Westjet 2015 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2015 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WestJet Annual Report 2015 | 38

to fix the interest rates over the term of all such debt. The swap agreements were designated as cash flow hedges for

accounting purposes.

For a discussion of the nature and extent of our use of interest rate swap agreements, including the business purposes they

serve, the financial statement classification and amount of income, expense, gain and loss associated with these instruments

and the significant assumptions made in determining their fair value, please refer to

Liquidity and Capital Resources –

Financing

on page 31 of this MD&A.

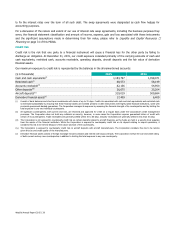

Credit risk

Credit risk is the risk that one party to a financial instrument will cause a financial loss for the other party by failing to

discharge an obligation. At December 31, 2015, our credit exposure consisted primarily of the carrying amounts of cash and

cash equivalents, restricted cash, accounts receivable, operating deposits, aircraft deposits and the fair value of derivative

financial assets.

Our maximum exposure to credit risk is represented by the balances in the aforementioned accounts:

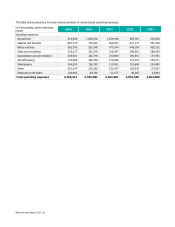

($ in thousands)

2015

2014

Cash and cash equivalents

(i)

1,183,797 1,358,071

Restricted cash

(i)

68,573 58,149

Accounts receivable

(ii)

82,136 54,950

Other deposits

(iii)

26,675 25,204

Aircraft deposits

(iv)

319,019 509,684

Derivative financial assets

(v)

17,409 6,409

(i) Consist of bank balances and short-term investments with terms of up to 31 days. Credit risk associated with cash and cash equivalents and restricted cash

is minimized substantially by ensuring that these financial assets are invested primarily in debt instruments with highly rated financial institutions, some with

provincial-government-backed guarantees. The Corporation manages its exposure by assessing the financial strength of its counterparties and by limiting the

total exposure to any one individual counterparty.

(ii) All significant counterparties, both current and new, are reviewed and approved for credit on a regular basis under the Corporation's credit management

processes. The Corporation does not hold any collateral as security, however, in some cases the Corporation requires guaranteed letters of credit with

certain of its counterparties. Trade receivables are generally settled within 30 to 60 days. Industry receivables are generally settled in less than 30 days.

(iii) The Corporation is not exposed to counterparty credit risk on certain deposits related to aircraft financing, as the funds are held in a security trust separate

from the assets of the financial institution. While the Corporation is exposed to counterparty credit risk on its deposit relating to airport operations, it

considers this risk to be remote because of the nature and size of the counterparty.

(iv) The Corporation is exposed to counterparty credit risk on aircraft deposits with aircraft manufacturers. The Corporation considers this risk to be remote

given the size and credit quality of the manufacturers.

(v) Derivative financial assets consist of foreign exchange forward contracts and interest rate swap contracts. The Corporation reviews the size and credit rating

of both current and any new counterparties in addition to limiting the total exposure to any one counterparty.