WeightWatchers 2004 Annual Report Download - page 31

Download and view the complete annual report

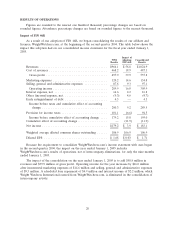

Please find page 31 of the 2004 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Marketing expenses increased $6.6 million, or 5.8%, to $120.2 million for the year ended

January 1, 2005 from $113.6 million in the year ended January 3, 2004, with the majority of the

increase resulting from currency translation. As a percentage of net revenue, marketing expenses were

12.4% for the year, as compared to 12.0% in the prior year period, driven by the softness in revenues.

Selling, general and administrative expenses were $87.8 million for the year ended January 1, 2005,

an increase of $14.0 million, or 19.0%, from $73.8 million in the prior year. Expenses were driven up

by professional fees and expenses related to compliance with Sarbanes-Oxley, as well as by a

strengthening of our management team and increase in our headcount to drive the future growth of

our business. Selling, general and administrative expenses were 9.1% of revenues for the year ended

January 1, 2005, as compared to 7.8% in the prior year.

Operating income was $289.9 million for the year ended January 1, 2005, a decrease of

$26.2 million, or 8.3%, from $316.1 million for the year ended January 3, 2004. Our operating income

margin for the year on this stand-alone basis was 30.0%, as compared to 33.5% in the prior year.

Net interest charges were down 56.7%, or $19.1 million, to $14.6 million for the year ended

January 1, 2005 from $33.7 million for the year ended January 3, 2004. The repurchase and retirement

in the third quarter of 2003 of most of our 13% Senior Subordinated Notes and the refinancing of our

Credit Facility at that time and again in January 2004 lowered our interest expense significantly.

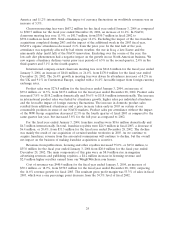

For the year ended January 1, 2005, we reported other income of $9.3 million, as compared to

other expense of $2.8 million for the year ended January 3, 2004. In 2004, we received higher loan

repayments from WeightWatchers.com, which increased our other income by $4.8 million. In 2003, we

incurred unrealized currency translation gains and losses associated with our Senior Subordinated Notes

until the majority were retired in the third quarter of 2003. This has resulted in a $9.2 million decrease

in this expense.

We recognized early extinguishment of debt expenses of $4.3 million for the year ended January 1,

2005 as a result of the refinancing of our Credit Facility, which we undertook in the first quarter of

2004, and the repurchase and retirement of the balance of our Senior Subordinated Notes in the third

quarter of 2004. These expenses included the write off of unamortized debt issuance costs from prior

refinancings and the recognition of tender premiums and fees associated with these transactions. In the

third quarter of 2003, when we repurchased and retired the majority of our Senior Subordinated Notes,

we recognized early extinguishment of debt expenses of $47.4 million. These included tender premiums

of $42.6 million, the write off of unamortized debt issuance costs of $4.4 million and $0.4 million of

fees associated with the transaction.

Our effective tax rate for the year ended January 1, 2005 was 36.1% as compared to 38.0% for the

year ended January 3, 2004. We recorded a tax benefit in the third quarter of 2004 by reversing a

$5.5 million accrued but no longer necessary tax liability recorded as a result of the September 1999

recapitalization and stock purchase transaction with our former parent, H.J. Heinz Company.

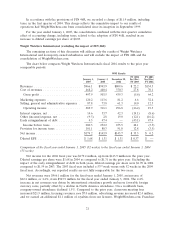

Comparison of the fiscal year ended January 3, 2004 (53 weeks) to the fiscal year ended December 28, 2002

(52 weeks).

Net revenues were $943.9 million for the fiscal year ended January 3, 2004, an increase of

$134.3 million, or 16.6%, from $809.6 million for the fiscal year ended December 28, 2002. The 16.6%

increase in net revenues was partially the result of worldwide attendance growth of 10.1%, which drove

an $86.5 million increase in classroom meeting fees. The other components of the $134.3 million

increase in net revenues in fiscal 2003 over fiscal 2002 were $39.2 million of product sales, $2.9 million

of royalties from our licensee, WeightWatchers.com, $12.2 million attributable to our publications and

other licensing sources, offset by a $6.5 million decrease in franchise revenues. Excluding the impact of

fluctuations in foreign currency translations, meeting fees and product sales increased 10.7% in North

23