WeightWatchers 2004 Annual Report Download - page 54

Download and view the complete annual report

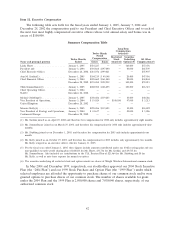

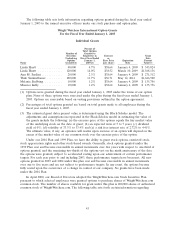

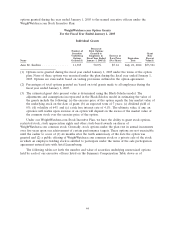

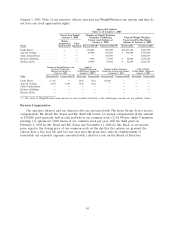

Please find page 54 of the 2004 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Executive Savings and Profit Sharing Plan

We sponsor a savings plan for salaried and eligible hourly employees. This defined contribution

plan provides for employer matching contributions up to 100% of the first 3% of an employee’s eligible

compensation. The savings plan also permits employees to contribute between 1% and 13% of eligible

compensation on a pre-tax basis.

The savings plan also contains a profit sharing component for full-time salaried employees that are

not key management personnel, which provides for a guaranteed monthly employer contribution for

each participant based on the participant’s age and a percentage of the participant’s eligible

compensation. In addition, the profit sharing plan has a supplemental employer contribution

component, based on our achievement of certain annual performance targets, and a discretionary

contribution component.

We also established an executive profit sharing plan, which provides a non-qualified profit sharing

plan for key management personnel who are not eligible to participate in our profit sharing plan. This

non-qualified profit sharing plan has similar features to our profit sharing plan.

Continuity Agreements

Purpose; Covered Executives

The Board of Directors has determined that it is in the best interests of our stockholders to

reinforce and encourage the continued attention and dedication of our key executives to their duties

with us, without personal distraction or conflict of interest in circumstances that could arise in

connection with any change of ownership or control of the Company. Therefore, in October 2003, we

entered into continuity agreements with the following executives: Linda Huett, Ann Sardini, Robert

Hollweg, and certain other executive officers. These agreements contain terms that are substantially

similar to each other, except where described below.

Term of Agreements

These agreements have an initial term of three years from the date of execution, and continue to

renew annually thereafter unless either party provides 180-day advance written notice to the other party

that the term of the agreement will not renew. However, upon the occurrence of a ‘‘change in control’’

(as defined in the agreements), the term of the agreement may not terminate until the second

anniversary of the date of the change of ownership or control of the Company.

Severance Payments and Benefits.

If, within two years following a change of ownership or control of the Company, an executive’s

employment is terminated without cause by us or for good reason by the executive (as such terms are

defined in the agreements), the following executives will receive the following payments and benefits:

• Ms. Huett, Ms. Sardini and Mr. Hollweg are entitled to receive the following:

(i) A lump sum cash payment equal to three times the sum of (x) the executive’s annual base

salary on the date of the change in control (or, if higher, the annual base salary in effect

immediately prior to the giving of the notice of termination) and (y) the executive’s target annual

bonus (the ‘‘target bonus’’) in respect of the fiscal year of the Company (a ‘‘fiscal year’’) in which

the termination occurs (or, if higher, the average annual bonus actually earned by the executive in

respect of the three full fiscal years prior to the year in which the notice of termination is given)

under our bonus plan;

(ii) A lump sum cash payment equal to the sum of (w) the executive’s unpaid base salary and

vacation days accrued through the date of termination, (x) the unpaid portion, if any, of bonuses

46