WeightWatchers 2004 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2004 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.respect of which comparable welfare benefit coverage is provided, as described in clause (b)

above; and

• the cost of outplacement services provided to the executives as described in clause (viii)

above shall not be more than $15,000.

Excess Parachute Payment Excise Taxes

If (i) it is determined that the payments and benefits provided under the agreements or otherwise

in the aggregate (a ‘‘parachute payment’’) would be subject to the excise tax imposed under the U.S.

Internal Revenue Code, and the aggregate value of the parachute payment exceeds a certain threshold

amount, calculated under the U.S. Internal Revenue Code (the ‘‘base amount’’) by 5% or less, then

(ii) the parachute payment will be reduced to the extent necessary so that the aggregate value of the

parachute payment is equal to an amount that is less than such threshold amount; provided, however,

that if the aggregate value of the parachute payment exceeds the threshold amount by more than 5%,

then the executive will be entitled to receive an additional payment or payments in an amount such

that, after payment by the executive of all taxes (including any interest or penalties imposed with

respect to such taxes), including any excise tax, imposed upon this payment, the executive retains an

amount equal to the excise tax imposed upon the parachute payment.

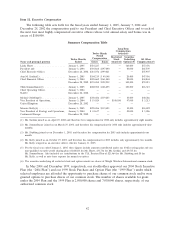

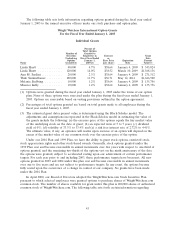

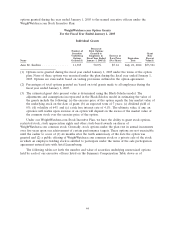

Item 12. Security Ownership of Certain Beneficial Owners and Management

Principal Shareholders

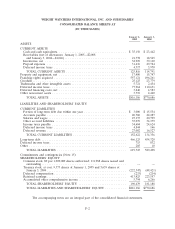

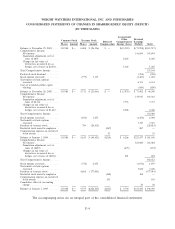

The following table sets forth information regarding the beneficial ownership of our common stock

by (1) all persons known by us to own beneficially more than 5% of our common stock, (2) our chief

executive officer and each of the named executive officers, (3) each director and (4) all directors and

executive officers as a group.

Beneficial ownership is determined in accordance with the rules of the Securities and Exchange

Commission. In computing the number of shares beneficially owned by a person and the percentage

ownership of that person, shares of common stock subject to options held by that person that are

currently exercisable or exercisable within 60 days after January 1, 2005 are deemed issued and

outstanding. These shares, however, are not deemed outstanding for purposes of computing percentage

ownership of each other shareholder.

48