual values ranging between $2.5 million and $6.0 million

per aircraft. The cost to overhaul our engines, airframes and landing gear on owned aircraft is depreciated over a term of

three to 12 years. Spare engines are depreciated over a term of 15 to 20 years, with a residual value equal to approximately

10 per cent of the original purchase price. Buildings are depreciated over a term of 40 years and ground property and

equipment is depreciated over three to 25 years.

Included in intangible assets are costs related to software, trademarks and landing rights. Intangible assets with definite lives

are carried at cost less accumulated amortization and are amortized on a straight-line basis over their respective useful life of

five and 20 years. Expected useful lives and amortization methods are reviewed annually. Intangible assets with indefinite

useful lives are carried at cost less any accumulated impairment losses.

Expense is recorded on the consolidated statement of earnings as depreciation and amortization.

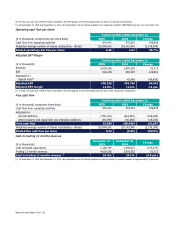

(ii) Maintenance provisions

We have legal obligations to adhere to certain maintenance conditions set out in our aircraft operating lease agreements

relating to the condition of the aircraft when it is returned to the lessor. To fulfill these obligations, a provision is made during

the lease term. Estimates related to the maintenance provision include the likely utilization of the aircraft, the expected future

cost of the maintenance, the point in time at which maintenance is expected to occur, the discount rate used to calculate the

present value of future cash flows and the lifespan of life-limited parts. These estimates are based on data and information

obtained from various sources including the lessor, current maintenance schedules and fleet plans, contracted costs with

maintenance service providers, other vendors and company-specific history and experience.

We recognize maintenance expense in the consolidated statement of earnings based on aircraft usage and the passage of

time as well as changes to previously made judgments or estimates based on new information. The unwinding of the

discounted present value is recorded as a finance cost. At December 31, 2015, the Corporation’s aircraft lease maintenance

provisions are discounted using a weighted average risk-free rate of approximately 1.0% (December 31, 2014 – 0.91%) to

reflect the weighted average remaining term of approximately 27 months (December 31, 2014 – 30 months) until cash

outflow.

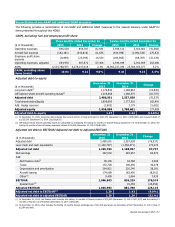

(iii) Income taxes

Current tax assets and liabilities are recognized based on amounts receivable from or payable to a tax authority within the

next 12 months. A current tax asset is recognized for a benefit relating to an unused tax loss or unused tax credit that can be

carried back to recover current tax of a previous period. Deferred tax assets and liabilities are recognized for temporary

differences between the tax and accounting bases of assets and liabilities on the consolidated statement of financial position

using the tax rates that are expected to apply in the period in which the deferred tax asset or liability is expected to settle.

Deferred tax assets are only recognized to the extent that it is probable that a taxable profit will be available when the

deductible temporary differences can be utilized. A deferred tax asset is also recognized for any unused tax losses and unused

tax credits to the extent that it is probable that future taxable profit will be available for use against the unused tax losses and

unused tax credits.

Deferred tax assets and liabilities contain estimates about the nature and timing of future permanent and temporary

differences as well as the future tax rates that will apply to those differences. Changes in tax laws and rates as well as

changes to the expected timing of reversals may have a significant impact on the amounts recorded for deferred tax assets

and liabilities. Our general corporate income tax rate for Alberta increased to 12 per cent, from 10 per cent, effective July 1,

2015. As a result, for the year ended December 31, 2015, WestJet reported an effective tax rate of 32 per cent which resulted

in an increase to deferred income taxes of $2.6 million in the quarter. We continue to closely monitor current and potential

changes to tax law and base our estimate on the best available information at each reporting date.