WeightWatchers 2004 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2004 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

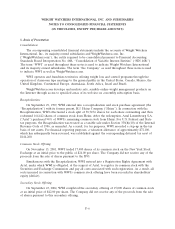

2. Summary of Significant Accounting Policies (Continued)

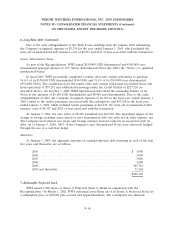

The American Jobs Creation Act of 2004 (the ‘‘AJCA’’) was enacted on October 22, 2004 and

includes a special one-time deduction of 85% of certain foreign earnings repatriated to the U.S. In

December 2004, the FASB issued FSP FAS 109-2, Accounting and Disclosure Guidance for the Foreign

Earnings Repatriation Provision within the AJCA, allowing companies additional time to evaluate the

effect of the AJCA on plans for reinvestment or repatriation of foreign earnings. The Company is in

the process of evaluating the effects of the repatriation provision; however, the Company does not

expect to complete this evaluation until after Congress or the U.S. Treasury Department provides

further clarification on key elements of the provision. As such, the Company has not concluded its

analysis to determine whether, and to what extent, it might repatriate foreign earnings. The Company

expects to be in a position to finalize the assessment within a reasonable amount of time after the

issuance of clarifying U.S. Treasury or Congressional guidance.

Reclassification:

Certain prior year amounts have been reclassified to conform to the current year presentation.

3. Acquisitions

All acquisitions have been accounted for under the purchase method of accounting and,

accordingly, earnings have been included in the consolidated operating results of the Company since

the date of acquisition. During fiscal 2004 and 2003, the Company acquired certain assets of its

franchises as outlined below.

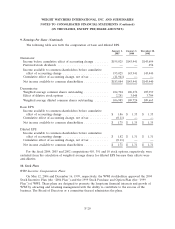

On August 22, 2004, the Company completed the acquisition of certain assets of its Fort Worth

franchisee, Weight Watchers of Fort Worth, Inc., for a purchase price of $30,000 that was financed

through cash from operations. The purchase price has been allocated to franchise rights ($29,421), fixed

assets ($226), inventory ($286) and other assets ($67). Pro forma results of operations, assuming this

acquisition had been completed at the beginning of fiscal 2004 and 2003, would not differ materially

from the reported results.

On May 9, 2004, the Company completed the acquisition of certain assets of its Washington, D.C.

area franchisee, F-W Family Corporation (d/b/a Weight Watchers of Washington, D.C.), for a purchase

price of $30,500, which was financed through cash from operations, plus assumed liabilities of $348.

The total purchase price has been allocated to franchise rights ($30,268), fixed assets ($300), inventory

($228) and other assets ($52). Pro forma results of operations, assuming this acquisition had been

completed at the beginning of fiscal 2004 and 2003, would not differ materially from the reported

results.

On November 30, 2003, the Company completed the acquisition of certain assets of two of its

franchisees, Weight Watchers of Dallas, Inc. and Pedebud, Inc. (d/b/a Weight Watchers of Northern

New Mexico), pursuant to the terms of a combined asset purchase agreement with these two entities

(collectively ‘‘Dallas/New Mexico’’) and the Company. The purchase price was $27,200 plus assumed

liabilities of $300, and was allocated to franchise rights ($26,874), property and equipment ($412), and

inventory ($214). The acquisition was financed through cash from operations. Pro forma results of

operations, assuming this acquisition had been completed at the beginning of fiscal 2003 and 2002

would not differ materially from the reported results.

F-13