WeightWatchers 2004 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2004 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Credit Facility, the repurchase of all $25.0 million of our outstanding preferred stock and the $1.2 million

cumulative final dividend payment on our preferred stock.

Balance Sheet

On the balance sheet, our cash balance of $18.7 million is $4.7 million lower than at January 3,

2004. Our working capital deficit at January 1, 2005 was $31.7 million compared to $19.6 million at

January 3, 2004. The $12.1 million increase in the working capital deficit was primarily attributable to a

$10.1 million increase in income taxes payable caused by the timing of tax payments, the $4.6 million

increase in current deferred tax liabilities primarily due to loan repayments from WeightWatchers.com,

a $6.2 million decrease in inventory resulting from our efforts to more efficiently manage inventory

levels, the $4.7 million decrease in cash, partially offset by the $12.6 million reduction in the current

portion of our long-term debt resulting from the repurchase and retirement of our remaining Senior

Subordinated Notes.

Capital spending has averaged approximately $4.7 million annually over the last three years and

has consisted primarily of leasehold improvements, furniture and equipment for meeting locations and

information system expenditures.

Long-Term Debt

Our Credit Facility (as defined in Note 6 to the Consolidated Financial Statements), as amended,

consists of Term Loans and a revolving line of credit (the ‘‘Revolver’’). Our total debt outstanding was

similar year-over-year at $469.1 million and $469.9 million at January 1, 2005 and January 3, 2004,

respectively. In January 2004, we refinanced our Credit Facility, moving a large portion of our fixed

Term Loans to the Revolver. This has provided us with a greater degree of flexibility and the ability to

more efficiently manage cash. Under this refinancing, our Term Loans were reduced from

$454.2 million to $150.0 million and our Revolver capacity was increased from $45.0 million to

$350.0 million. To complete the refinancing, we drew down $310.0 million of the Revolver. In

October 2004, we increased our net borrowing capacity by adding an additional Term Loan to our

existing Credit Facility in the amount of $150.0 million, coterminous with the previously existing Credit

Facility. These funds were initially used to reduce borrowings under our Revolver, resulting in no

increase to our net borrowing. Additionally, in October 2004, we repurchased and retired the remaining

balance of our Senior Subordinated Notes. In connection with the refinancing and retirement of debt

described above, we incurred expenses of approximately $4.3 million in the year ended January 1, 2005.

At January 1, 2005, our debt consisted entirely of variable-rate instruments. At January 3, 2004 and

December 28, 2002, fixed-rate debt constituted approximately 3.3% and 56.0% of our total debt,

respectively. The average interest rate on our debt was approximately 4.1%, 3.7% and 9.1% at

January 1, 2005, January 3, 2004 and December 28, 2002, respectively.

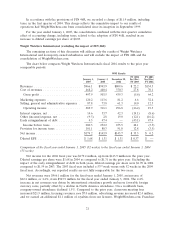

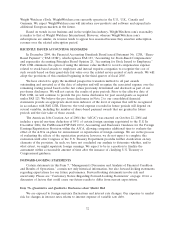

The following schedule sets forth our long-term debt obligations (and interest rates) at January 1,

2005:

Long-Term Debt

As of January 1, 2005

Interest

Balance Rate

(in millions)

Revolver due 2009 ................................. $171.0 4.03%

Term Loan B due 2010 .............................. 148.5 4.16%

Additional Term Loan B due 2010 ...................... 149.6 3.77%

Total Debt .................................... 469.1

Less Current Portion .............................. 3.0

Total Long-Term Debt ........................... $466.1

29