Westjet 2015 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2015 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

As at and for the years ended December 31, 2015 and 2014

(Stated in thousands of Canadian dollars, except percentage, ratio, share and per share amounts)

WestJet Annual Report 2015 | 80

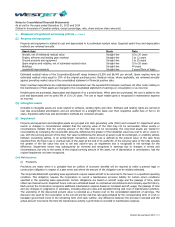

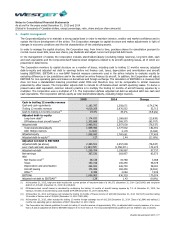

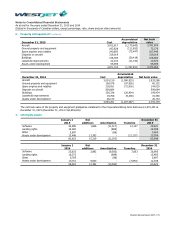

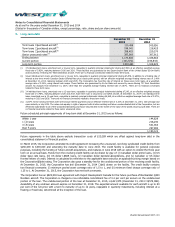

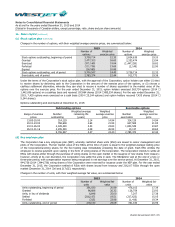

7. Intangible assets (continued)

December 31, 2015

Cost

Accumulated

amortization

Net book

value

Software

85,348

(55,707)

29,641

Landing rights

17,781

(3,186)

14,595

Other

5,836

(227)

5,609

Assets under development

13,704

-

13,704

122,669

(59,120)

63,549

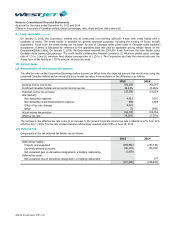

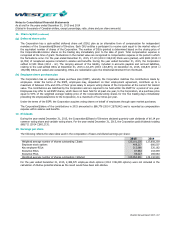

December 31, 2014

Cost

Accumulated

amortization

Net book

value

Software

73,598

(46,603)

26,995

Landing rights

17,781

(2,298)

15,483

Other

5,836

(139)

5,697

Assets under development

12,448

-

12,448

109,663

(49,040)

60,623

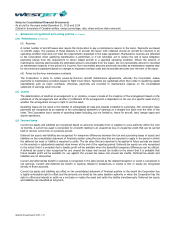

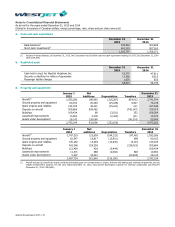

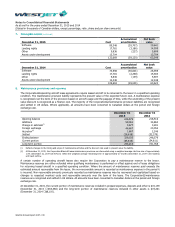

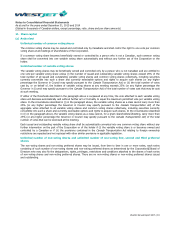

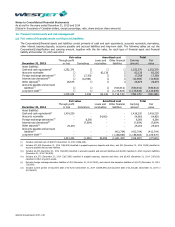

8. Maintenance provisions and reserves

The Corporation’s operating aircraft lease agreements require leased aircraft to be returned to the lessor in a specified operating

condition. The maintenance provision liability represents the present value of the expected future cost. A maintenance expense

is recognized over the term of the provision based on aircraft usage and the passage of time, while the unwinding of the present

value discount is recognized as a finance cost. The majority of the Corporation’s maintenance provision liabilities are recognized

and settled in US dollars. Where applicable, all amounts have been converted to Canadian dollars at the period end foreign

exchange rate.

December 31

2015

December 31

2014

Opening balance

246,579

218,516

Additions

59,061

34,863

Change in estimate(i)

3,677

3,281

Foreign exchange

46,667

20,052

Accretion(ii)

1,667

2,246

Settled

(28,618)

(32,379)

Ending balance

329,033

246,579

Current portion

(85,819)

(54,811)

Long-term portion

243,214

191,768

(i) Reflects changes to the timing and scope of maintenance activities and the discount rate used to present value the liability.

(ii) At December 31, 2015, the Corporation’s aircraft lease maintenance provisions are discounted using a weighted average risk-free rate of approximately

1.0% (December 31, 2014 – 0.91%) to reflect the weighted average remaining term of approximately 27 months (December 31, 2014 – 30 months)

until cash outflow.

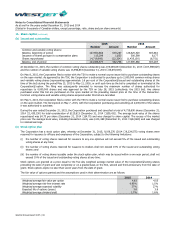

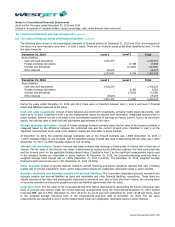

A certain number of operating aircraft leases also require the Corporation to pay a maintenance reserve to the lessor.

Maintenance reserves are either refunded when qualifying maintenance is performed or offset against end of lease obligations

for returning leased aircraft in a specified operating condition. Where the amount of maintenance reserves paid exceeds the

estimated amount recoverable from the lessor, the non-recoverable amount is recorded as maintenance expense in the period it

is incurred. Non-recoverable amounts previously recorded as maintenance expense may be recovered and capitalized based on

changes to expected overhaul costs and recoverable amounts over the term of the lease. The Corporation’s maintenance

reserves are recognized and settled in US dollars. All amounts have been converted to Canadian dollars at the period end foreign

exchange rate.

At December 31, 2015, the current portion of maintenance reserves included in prepaid expenses, deposits and other is $15,190

(December 31, 2014 – $54,466) and the long-term portion of maintenance reserves included in other assets is $19,261

(December 31, 2014 – $8,110).