WeightWatchers 2004 Annual Report Download - page 59

Download and view the complete annual report

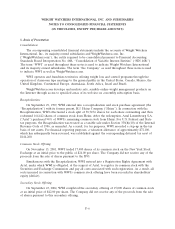

Please find page 59 of the 2004 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.• employ or engage any officer or employee of the other party.

Neither Artal Luxembourg nor we, nor our respective related parties, will be liable to each other

as a result of engaging in any of these activities.

Under the corporate agreement, if one of our officers or directors who also serves as an officer,

director or advisor of Artal Luxembourg becomes aware of a potential transaction related primarily to

the group education-based weight-loss business that may represent a corporate opportunity for both

Artal Luxembourg and us, the officer, director or advisor has no duty to present that opportunity to

Artal Luxembourg, and we will have the sole right to pursue the transaction if our board so

determines. If one of our officers or directors who also serves as an officer, director or advisor of Artal

Luxembourg becomes aware of any other potential transaction that may represent a corporate

opportunity for both Artal Luxembourg and us, the officer or director will have a duty to present that

opportunity to Artal Luxembourg, and Artal Luxembourg will have the sole right to pursue the

transaction if Artal Luxembourg’s board so determines. If one of our officers or directors who does not

serve as an officer, director or advisor of Artal Luxembourg becomes aware of a potential transaction

that may represent a corporate opportunity for both Artal Luxembourg and us, neither the officer nor

the director nor we have a duty to present that opportunity to Artal Luxembourg, and we may pursue

the transaction if our board so determines.

If Artal Luxembourg transfers, sells or otherwise disposes of our then outstanding voting stock, the

transferee will generally succeed to the same rights that Artal Luxembourg has under this agreement by

virtue of its ownership of our voting stock, subject to Artal Luxembourg’s option not to transfer those

rights.

WeightWatchers.com Note

On September 10, 2001, we amended and restated our loan agreement with WeightWatchers.com,

increasing the aggregate commitment thereunder to $34.5 million. The note bears interest at 13% per

year, beginning on January 1, 2002, which interest, except as set forth below, is paid semi-annually

starting on March 31, 2002. All principal outstanding under this note is payable in six semi-annual

installments, starting on March 31, 2004. The note may be prepaid at any time in whole or in part,

without penalty. In 2003, we received a $5.0 million early loan payment from WeightWatchers.com,

which reduced the principal balance outstanding to $29.5 million at January 3, 2004. In fiscal 2004, we

received two regularly scheduled principal payments aggregating $9.8 million, which reduced the

principal balance outstanding to $19.7 million at January 1, 2005.

WeightWatchers.com Warrant Agreements

Under the warrant agreements that we entered into with WeightWatchers.com, we have received

warrants to purchase an additional 6,394,997 shares of WeightWatchers.com’s common stock in

connection with the loans that we made to WeightWatchers.com under the note described above. These

warrants will expire from November 24, 2009 to September 10, 2011 and may be exercised at a price of

$7.14 per share of WeightWatchers.com’s common stock until their expiration. We own 20.1% of the

outstanding common stock of WeightWatchers.com, or approximately 38% on a fully diluted basis

(including the exercise of all options and all the warrants we own in WeightWatchers.com).

Collateral Assignment and Security Agreement

In connection with the WeightWatchers.com note, we entered into a collateral assignment and

security agreement whereby we obtained a security interest in the assets of WeightWatchers.com. Our

security interest in those assets will terminate when the note has been paid in full.

51