Westjet 2015 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2015 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WestJet Annual Report 2015 | 17

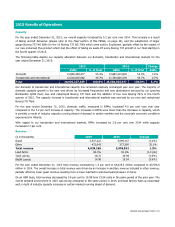

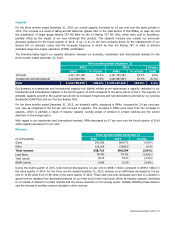

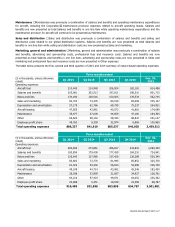

On an ASM basis, operating expenses for the year ended December 31, 2015 decreased by 6.0 per cent to 12.86 cents from

13.68 cents in 2014. Included in the first half of 2014 is a fuel value added tax recovery (VAT recovery) of $20.1 million,

comprised of $17.6 million in aircraft fuel expense and $2.5 million in airport operations expense, related to the periods 2009

to 2013. Excluding the VAT recovery from the comparable period, CASM would have decreased by 6.5 per cent and CASM,

excluding fuel and profit share would have increased by 3.2 per cent over the same period in 2014.

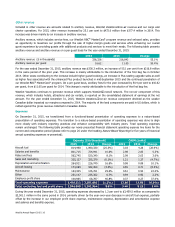

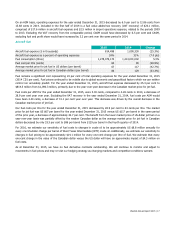

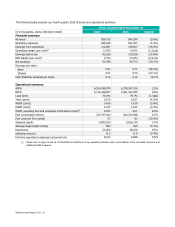

Aircraft fuel

2015

2014

Change

Aircraft fuel expense ($ in thousands) 814,498

1,090,330

(25.3%)

Aircraft fuel expense as a percent of operating expenses 24% 31% (7.0 pts)

Fuel consumption (litres) 1,278,079,174

1,214,001,002

5.3%

Fuel cost per litre (cents) 64 90 (28.9%)

Average market price for jet fuel in US dollars (per barrel)

67 117 (42.7%)

Average market price for jet fuel in Canadian dollars (per barrel)

86 129 (33.3%)

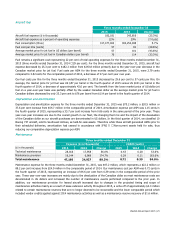

Fuel remains a significant cost representing 24 per cent of total operating expenses for the year ended December 31, 2015

(2014 – 31 per cent). Fuel prices continued to be volatile due to global economic and geopolitical factors which we can neither

control nor accurately predict. For the year ended December 31, 2015, aircraft fuel expense decreased by 25.3 per cent to

$814.5 million from $1,090.3 million, primarily due to the year-over-year decrease in the Canadian market price for jet fuel.

Fuel costs per ASM for the year ended December 31, 2015, were 3.03 cents, compared to 4.26 cents in 2014, a decrease of

28.9 per cent year over year. Excluding the VAT recovery in the year ended December 31, 2014, fuel costs per ASM would

have been 4.40 cents, a decrease of 31.1 per cent year over year. This decrease was driven by the overall decrease in the

Canadian market price of jet fuel.

Our fuel costs per litre for the year ended December 31, 2015 decreased by 28.9 per cent to 64 cents per litre. The market

price for jet fuel was US $67 per barrel for the year ended December 31, 2015 versus US $117 per barrel in the same period

of the prior year, a decrease of approximately 42.7 per cent. The benefit from the lower market price of US-dollar jet fuel on a

year-over-year basis was partially offset by the weaker Canadian dollar as the average market price for jet fuel in Canadian

dollars decreased by only 33.3 per cent to $86 per barrel from $129 per barrel in the fourth quarter of 2014.

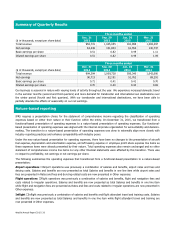

For 2016, we estimate our sensitivity of fuel costs to changes in crude oil to be approximately US $8.8 million annually for

every one US-dollar change per barrel of West Texas Intermediate (WTI) crude oil. Additionally, we estimate our sensitivity to

changes in fuel pricing to be approximately $14.1 million for every one-cent change per litre of fuel. We estimate that every

one-cent change in the value of the Canadian dollar versus the US dollar will have an approximate impact of $4.3 million on

fuel costs.

As at December 31, 2015, we have no fuel derivative contracts outstanding. We will continue to monitor and adjust to

movements in fuel prices and may re-visit our hedging strategy as changing markets and competitive conditions warrant.