Westjet 2015 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2015 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

As at and for the years ended December 31, 2015 and 2014

(Stated in thousands of Canadian dollars, except percentage, ratio, share and per share amounts)

WestJet Annual Report 2015 | 88

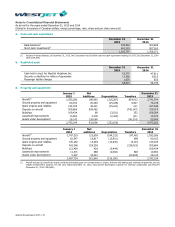

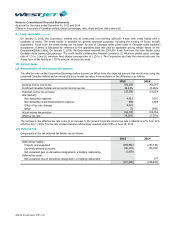

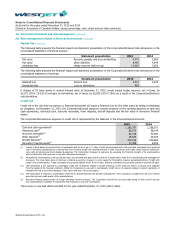

14. Financial instruments and risk management

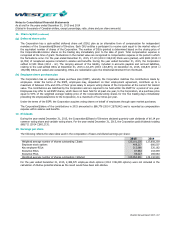

(a) Fair value of financial assets and financial liabilities

The Corporation’s financial assets and liabilities consist primarily of cash and cash equivalents, accounts receivable, derivatives,

other interest bearing deposits, accounts payable and accrued liabilities and long-term debt. The following tables set out the

Corporation’s classification and carrying amount, together with the fair value, for each type of financial asset and financial

liability at December 31, 2015 and 2014:

Fair value

Amortized cost

Total

December 31, 2015

Through profit

or loss

Derivatives

Loans and

receivables

Other financial

liabilities

Carrying

amount

Fair

value

Asset (liability):

Cash and cash equivalents(i)

1,252,370

–

–

–

1,252,370

1,252,370

Accounts receivable

–

–

82,136

–

82,136

82,136

Foreign exchange derivatives(ii)

–

17,358

–

–

17,358

17,358

Interest rate derivatives(iii)

–

(12,964)

–

–

(12,964)

(12,964)

Other deposits(iv)

26,675

–

–

–

26,675

26,675

Accounts payable and accrued

liabilities

(v)

–

–

–

(540,912)

(540,912)

(540,912)

Long-term debt(vi)

–

–

–

(1,174,833)

(1,174,833)

(1,124,849)

1,279,045

4,394

82,136

(1,715,745)

(350,170)

(300,186)

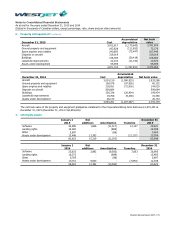

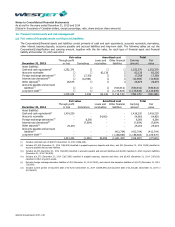

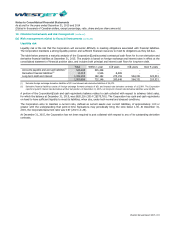

Fair value

Amortized cost

Total

December 31, 2014

Through profit

or loss

Derivatives

Loans and

receivables

Other financial

liabilities

Carrying

amount

Fair

value

Asset (liability):

Cash and cash equivalents(i)

1,416,220

−

−

−

1,416,220

1,416,220

Accounts receivable

−

−

54,950

−

54,950

54,950

Foreign exchange derivatives(ii)

−

6,360

−

−

6,360

6,360

Interest rate derivatives(iii)

−

(7,654)

−

−

(7,654)

(7,654)

Other deposits(iv)

25,204

−

−

−

25,204

25,204

Accounts payable and accrued

liabilities

(v)

−

−

−

(412,704)

(412,704)

(412,704)

Long-term debt(vi)

−

−

−

(1,188,663)

(1,188,663)

(1,109,970)

1,441,424

(1,294)

54,950

(1,601,367)

(106,287)

(27,594)

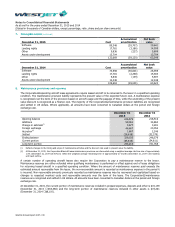

(i) Includes restricted cash of $68,573 (December 31, 2014 – $58,149).

(ii) Includes $17,409 (December 31, 2014 – $6,409) classified in prepaid expenses, deposits and other, and $51 (December 31, 2014 – $49) classified in

accounts payable and accrued liabilities.

(iii) Includes $4,475 (December 31, 2014 – $2,809) classified in accounts payable and accrued liabilities and $8,489 classified in other long-term liabilities

(December 31, 2014 – $4,845).

(iv) Includes $21,275 (December 31, 2014 – $17,585) classified in prepaid expenses, deposits and other, and $5,400 (December 31, 2014 – $7,619)

classified in other long-term assets.

(v) Excludes foreign exchange derivative liabilities of $51 (December 31, 2014 – $49), and interest rate derivative liabilities of $4,475 (December 31, 2014

– $2,809).

(vi) Includes current portion of long-term debt of $141,572 (December 31, 2014 – $159,843) and long-term debt of $1,033,261 (December 31, 2014 –

$1,028,820).