Walgreens 2014 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2014 Walgreens annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Allowance for doubtful accounts – The provision for bad debt is based on both historical write-off percentages

and specifically identified receivables. We have not made any material changes to the method of estimating our

allowance for doubtful accounts during the last three years. Based on current knowledge, we do not believe there

is a reasonable likelihood that there will be a material change in the estimates or assumptions used to determine

the allowance.

Vendor allowances – Vendor allowances are principally received as a result of purchases, sales or promotion of

vendors’ products. Allowances are generally recorded as a reduction of inventory and are recognized as a

reduction of cost of sales when the related merchandise is sold. Those allowances received for promoting

vendors’ products are offset against advertising expense and result in a reduction of selling, general and

administrative expenses to the extent of advertising incurred, with the excess treated as a reduction of inventory

costs. We have not made any material changes to the method of estimating our vendor allowances during the last

three years. Based on current knowledge, we do not believe there is a reasonable likelihood that there will be a

material change in the estimates or assumptions used to determine vendor allowances.

Asset impairments – The impairment of long-lived assets is assessed based upon both qualitative and quantitative

factors, including years of operation and expected future cash flows, and tested for impairment annually or

whenever events or circumstances indicate that a certain asset may be impaired. If the future cash flows reveal

that the carrying value of the asset group may not be recoverable, an impairment charge is immediately

recorded. We have not made any material changes to the method of estimating our asset impairments during the

last three years. Based on current knowledge, we do not believe there is a reasonable likelihood that there will be

a material change in the estimates or assumptions used to determine asset impairments.

Liability for closed locations – The liability is based on the present value of future rent obligations and other

related costs (net of estimated sublease rent) to the first lease option date. We have not made any material

changes to the method of estimating our liability for closed locations during the last three years. Based on current

knowledge, we do not believe there is a reasonable likelihood that there will be a material change in the estimates

or assumptions used to determine the liability.

Liability for insurance claims – The liability for insurance claims is recorded based on estimates for claims

incurred and is not discounted. The provisions are estimated in part by considering historical claims experience,

demographic factors and other actuarial assumptions. We have not made any material changes to the method of

estimating our liability for insurance claims during the last three years. Based on current knowledge, we do not

believe there is a reasonable likelihood that there will be a material change in the estimates or assumptions used

to determine the liability.

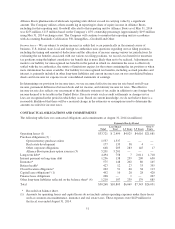

Cost of sales – Drugstore cost of sales is derived based on point-of-sale scanning information with an estimate

for shrinkage and adjusted based on periodic inventory counts. Inventories are valued at the lower of cost or

market determined by the last-in, first-out (LIFO) method. We have not made any material changes to the

method of estimating cost of sales during the last three years. Based on current knowledge, we do not believe

there is a reasonable likelihood that there will be a material change in the estimates or assumptions used to

determine cost of sales.

Equity method investments - We use the equity method to account for investments in companies if the investment

provides the ability to exercise significant influence, but not control, over operating and financial policies of the

investee. Our proportionate share of the net income or loss of these companies is included in consolidated net

earnings. Judgment regarding the level of influence over each equity method investment includes considering

key factors such as our ownership interest, representation on the board of directors, participation in policy-

making decisions and material intercompany transactions.

The underlying net assets of the Company’s equity method investment in Alliance Boots include goodwill and

indefinite-lived intangible assets. These assets are evaluated for impairment annually or more frequently if an

event occurs or circumstances change that would more likely than not reduce the fair value of a reporting unit

below its carrying value. Based on the Company’s evaluation as of August 31, 2014, the fair value of one of the

50