Westjet 2015 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2015 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

As at and for the years ended December 31, 2015 and 2014

(Stated in thousands of Canadian dollars, except percentage, ratio, share and per share amounts)

WestJet Annual Report 2015 | 86

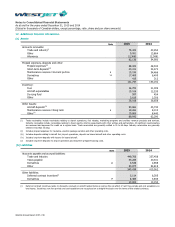

11. Share capital (continued)

(e) Executive share unit plan

The Corporation has an equity-based executive share unit (ESU) plan, whereby RSUs and performance share units (PSU) may be

issued to senior executive officers. At December 31, 2015, 1,011,927 (2014 – 1,011,927) voting shares of the Corporation were

reserved for issuance under the ESU plan.

The fair market value of the RSUs and PSUs at the time of grant is equal to the weighted average trading price of the

Corporation’s voting shares for the five trading days immediately preceding the grant date.

Each RSU entitles the senior executive officers to receive payment upon vesting in the form of voting shares of the Corporation.

RSUs time vest over a period of up to three years, with compensation expense being recognized in net earnings over the service

period.

Each PSU entitles the senior executive officers to receive payment upon vesting in the form of voting shares of the Corporation.

PSUs time vest over a period of up to three years and incorporate performance criteria established at the time of grant.

Compensation expense is recognized in net earnings over the service period based on the number of units expected to vest.

The Corporation intends to settle all RSUs and PSUs with shares either through the purchase of voting shares on the open

market or the issuance of new shares from treasury; however, wholly at its own discretion, the Corporation may settle the units

in cash. For the year ended December 31, 2015, the Corporation settled 77,318 RSUs and 107,658 PSUs through the purchase

of shares on the open market and nil through the issuance from treasury (December 31, 2014 – 74,221 and 69,713 and nil,

respectively).

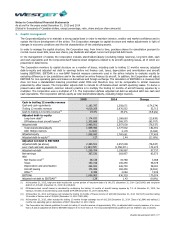

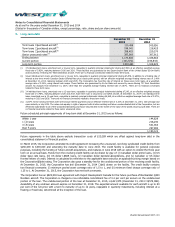

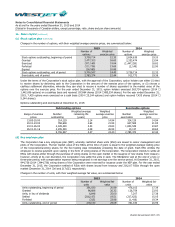

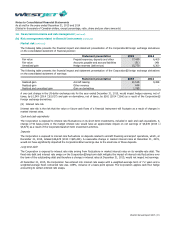

Changes in the number of units, with their weighted average fair value, are summarized below:

2015

2014

RSUs

PSUs

RSUs

PSUs

Number

of units

Weighted

fair value

Number

of units

Weighted

fair value

Number

of units

Weighted

fair value

Number

of units

Weighted

fair value

Units outstanding,

beginning of period

179,890

19.85

321,620

20.88

192,084

17.35

243,567

17.18

Granted

144,636

24.41

142,092

26.12

60,338

24.34

144,559

24.33

Units, in lieu of

dividends

3,332

23.65

6,032

24.28

1,689

28.17

3,207

28.54

Settled

(77,318)

15.23

(107,658)

15.61

(74,221)

17.22

(69,713)

15.44

Forfeited

(27,820)

23.28

(59,199)

23.41

-

-

-

-

Units outstanding,

end of period

222,720

24.04

302,887

24.79

179,890

19.85

321,620

20.88

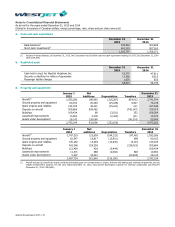

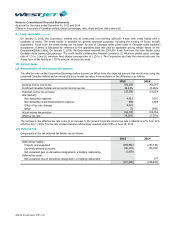

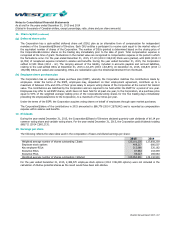

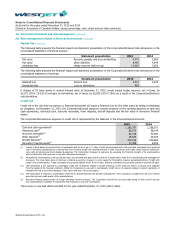

(f) Share-based payment expense

The following table summarizes share-based payment expense for the Corporation’s equity-based plans:

2015

2014

Stock option plan

10,955

11,449

Key employee plan

2,700

3,039

Executive share unit plan

3,599

4,138

Total share-based payment expense

17,254

18,626