WeightWatchers 2004 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2004 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

6. Long-Term Debt (Continued)

Due to the early extinguishment of the Term Loans resulting from the January 2004 refinancing,

the Company recognized expenses of $3,254 for the year ended January 1, 2005, which included the

write-off of unamortized debt issuance costs of $2,933 and $321 of fees associated with the transaction.

Senior Subordinated Notes

As part of the Recapitalization, WWI issued $150,000 USD denominated and A100,000 euro

denominated principal amount of 13% Senior Subordinated Notes due 2009 (the ‘‘Notes’’) to qualified

institutional buyers.

In fiscal 2003, WWI successfully completed a tender offer and consent solicitation to purchase

96.6% of its $150,000 USD denominated ($144,900) and 91.6% of its A100,000 euro denominated

(A91,600) Notes. The consideration for the tender offer and consent solicitation was funded from cash

from operations of $57,292 and additional borrowings under the Credit Facility of $227,326 (as

described above). On October 1, 2004, WWI repurchased and retired the remaining balance of its

Notes in the amounts of $5,100 USD denominated and A8,400 euro-denominated. Due to this early

extinguishment of debt, the Company recognized expenses of $1,010 in the fiscal year ended January 1,

2005 related to the tender premiums associated with this redemption, and $47,368 in the fiscal year

ended January 3, 2004, which included tender premiums of $42,619, the write-off of unamortized debt

issuance costs of $4,387 and $362 of fees associated with the transaction.

At January 3, 2004, the euro notes of A8,388 translated into $10,564. The unrealized impact of the

change in foreign exchange rates related to euro denominated debt was reflected in other expense, net.

The Company used interest rate swaps and foreign currency forward contracts in association with its

debt. As of January 3, 2004, 100% of the Company’s euro denominated Notes were effectively hedged

through the use of a cash flow hedge.

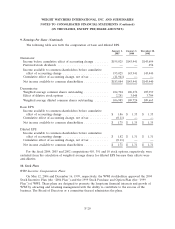

Maturities

At January 1, 2005, the aggregate amounts of existing long-term debt maturing in each of the next

five years and thereafter are as follows:

2005 ................................................... $ 3,000

2006 ................................................... 3,000

2007 ................................................... 3,000

2008 ................................................... 3,000

2009 ................................................... 385,781

2010 and thereafter ........................................ 71,344

$469,125

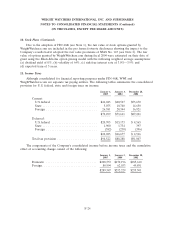

7. Redeemable Preferred Stock

WWI issued 1,000 shares of Series A Preferred Stock to Heinz in conjunction with the

Recapitalization. On March 1, 2002, WWI redeemed from Heinz all of its Series A Preferred Stock for

a redemption price of $25,000 plus accrued and unpaid dividends. The redemption was financed

F-18