WeightWatchers 2004 Annual Report Download - page 71

Download and view the complete annual report

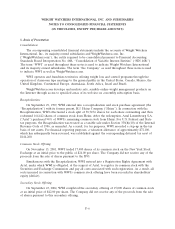

Please find page 71 of the 2004 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

2. Summary of Significant Accounting Policies (Continued)

Intangible Assets:

In accordance with the provisions of SFAS No. 141, ‘‘Business Combinations’’ and SFAS No. 142,

‘‘Goodwill and Other Intangible Assets,’’ beginning in fiscal 2002, the Company no longer amortizes

goodwill and other indefinite-lived intangible assets but conducts an annual review of these assets for

potential impairment. Finite-lived intangible assets are amortized using the straight-line method over

their estimated useful lives of three to 20 years.

The Company accounts for software costs under the American Institute of Certified Public

Accountants (‘‘AICPA’’) Statement of Position No. 98-1, ‘‘Accounting for the Costs of Computer

Software Developed or Obtained for Internal Use,’’ which requires capitalization of certain costs

incurred in connection with developing or obtaining internally used software. Software costs are

amortized over 3 to 5 years.

Pursuant to Emerging Issues Task Force No. 00-2, ‘‘Web Site Development Costs’’ (‘‘EITF 00-2’’),

WeightWatchers.com applies AICPA Statement of Position No. 98-1 to account for web site

development costs. In accordance with EITF 00-2, WeightWatchers.com expenses all costs incurred

during the preliminary project stage and capitalizes all internal and external direct costs of materials

and services consumed in developing the software, once the development has reached the application

development stage. Application development stage costs generally include software configuration,

coding, installation to hardware and testing. These costs are amortized over their estimated useful life.

All costs incurred for upgrades, maintenance and enhancements, including the cost of web site content,

that does not result in additional functionality, are expensed as incurred.

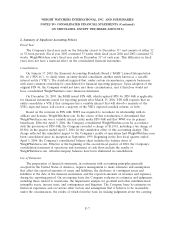

Revenue Recognition:

WWI earns revenue by conducting meetings, selling products and aids in its meetings and to its

franchisees, collecting commissions from franchisees operating under the Weight Watchers name,

collecting royalties related to licensing agreements and selling advertising space in and copies of its

magazine. WWI charges non-refundable registration fees in exchange for an introductory information

session and materials it provides to new members. Revenue from these registration fees is recognized

when the service and products are provided, which is generally at the same time payment is received

from the customer. Revenue from meeting fees, product sales, commissions and royalties is recognized

when services are rendered, products are shipped to customers and title and risk of loss pass to the

customer, and commissions and royalties are earned. Advertising revenue is recognized when ads are

published. Revenue from magazine sales is recognized when the magazine is shipped. Deferred

revenue, consisting of prepaid lecture and magazine subscription revenue, is amortized into income

over the period earned. Discounts to customers, including free registration offers, are recorded as a

deduction from gross revenue in the period such revenue was recognized. WeightWatchers.com

generates revenue from monthly subscriptions to its web site. Subscription fee revenues are recognized

over the period that products are provided. One time sign up fees are deferred and recognized over the

expected customer relationship period. Subscription fee revenues that are paid in advance are deferred

and recognized on a straight-line basis over the subscription period. The Company grants refunds under

limited circumstances and at aggregate amounts that historically have not been material. Because the

period of payment generally approximates the period revenue was originally recognized, refunds are

recorded as a reduction of revenue when paid.

F-9