WeightWatchers 2004 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2004 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

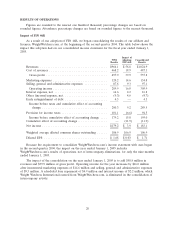

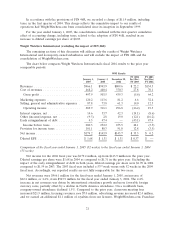

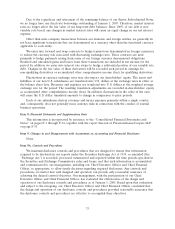

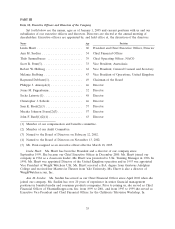

The following chart shows the change in gross profit margin for each quarter of the last two fiscal

years:

Fiscal Year 2003

First Second Third Fourth Full

Quarter Quarter Quarter Quarter Year

Revenues, net ................... $251.5 $258.8 $217.5 $216.1 $943.9

Cost of revenues ................. 113.3 116.1 107.3 103.7 440.4

Gross profit ($) .................. $138.2 $142.7 $110.2 $112.4 $503.5

Gross profit (%) ................. 55.0% 55.1% 50.7% 52.0% 53.3%

Fiscal Year 2002

First Second Third Fourth Full

Quarter Quarter Quarter Quarter Year

Revenues, net ................... $212.5 $217.9 $189.2 $190.1 $809.7

Cost of revenues ................. 96.0 96.0 85.6 92.6 370.2

Gross profit ($) .................. $116.5 $121.9 $103.6 $ 97.5 $439.5

Gross profit (%) ................. 54.8% 55.9% 54.8% 51.3% 54.3%

Gross profit for fiscal 2003 was $503.5 million, up 14.6% from $439.3 million in fiscal 2002. The

change in the gross profit margin percentage for the full year 2003 as compared to 2002 resulted

primarily from factors relating to the timing of our Fall 2003 NACO innovation. These included

significant expenses in the third quarter 2003 relating to the nationwide innovation training meetings

held with our meeting room staff, the write-off of some unused program material and the decision to

keep more meetings open than we normally would have during the lower attendance summer months

in anticipation of the expected increased volume due to the innovation.

Marketing expenses increased $32.4 million, or 39.9%, to $113.6 million in the fiscal year ended

January 3, 2004 from $81.2 million in the fiscal year ended December 28, 2002. During 2003, we made

the decision to increase marketing to support the continuing growth of the business while specifically

targeting some of our key markets. As a percentage of net revenues, marketing expenses increased

from 10.0% in 2002 to 12.0% in 2003.

Selling, general and administrative expenses were $73.8 million for the fiscal year ended January 3,

2004, an increase of $12.5 million, or 20.4%, from $61.3 million for the fiscal year ended December 28,

2002. The main drivers of this increase were the acquisition of WW Group franchise territories, higher

medical and other insurance rates and legal fees, and expenses associated with additional regulatory

and compliance requirements. The impact of the dollar weakening relative to the currencies of our

international subsidiaries also had the result of increasing selling, general and administrative expenses.

As a percentage of revenue, selling, general and administrative expenses remained fairly consistent at

7.8% as compared to 7.6% last year.

Operating income was $316.1 million for the fiscal year ended January 3, 2004, an increase of

$19.3 million, or 6.5%, from $296.8 million for the fiscal year ended December 28, 2002. Operating

income growth lagged top line revenue growth primarily due to our decision to implement major

increases in marketing spending. Accordingly, our operating income margin fell in fiscal 2003 to 33.5%,

from 36.7% in the prior year. The decline in gross margin from the prior year also contributed to the

operating margin compression.

Net interest charges in 2003 were down 20.3% from $42.3 million in 2002 to $33.7 million. The

repurchase and retirement in the third quarter of 2003 of most of our 13% Senior Subordinated Notes

25