WeightWatchers 2004 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2004 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

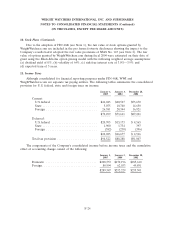

13. Employee Benefit Plans (Continued)

Company made on the employees’ behalf instead of an individual account with a cash balance. The

account is valued at the end of each fiscal month, based on an annualized interest rate of prime plus

2%, with an annualized cap of 15%. Expense related to these contributions for the fiscal years ended

January 1, 2005, January 3, 2004 and December 28, 2002 was $947, $774, and $567, respectively.

During fiscal 2002, the Company received a favorable determination letter from the IRS that

qualifies WWI’s Savings Plan under Section 401(a) of the IRS Code.

The Company also sponsors the WeightWatchers.com Savings Plan for salaried and hourly

employees of WeightWatchers.com. This plan is a defined contribution plan that permits employees to

contribute between 1% and 13% of eligible compensation on a pre-tax basis. There are no employer

matching contributions and therefore no expense is recognized for this plan in the consolidated

financial statements.

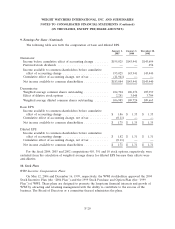

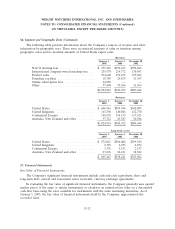

14. Cash Flow Information

January 1, January 3, December 28,

2005 2004 2002

Net cash paid during the year for:

Interest expense ........................ $13,564 $38,533 $41,588

Income taxes ........................... $53,102 $59,739 $75,684

Noncash investing and financing activities were

as follows:

Fair value of net assets acquired in connection

with the acquisitions .................... $ 811 $ 4,797 $ 461

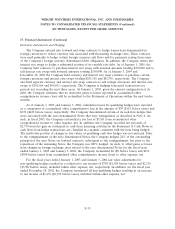

15. Commitments and Contingencies

Legal:

On February 18, 2005, WWI satisfactorily settled the lawsuit with CoolBrands International, Inc.

(‘‘CoolBrands’’) and as of May 1, 2005, CoolBrands will no longer manufacture, sell, market or

distribute ice cream and frozen novelty products using WWI’s trademarks. On August 3, 2004, WWI

filed a lawsuit to enforce the sell-off provisions of the CoolBrands license. On August 11, 2004,

CoolBrands filed a lawsuit in the Supreme Court, State of New York, Nassau County, against WWI and

Wells’ Dairy Inc., WWI’s new licensee for ice cream and frozen novelty products effective October 1,

2004.

Due to the nature of its activities, the Company is, at times, also subject to pending and

threatened legal actions that arise out of the normal course of business. In the opinion of management,

based in part upon advice of legal counsel, the disposition of all such matters is not expected to have a

material effect on the Company’s results of operations, financial condition or cash flows.

F-29