WeightWatchers 2004 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2004 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

2. Summary of Significant Accounting Policies (Continued)

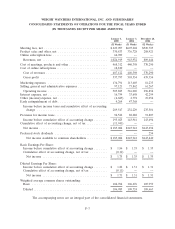

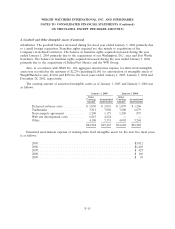

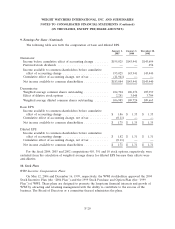

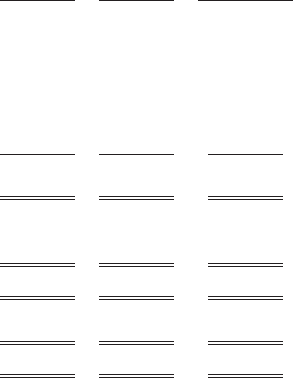

The following table illustrates the effect on net income and earnings per share if the Company had

applied the fair value recognition provisions of SFAS No. 123 in each fiscal year:

January 1, January 3, December 28,

2005 2004 2002

Net income, as reported .................. $183,084 $143,941 $143,694

Deduct:

Total stock-based employee compensation

expense determined under the fair value

method for all stock options awards, net of

related tax effect .................... 4,223 2,036 696

Pro forma net income .................... $178,861 $141,905 $142,998

Earnings per share:

Basic—as reported ..................... $ 1.75 $ 1.35 $ 1.35

Basic—pro forma ...................... $ 1.71 $ 1.33 $ 1.35

Diluted—as reported ................... $ 1.71 $ 1.31 $ 1.31

Diluted—pro forma .................... $ 1.67 $ 1.29 $ 1.30

Included in ‘‘Total stock-based compensation expense determined under the fair value method for

all stock option awards, net of related tax effect’’ is $463 of expense related to WeightWatchers.com

options.

Recently Issued Accounting Standards

In December 2004, the Financial Accounting Standards Board issued Statement No. 123R, ‘‘Share-

Based Payment’’ (‘‘FAS 123R’’), which replaces FAS 123, ‘‘Accounting for Stock-Based Compensation’’

and supercedes Accounting Principles Board Opinion 25, ‘‘Accounting for Stock Issued to Employees.’’

FAS 123R eliminates the option of using the intrinsic value method to record compensation expense

related to stock-based awards to employees and instead requires companies to recognize the cost of

such awards based on their grant-date fair value over the related service period of such awards. The

Company will adopt the provisions of this standard beginning in the third quarter of fiscal 2005.

The Company has elected to apply the modified prospective transition method to all past awards

outstanding and unvested as of the date of adoption and will recognize the associated expense over the

remaining vesting period based on the fair values previously determined and disclosed as part of its

pro-forma disclosures. The Company will not restate the results of prior periods. Prior to the effective

date of FAS 123R, the Company will continue to provide the pro forma disclosures for past award

grants as required under FAS 123. The Company believes the pro forma disclosures in Note 2 provide

an appropriate short-term indicator of the level of expense that will be recognized in accordance with

FAS 123R. However, the total expense recorded in future periods will depend on several variables,

including the number of share-based payment awards that are granted in future periods and the fair

value of those awards.

F-12