WeightWatchers 2004 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2004 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

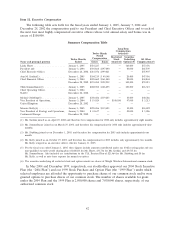

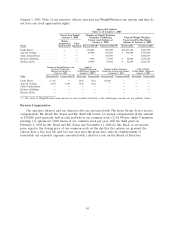

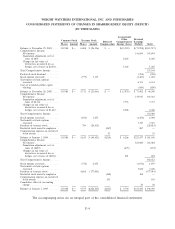

The following table summarizes our equity compensation plan information as of January 1, 2005.

Equity Compensation Plan Information

Number of securities to Weighted average

be issued upon exercise exercise price of Number of securities

of outstanding options, outstanding options, remaining available

Plan category warrants and rights warrants and rights for future issuance

Equity compensation plans approved by

security holders ................... 4,329,549 $14.80 2,762,807

Equity compensation plans not approved by

security holders ................... — — —

Total ............................ 4,329,549 $14.80 2,762,807

Item 13. Certain Relationships and Related Transactions

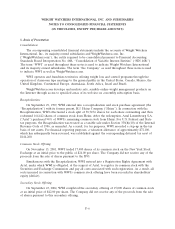

Shareholders’ Agreements

Shortly after our acquisition by Artal Luxembourg, we entered into a shareholders’ agreement with

Artal Luxembourg and Merchant Capital, Inc., Richard and Heather Penn, Longisland International

Limited, Envoy Partners and Scotiabanc, Inc. relating to their rights with respect to our common stock

held by parties, other than Artal Luxembourg. Without the consent of Artal Luxembourg, transfers of

our common stock by these shareholders are restricted with certain exceptions. Subsequent transferees

of our common stock must, subject to limited exceptions, agree to be bound by the terms and

provisions of the agreement. Additionally, this agreement provides the shareholders with the right to

participate pro rata in certain transfers of our common stock by Artal Luxembourg and grants Artal

Luxembourg the right to require the other shareholders to participate on a pro rata basis in certain

transfers of our common stock by Artal Luxembourg.

Registration Rights Agreement

Simultaneously with the closing of our acquisition by Artal Luxembourg, we entered into a

registration rights agreement with Artal Luxembourg and Heinz. The registration rights agreement

grants Artal Luxembourg the right to require us to register shares of our common stock for public sale

under the Securities Act (1) upon demand and (2) in the event that we conduct certain types of

registered offerings. Heinz has sold all shares of our common stock and accordingly no longer has any

rights under this agreement. Merchant Capital, Inc., Richard and Heather Penn, Long Island

International Limited, Envoy Partners and Scotiabanc, Inc. became parties to this registration rights

agreement under joinder agreements, and each acquired the right to require us to register and sell

their stock in the event that we conduct certain types of registered offerings.

Corporate Agreement

We have entered into a corporate agreement with Artal Luxembourg. We have agreed that so long

as Artal Luxembourg beneficially owns 10% or more, but less than a majority of our then outstanding

voting stock, Artal Luxembourg will have the right to nominate a number of directors approximately

equal to that percentage multiplied by the number of directors on our board. This right to nominate

directors will not restrict Artal Luxembourg from nominating a greater number of directors.

We have agreed with Artal Luxembourg that both we and Artal Luxembourg have the right to:

• engage in the same or similar business activities as the other party;

• do business with any customer or client of the other party; and

50