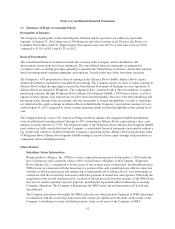

Walgreens 2014 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2014 Walgreens annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

exercised and the ramifications thereof; the occurrence of any event, change or other circumstance that could give

rise to the termination, cross-termination or modification of any of the transaction documents; the risks associated

with transitions in supply arrangements; risks that legal proceedings may be initiated related to the transactions; the

amount of costs, fees, expenses and charges incurred by Walgreens and Alliance Boots related to the transactions;

the ability to retain key personnel; changes in financial markets, interest rates and foreign currency exchange rates;

the risks associated with international business operations; the risk of unexpected costs, liabilities or delays; changes

in network participation and reimbursement and other terms; risks of inflation in the costs of goods, including

generic drugs; risks associated with the operation and growth of our customer loyalty program; risks associated with

outcomes of legal and regulatory matters, and changes in legislation, regulations or interpretations thereof; and other

factors described in Item 1A (Risk Factors) above and in other documents that we file or furnish with the SEC.

Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect,

actual results may vary materially from those indicated or anticipated by such forward-looking statements.

Accordingly, you are cautioned not to place undue reliance on these forward-looking statements, which speak only

as of the date they are made. Except to the extent required by law, we do not undertake, and expressly disclaim, any

duty or obligation to update publicly any forward-looking statement after the date the statement is made, whether as

a result of new information, future events, changes in assumptions or otherwise.

Item 7A. Qualitative and Quantitative Disclosures about Market Risk

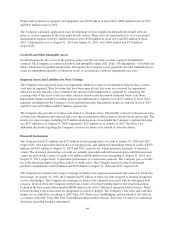

We are exposed to interest rate volatility with regard to future issuances of fixed-rate debt, and existing and

future issuances of floating-rate debt. Primary exposures include U.S. Treasury rates, LIBOR, and commercial

paper rates. From time to time, we use interest rate swaps and forward-starting interest rate swaps to hedge our

exposure to interest rate changes, to reduce the volatility of our financing costs and, based on current and

projected market conditions, achieve a desired proportion of fixed versus floating-rate debt. Generally under

these swaps, we agree with a counterparty to exchange the difference between fixed-rate and floating-rate interest

amounts based on an agreed upon notional principal amount. In September 2014, we entered into an additional

forward-starting interest rate swap for a $250 million notional amount.

Information regarding our interest rate swap transactions is set forth in Note 10 to our Consolidated Financial

Statements in Part II, Item 8 of this Form 10-K. These financial instruments are sensitive to changes in interest

rates. On August 31, 2014, we had $1.0 billion in long-term debt obligations that had floating interest rates. A

one percentage point increase or decrease in interest rates would increase or decrease the annual interest expense

we recognize and the cash we pay for interest expense by approximately $10 million.

In connection with our Purchase and Option Agreement with Alliance Boots and the transactions contemplated

thereby, our exposure to foreign currency risks, primarily with respect to the British pound Sterling, and to a

lesser extent the Euro and certain other foreign currencies, is expected to increase. We are exposed to the

translation of foreign currency earnings to the U.S. dollar as a result of our 45% interest in Alliance Boots, which

we account for using the equity method of accounting on a three-month lag. This exposure will further increase if

the second step transaction is completed. Foreign currency forward contracts and other derivative instruments

may be used from time to time in some instances to hedge in full or in part certain risks relating to foreign

currency denominated assets and liabilities, intercompany transactions, and in connection with acquisitions, joint

ventures or investments outside the United States. As of August 31, 2014 and August 31, 2013, we did not have

any outstanding foreign exchange derivative instruments.

Changes in AmerisourceBergen common stock price and equity volatility may have a significant impact on the value of

the warrants to acquire AmerisourceBergen common stock described in Note 10 to our Consolidated Financial

Statements in Part II, Item 8 of this Form 10-K. As of August 31, 2014, a one dollar change in AmerisourceBergen’s

common stock would, holding other factors constant, increase or decrease the fair value of the Company’s warrants by

$22 million and a one percent change in AmerisourceBergen’s equity volatility would, holding other factors constant,

increase or decrease the fair value of the Company’s warrants by $2 million. Additionally, the Company holds an

investment in AmerisourceBergen common stock. As of August 31, 2014, a one dollar change in AmerisourceBergen’s

common stock would increase or decrease the fair value of the Company’s investment by $12 million.

55