WeightWatchers 2004 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2004 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

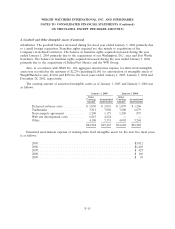

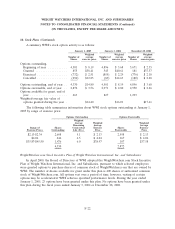

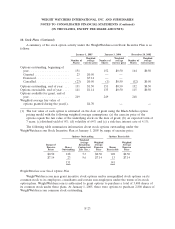

10. Stock Plans (Continued)

Due to the adoption of FIN 46R (see Note 1), the fair value of stock options granted by

WeightWatchers.com are included in the pro forma footnote disclosures showing the impact to the

Company’s results had it adopted the fair value provisions of SFAS No. 123 (see Note 2). The fair

value of options granted by WeightWatchers.com during fiscal 2004 were estimated on their date of

grant using the Black-Scholes option pricing model with the following weighted average assumptions:

(a) dividend yield of 0%, (b) volatility of 64%, (c) risk-free interest rate of 3.0%—3.9% and

(d) expected term of 5 years.

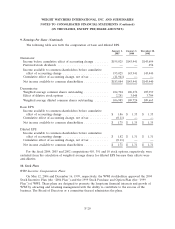

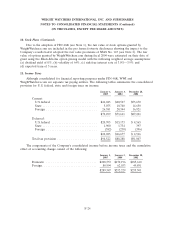

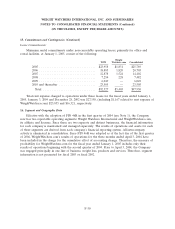

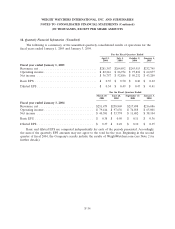

11. Income Taxes

Although consolidated for financial reporting purposes under FIN 46R, WWI and

WeightWatchers.com are separate tax paying entities. The following tables summarize the consolidated

provision for U.S. federal, state and foreign taxes on income:

January 1, January 3, December 28,

2005 2004 2002

Current:

U.S federal .......................... $41,043 $40,527 $55,670

State ............................... 5,075 10,740 14,650

Foreign ............................. 26,381 20,344 16,921

$72,499 $71,611 $87,241

Deferred:

U.S federal .......................... $20,705 $15,173 $ 4,565

State ............................... 1,900 1,734 397

Foreign ............................. (582) (230) (396)

$22,023 $16,677 $ 4,566

Total tax provision ....................... $94,522 $88,288 $91,807

The components of the Company’s consolidated income before income taxes and the cumulative

effect of accounting change consist of the following:

January 1, January 3, December 28,

2005 2004 2002

Domestic ............................. $208,553 $170,196 $185,610

Foreign ............................... 80,994 62,033 49,891

$289,547 $232,229 $235,501

F-24