Walgreens 2014 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2014 Walgreens annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

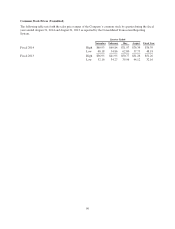

Company’s consolidated financial statements in a future fiscal period. Management’s assessment of current

litigation and other legal proceedings, including the corresponding accruals, could change because of the

discovery of facts with respect to legal actions or other proceedings pending against the Company which are not

presently known. Adverse rulings or determinations by judges, juries, governmental authorities or other parties

could also result in changes to management’s assessment of current liabilities and contingencies. Accordingly,

the ultimate costs of resolving these claims may be substantially higher or lower than the amounts reserved.

On June 11, 2013, the Company entered into a Settlement and Memorandum of Agreement (the Agreement) with

the United States Department of Justice and the United States Drug Enforcement Administration (DEA) that

settled and resolved all administrative and civil matters arising out of DEA’s previously-disclosed concerns

relating to the Company’s distribution and dispensing of controlled substances. Under the terms of the

Agreement, the Company paid an $80 million settlement amount, surrendered its DEA registrations for six

pharmacies in Florida until May 26, 2014, and for its Jupiter, Florida distribution center until Sept. 13, 2014, and

agreed to implement certain remedial actions. In addition, the Company dismissed with prejudice its petition with

the United States Court of Appeals for the District of Columbia Circuit that challenged certain enforcement

authority of the DEA. On July 31, 2013 and August 13, 2013, putative shareholders filed derivative actions in

federal court in the Northern District of Illinois against the Walgreens Board of Directors and Walgreen Co. as a

nominal defendant (collectively, the defendants), arising out of the Company’s June 2013 settlement with the

DEA described above. The actions assert claims for breach of fiduciary duty on the grounds that the directors

allegedly should have prevented the events that led to the settlement. The plaintiffs filed an amended

consolidated complaint on October 4, 2013, pursuant to which they seek damages and other relief on behalf of

the Company. The defendants filed their motion to dismiss on December 3, 2013. Subsequent thereto, the

plaintiffs filed an opposition brief on February 7, 2014 and the defendants filed their reply brief on March 10,

2014. In June 2014, the parties executed a settlement term sheet reflecting an agreement in principle to settle this

matter, subject to, among other things, the execution of final settlement documentation and court approval. On

September 11, 2014, the defendants, denying all wrongdoing and liability, entered into a Stipulation and

Agreement of Settlement whereby the Company agreed to certain corporate governance measures and the

payment of up to $3.5 million for plaintiffs’ counsel fees and costs in exchange for a complete release of all

claims against all defendants. The Court entered an order preliminarily approving the Stipulation and Agreement

of Settlement on September 19, 2014. A final hearing to approve the settlement is scheduled for December 9,

2014. Settlement of this matter on the agreed terms would not have a material adverse effect on the Company’s

consolidated financial position, results of operations or cash flows.

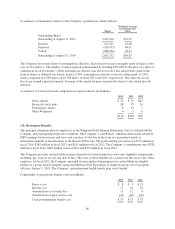

(13) Capital Stock

The Company’s long-term capital policy is to maintain a strong balance sheet and financial flexibility; reinvest in

its core strategies; invest in strategic opportunities that reinforce its core strategies and meet return requirements;

and return surplus cash flow to shareholders in the form of dividends and share repurchases over the long

term. In connection with the Company’s capital policy, the Board of Directors set a long-term dividend payout

ratio target between 30 and 35 percent of net income. On July 13, 2011, the Board of Directors authorized the

2012 repurchase program, which allows for the repurchase of up to $2.0 billion of the Company’s common stock

prior to its expiration on December 31, 2015. In August 2014, the Board of Directors approved the 2014 share

repurchase program, which replaces the 2012 repurchase program, that allows for the purchase of up to $3.0

billion of the Company’s common stock prior to its expiration on August 31, 2016.

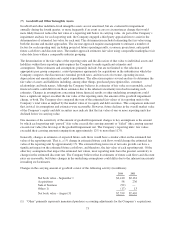

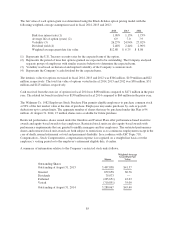

Activity related to these programs was as follows (in millions):

Fiscal Year Ended

2014 2013 2012

2012 stock repurchase program $— $— $1,151

2014 stock repurchase program — — —

$— $— $1,151

83