WeightWatchers 2004 Annual Report Download - page 70

Download and view the complete annual report

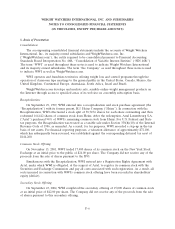

Please find page 70 of the 2004 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

2. Summary of Significant Accounting Policies (Continued)

values of assets and liabilities that are not readily apparent from other sources. Actual amounts could

differ from these estimates.

Translation of Foreign Currencies:

For all foreign operations, the functional currency is the local currency. Assets and liabilities of

these operations are translated into U.S. dollars using the exchange rate in effect at the end of each

reporting period. Income statement accounts are translated at the average rate of exchange prevailing

during each reporting period. Translation adjustments arising from the use of differing exchange rates

from period to period are included in accumulated other comprehensive income (loss).

Foreign currency gains and losses arising from the translation of intercompany receivables with the

Company’s international subsidiaries are recorded as a component of other expense, net, unless the

receivable is considered long-term in nature, in which case the foreign currency gains and losses are

recorded as a component of other comprehensive income (loss).

Cash Equivalents:

Cash and cash equivalents are defined as highly liquid investments with original maturities of three

months or less. Cash balances may, at times, exceed insurable amounts. The Company believes it

mitigates this risk by investing in or through major financial institutions.

Inventories:

Inventories, which consist of finished goods, are stated at the lower of cost or market on a first-in,

first-out basis, net of reserves for obsolescence and shrinkage.

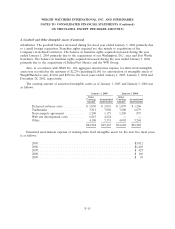

Property and Equipment:

Property and equipment are recorded at cost. For financial reporting purposes, equipment is

depreciated on the straight-line method over the estimated useful lives of the assets (3 to 10 years).

Leasehold improvements are amortized on the straight-line method over the shorter of the term of the

lease or the useful life of the related assets. Expenditures for new facilities and improvements that

substantially extend the useful life of an asset are capitalized. Ordinary repairs and maintenance are

expensed as incurred. When assets are retired or otherwise disposed of, the cost and related

depreciation are removed from the accounts and any related gains or losses are included in income.

Impairment of Long Lived Assets:

In accordance with the provisions of Statement of Financial Accounting Standards (‘‘SFAS’’)

No. 144, ‘‘Accounting for the Impairment or Disposal of Long-Lived Assets,’’ the Company reviews

long-lived assets, including amortizable intangible assets, for impairment whenever events or changes in

business circumstances indicate that the carrying amount of the assets may not be fully recoverable.

F-8