Walgreens 2014 Annual Report Download - page 76

Download and view the complete annual report

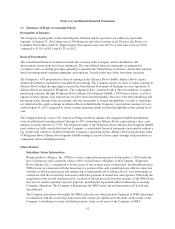

Please find page 76 of the 2014 Walgreens annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In April 2014, the FASB issued ASU 2014-08, Reporting Discontinued Operations and Disclosures of Disposals

of Components of an Entity. This ASU raises the threshold for a disposal to qualify as discontinued operations

and requires new disclosures for individually material disposal transactions that do not meet the definition of a

discontinued operation. Under the new standard, companies report discontinued operations when they have a

disposal that represents a strategic shift that has or will have a major impact on operations or financial

results. This update will be applied prospectively and is effective for annual periods, and interim periods within

those years, beginning after December 15, 2014 (fiscal 2016). Early adoption is permitted provided the disposal

was not previously disclosed. This update will not have a material impact on the Company’s reported results of

operations and financial position. This ASU is non-cash in nature and will not affect the Company’s cash

position.

In May 2013, the FASB reissued an exposure draft on lease accounting that would require entities to recognize

assets and liabilities arising from lease contracts on the balance sheet. The proposed exposure draft states that

lessees and lessors should apply a “right-of-use model” in accounting for all leases. Under the proposed model,

lessees would recognize an asset for the right to use the leased asset, and a liability for the obligation to make

rental payments over the lease term. When measuring the asset and liability, variable lease payments are

excluded, whereas renewal options that provide a significant economic incentive upon renewal would be

included. The accounting by a lessor would reflect its retained exposure to the risks or benefits of the underlying

leased asset. A lessor would recognize an asset representing its right to receive lease payments based on the

expected term of the lease. The lease expense from real estate based leases would continue to be recorded under a

straight-line approach, but other leases not related to real estate would be expensed using an effective interest

method that would accelerate lease expense. A final standard is currently expected to be issued in calendar 2014

and would be effective no earlier than annual reporting periods beginning on January 1, 2017 (fiscal 2018 for the

Company). The proposed standard, as currently drafted, would have a material impact on the Company’s

financial position and the impact on the Company’s reported results of operations is being evaluated. The impact

of this exposure draft is non-cash in nature and would not affect the Company’s cash position.

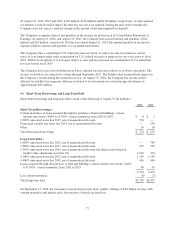

(2) Store Closures

In March 2014, the Board of Directors approved a plan to close underperforming stores in efforts to optimize and

focus resources in a manner intended to increase shareholder value. Total pre-tax charges associated with the

plan are estimated to be between $240 million and $280 million. In fiscal 2014, the Company incurred pre-tax

charges of $209 million as a result of closing 67 stores; $137 million from lease termination costs, $71 million

from asset impairment charges and $1 million of other charges.

(3) Leases

The Company owns approximately 20% of its operating locations; the remaining locations are leased

premises. Initial terms are typically 20 to 25 years, followed by additional terms containing renewal options at

five-year intervals, and may include rent escalation clauses. The commencement date of all lease terms is the

earlier of the date the Company becomes legally obligated to make rent payments or the date the Company has

the right to control the property. The Company recognizes rent expense on a straight-line basis over the term of

the lease. In addition to minimum fixed rentals, some leases provide for contingent rentals based upon a portion

of sales.

The Company continuously evaluates its real estate portfolio in conjunction with its capital needs. In fiscal 2014,

the Company entered into several sale-leaseback transactions. In some of these transactions, the Company

negotiated fixed rate renewal options which constitute a form of continuing involvement, resulting in the assets

remaining on the balance sheet and a corresponding finance lease obligation.

68