Westjet 2015 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2015 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WestJet Annual Report 2015 | 25

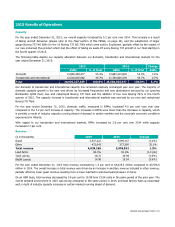

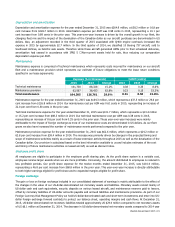

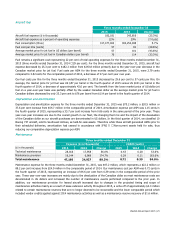

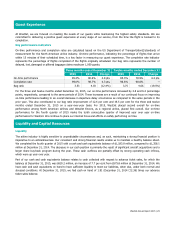

Aircraft fuel

Three months ended December 31

2015

2014

Change

Aircraft fuel expense ($ in thousands) 182,181

243,816

(25.3%)

Aircraft fuel expense as a percent of operating expenses 22% 29% (7.0 pts)

Fuel consumption (litres)

317,477,003

300,254,948

5.7%

Fuel cost per litre (cents) 57 81 (29.6%)

Average market price for jet fuel in US dollars (per barrel)

57 101 (43.6%)

Average market price for jet fuel in Canadian dollars (per barrel)

76

114

(33.3%)

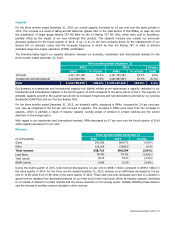

Fuel remains a significant cost representing 22 per cent of total operating expenses for the three months ended December 31,

2015 (three months ended December 31, 2014 – 29 per cent). For the three months ended December 31, 2015, aircraft fuel

expense decreased by 25.3 per cent to $182.2 million from $243.8 million primarily due to the year-over-year decrease in the

Canadian market price for jet fuel. Fuel costs per ASM for the three months ended December 31, 2015, were 2.79 cents

compared to 3.82 cents for the comparable period of 2014, a decrease of 27 per cent year over year.

Our fuel costs per litre for the three months ended December 31, 2015 decreased by 29.6 per cent to 57 cents per litre. On

average, the market price for jet fuel was US $57 per barrel in the fourth quarter of 2015 versus US $101 per barrel in the

fourth quarter of 2014, a decrease of approximately 43.6 per cent. The benefit from the lower market price of US-dollar jet

fuel on a year-over-year basis was partially offset by the weaker Canadian dollar as the average market price for jet fuel in

Canadian dollars decreased by only 33.3 per cent to $76 per barrel from $114 per barrel in the fourth quarter of 2014.

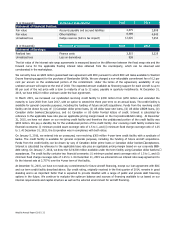

Depreciation and amortization

Depreciation and amortization expense for the three months ended December 31, 2015 was $75.2 million, a $20.5 million or

37.6 per cent increase from $54.7 million in the comparable period of 2014. Amortization expense per ASM was 1.15 cents in

the fourth quarter of 2015, representing a 33.7 per cent increase from 0.86 cents in the same period of the prior year. These

year-over-year increases are due to the overall growth in our fleet, the changing fleet mix and the impact of the devaluation

of the Canadian dollar as our aircraft purchases are denominated in US dollars. In the third quarter of 2014, we classified 10

Boeing 737 aircraft, sold to Southwest Airlines, as held-for-sale assets. Therefore while these aircraft generated ASMs prior to

their scheduled deliveries, amortization had ceased in accordance with IFRS 5 – Non-current assets held for sale, thus

reducing our comparative depreciation expense per ASM.

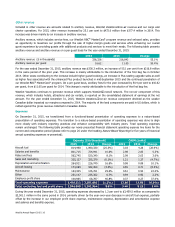

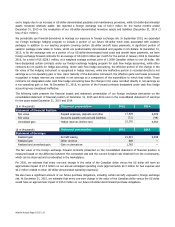

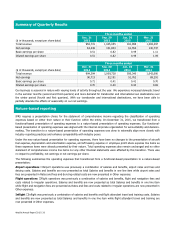

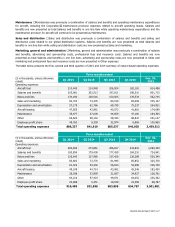

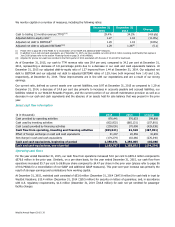

Maintenance

Three months ended December 31

Expense ($ in thousands)

CASM (cents)

($ in thousands)

2015 2014 Change 2015 2014 Change

Technical maintenance

28,016

17,958

56.0%

0.43

0.28

53.6%

Maintenance provision

19,144 6,969 174.7% 0.29 0.11 163.6%

Total maintenance

47,160

24,927

89.2%

0.72

0.39

84.6%

Maintenance expense for the three months ended December 31, 2015, was $47.2 million, which represents a $22.2 million or

89.2 per cent increase from $24.9 million in the comparable period of 2014. Our maintenance cost per ASM was 0.72 cents in

the fourth quarter of 2015, representing an increase of 84.6 per cent from 0.39 cents in the comparable period of the prior

year. These year-over-year increases are mainly due to the devaluation of the Canadian dollar as most maintenance costs are

denominated in US dollars and increased the number of maintenance events performed compared to the prior year. In

addition, our maintenance provision for leased aircraft increased due to changes in the projected timing and scope of

maintenance activities mainly as a result of lease extension activity throughout 2015, a write-off of approximately $4.3 million

related to certain maintenance reserves that are no longer deemed to be recoverable and the lower comparable period which

included vendor credits applied against 2014 maintenance activities as well as a maintenance reserve recovery of $1.6 million.