WeightWatchers 2004 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2004 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.and the associated refinancing of our debt, (which will be explained in more detail below) lowered our

interest expense for the remainder of 2003 and beyond.

Other expenses, net were $2.8 million for the fiscal year ended January 3, 2004 as compared to

$19.0 million for the fiscal year ended December 28, 2002. Primarily as a result of the aforementioned

retirement of the euro denominated portion of our 13% Senior Subordinated Notes, we saw a

reduction in unrealized currency gains/losses net of hedges from a loss of $17.1 million in 2002 to a loss

of $9.1 million in 2003. Additionally, in 2003 we received a $5.0 million loan repayment from our

licensee, WeightWatchers.com, which we recorded as a component of other income in 2003 since the

loan balance had been entirely written off by the end of fiscal 2001.

As was mentioned above, in the third quarter of 2003, we successfully completed a tender offer

and consent solicitation to purchase 96.6% of our $150.0 million USD denominated ($144.9 million)

and 91.6% of our A100.0 million euro denominated (A91.6 million) 13% Senior Subordinated Notes.

The consideration for the tender offer and consent solicitation was funded from cash on hand and

additional borrowings under our Credit Facility, which was refinanced concurrently. We recognized

expense for early extinguishment of debt of $47.4 million in the third quarter of 2003 that included

tender premiums of $42.6 million, the write-off of unamortized debt issuance costs of $4.4 million and

$0.4 million of fees associated with the transaction. The average interest rate on our debt declined from

9.1% at December 28, 2002 to approximately 3.7% at January 3, 2004 as a result of the refinancing.

Our effective tax rate for the year ended January 3, 2004 was 38.0% as compared to 39.0% for the

year ended December 28, 2002. The early extinguishment of debt in the third quarter of 2003 caused a

change in the mix of domestic and foreign earnings, resulting in a reduction to the effective tax rate in

the year ended January 3, 2004.

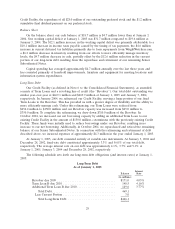

LIQUIDITY AND CAPITAL RESOURCES

Impact of FIN 46R

The Balance Sheet and Cash Flow tables below remove the impact of FIN 46R from our 2004

consolidated balances, and compare the stand-alone balances of Weight Watchers International for 2004

with those of the prior year.

26